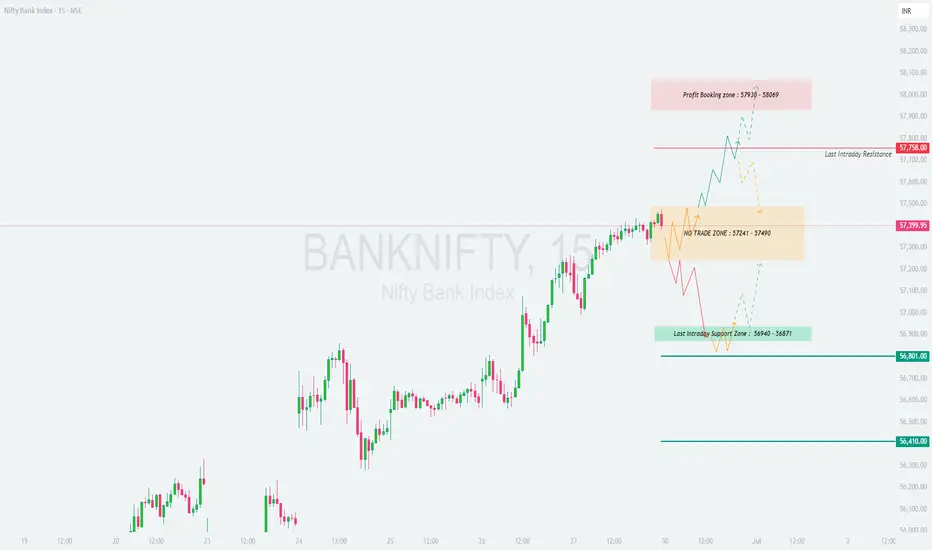

\📊 BANK NIFTY TRADING PLAN – 30-Jun-2025\

📍 \Previous Close:\ 57,400

📏 \Gap Reference Threshold:\ ±200 points

🕒 \Timeframe:\ 15-Min

📈 \Chart Zones Used:\ No Trade Zone, Support & Resistance areas

---

\

\[\*]\🚀 GAP-UP OPENING (Above 57,785):\

If Bank Nifty opens with a gap-up above \57,785\, it will immediately enter the \Profit Booking Zone (57,930 – 58,069)\. In this case, traders should be alert for potential exhaustion or consolidation in that zone. Avoid chasing the move unless a breakout is clean with strong follow-through volume.

✅ \Plan of Action:\

• Wait for price to test 57,930–58,069

• Enter long only if price consolidates and breaks out above 58,069 with good volume

• Watch for profit booking candles or bearish reversal near 58,000 zone

🎯 \Trade Setup:\

– \Buy:\ Only above 58,069 (confirmed breakout)

– \Target:\ 58,300+

– \SL:\ Below 57,785

📘 \Tip:\ Opening spikes often trap traders. Wait 15–30 mins before entering a trade after a gap-up.

\[\*]\⚖️ FLAT OPENING (Between 57,241 – 57,490):\

This area is defined as a \No Trade Zone\ due to expected choppy price action. Markets may consolidate or trap both bulls and bears. Best to avoid any directional trades here unless a breakout occurs with conviction.

✅ \Plan of Action:\

• No trade inside the zone (wait for breakout)

• If price breaks above 57,490 with volume → Long setup

• If price breaks below 57,241 → Short setup initiated

🎯 \Trade Setup Options:\

– \Buy:\ Only above 57,490

– \Sell:\ Only below 57,241

– \Targets:\ 57,785 (upside), 56,940 (downside)

– \SL:\ Opposite end of the zone or recent 15-min swing

📘 \Tip:\ In flat opens, structure develops post 9:30 AM. Be patient and follow only clear breakouts with volume.

\[\*]\📉 GAP-DOWN OPENING (Below 56,940):\

A gap-down below \56,940\ pushes the market into the \Last Intraday Support Zone (56,940 – 56,871)\. If this zone fails to hold, the next major support is at \56,410\. This setup favors sellers but must be executed after observing initial rejection or acceptance of the lower levels.

✅ \Plan of Action:\

• Short below 56,871 if initial candle confirms breakdown

• If price quickly reclaims 56,940, avoid shorts — it could trap bears

• Watch reversal pattern near 56,410 for potential long

🎯 \Trade Setup:\

– \Sell:\ Below 56,871

– \Target:\ 56,410

– \SL:\ Above 56,940

📘 \Tip:\ Don’t rush short trades. Let the price confirm failure of support before initiating.

---

\🧩 KEY ZONES TO TRACK:\

🔴 \Profit Booking:\ 57,930 – 58,069

🔴 \Last Intraday Resistance:\ 57,785

🟧 \No Trade Zone:\ 57,241 – 57,490

🟩 \Last Intraday Support:\ 56,940 – 56,871

🟦 \Major Support:\ 56,410

---

\💡 OPTIONS TRADING TIPS (For Intraday Traders):\

✅ Prefer ATM strikes in high IV zones to avoid time decay

✅ Use spreads (Bull Call / Bear Put) in low volatility conditions

✅ Avoid deep OTM buying on Friday due to Theta erosion

✅ Keep SL fixed: Options can lose value quickly after reversals

✅ Hedge naked options with proper risk-defined trades

✅ Monitor Open Interest buildup around support/resistance levels

---

\📌 SUMMARY – STRATEGY AT A GLANCE:\

• ✅ \Bullish above:\ 57,490 → Potential up move till 57,785 and 58,069

• ⛔️ \Sideways inside:\ 57,241 – 57,490 → Avoid trades in this zone

• ❌ \Bearish below:\ 56,871 → Breakdown setup with next support at 56,410

• 🧠 \Core Idea:\ Let price lead. React, don’t predict blindly.

---

\⚠️ DISCLAIMER:\

I am not a SEBI-registered advisor. This analysis is meant purely for educational purposes. Traders are advised to consult their financial advisor and manage risk strictly. Always use stop-loss and proper position sizing.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.