__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

__________________________________________________________________________________

Macro, News & On-Chain Analysis

__________________________________________________________________________________

__________________________________________________________________________________

Conclusion

__________________________________________________________________________________

__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

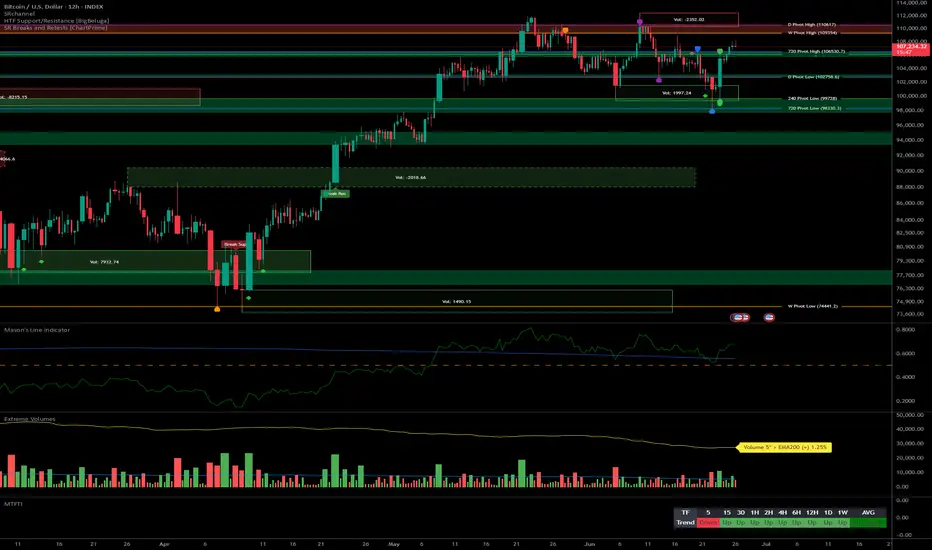

- Momentum: Clear bullish bias across all timeframes (MTFTI Up everywhere except 5min). Weak selling pressure, no distribution or capitulation signals.

- Support/Resistance: Key resistances: 110647–109554 (HTF). Major supports: 102756 (D Pivot Low), 98330 (720 Pivot Low). Multiple buy zones on retracement.

- Volume: Recent volumes below "extreme" threshold, no euphoria/capitulation detected.

- Multi-TF Behavior: Global bullish alignment, volatility present intraday, but no confirmed reversal risk. Risk On / Risk Off Indicator shows no major anomaly.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

- Strategic Bias: Structurally bullish market. Prioritize tactical buys on pullback, active risk management.

- Opportunities: Reinforce long positions on $106k/$103k/$100k retrace. Partial targets below 110–111k.

- Risk Zones: Rejection under 106500–107000 with extreme volume spike = short-term top signal. Invalidation if H1 < 106k or H4 < 102.7k.

- Macro Catalysts: US calendar (GDP, durable goods, jobless claims), geopolitics (Russia/Ukraine). No systemic alert, but caution required.

- Action Plan: Filter entries on technical supports, exit on extreme sell volume or macro shock.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

- 1D: Compression below historical resistances (109–111k), solid momentum, potential buy zone 102750–98330.

- 12H: Multiple resistances, uptrend, support confluence 102756–106530 pivot key.

- 6H: Price under resistance cluster (106530), possible profit-taking on rejection, strong support 102756.

- 4H: High-range structure, reinforced supports, next breakout could trigger acceleration with volume.

- 2H: Pivot zone 106500–107200, caution below close, buy zone on correction.

- 1H: Support stacking structure, no clear breakdown, critical node, aggressive buy 106100–105800.

- 30min: Compression at range high, caution on buying resistance, key spots 106000/104500.

- 15min: Possible buyer exhaustion under 108k, tactical buy on support 106000–106500 if confirmed.

- Summary: Strong bullish alignment, same key supports, no panic. Risk On / Risk Off Indicator neutral, controlled market, possible whipsaw on short-term TFs but no major reversal sign.

__________________________________________________________________________________

Macro, News & On-Chain Analysis

__________________________________________________________________________________

- Macro: Fed and traditional markets calm, no monetary alert. Israel/Iran ceasefire, increased volatility in Europe (Russia/Ukraine). Moderate risk-on sentiment.

- Calendar: June 26: US durable goods/GDP/jobless claims (potential volatility).

- On-chain: BTC range $100–110k, fundamental support $93–100k, no panic/capitulation. Low spot volumes, bullish digestion phase.

__________________________________________________________________________________

Conclusion

__________________________________________________________________________________

- Dominant bias: Up/moderately bullish in short term, focus on retracement buying.

- Risk management: Stop H4 < $102.7k, H1 < $106k, scalping: break of 106k with extreme volumes.

- Action zones: Reinforce on $106k/$103k/$100k retrace, partial TP below 110–111k, extension if confirmed breakout.

- Monitor: Volume, support reactions, macro catalysts.

Summary:

Technical and on-chain context remains bullish; best approach is tactical buying on pullback with dynamic stops. Stay agile in case of extreme selling volume or macro shocks. Act on signals, protect capital.

__________________________________________________________________________________

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.