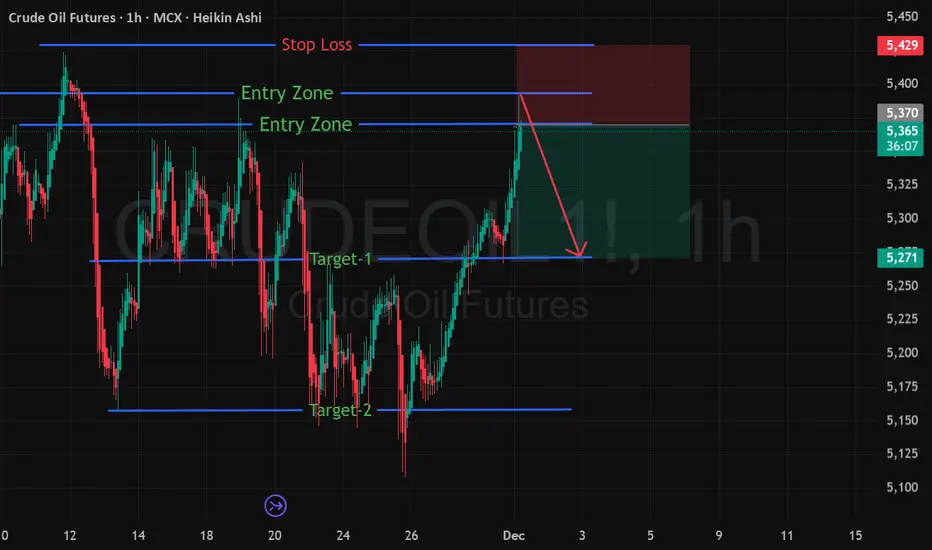

A fresh Bullish Trend Entry Zone has been detected on MCX Crude Oil DEC-25, indicating a potential upside continuation from the demand zone.

📈 Trade Setup

🟢 Entry Range: 5370 – 5390

🔴 Stop Loss: 5430

🎯 Target 1: 5270

🎯 Target 2: 5170

📊 Chart Explanation

Crude Oil has recently shown strong accumulation behavior near the lower demand band. Price is now entering a bullish reversal range, supported by:

Prior demand zone retest

Higher-low structure

Increasing bullish momentum

Buyers absorbing supply near 5370–5390

This setup indicates a possible swing move towards the 5270 and 5170 zones.

⚠️ Risk Management

Keep SL strictly at 5430

Position sizing is crucial as volatility remains high

This analysis is for educational purposes—trade with discipline

📌 Summary

Crude Oil DEC-25 is showing a clean bullish continuation structure. If price sustains above the entry zone, we may see a strong move toward the mentioned targets.

📈 Trade Setup

🟢 Entry Range: 5370 – 5390

🔴 Stop Loss: 5430

🎯 Target 1: 5270

🎯 Target 2: 5170

📊 Chart Explanation

Crude Oil has recently shown strong accumulation behavior near the lower demand band. Price is now entering a bullish reversal range, supported by:

Prior demand zone retest

Higher-low structure

Increasing bullish momentum

Buyers absorbing supply near 5370–5390

This setup indicates a possible swing move towards the 5270 and 5170 zones.

⚠️ Risk Management

Keep SL strictly at 5430

Position sizing is crucial as volatility remains high

This analysis is for educational purposes—trade with discipline

📌 Summary

Crude Oil DEC-25 is showing a clean bullish continuation structure. If price sustains above the entry zone, we may see a strong move toward the mentioned targets.

Dagangan aktif

Nota

📘 How My Trading Plan Works I follow a strict and mechanical rule-based system, designed to protect capital and maximize returns.

Below is the exact step-by-step plan:

✅ 1. My Fixed Risk–Reward Ratio: 1 : 2

Every trade is designed to achieve minimum 1:2 RR.

If SL is 60 points → target must be at least 120 points.

This keeps the system profitable even if win-rate drops.

✅ 2. When Target = 1:1 → Move Stoploss to Cost

Example:

Entry 5380 → SL 5430 (50 points) → 1:1 = 5330

➡️ Once price hits 5330, the stoploss is shifted to 5380 (cost-to-cost).

🔒 This makes the trade risk-free.

✅ 3. When Price Completes 80% Toward Target → Trail Profit

Target-1: 5270

80% zone ≈ 5290 – 5270

At this stage:

✔ We book partial profits or

✔ Trail SL to protect majority of gains

This avoids giving back profits during pullbacks.

Dagangan ditutup: sasaran tercapai

Target 1 is nearly achieved (Low: 5281)🎯 Target 1: 5270

(Already almost achieved) (If Follow 80% Trail profit rule)

🎯 Target 2: 5170

(Advanced continuation target)

🎯 4. Holding Plan for Advanced Traders

If you are an experienced trader:

➡️ Hold the remaining position

➡️ SL stays at Cost-to-Cost

➡️ Let price move naturally toward Target-2 (5170)

This is where trend followers capture the bigger move.

🔍 Market Outlook

The price reaction confirms the bearish continuation structure.

If the candles close below 5300, momentum toward 5170 becomes stronger.

Trend traders should track:

Supply zones forming on lower timeframes

Volatility expansion

Pullback rejection candles

✅ Conclusion

Target-1 has almost been hit exactly as per plan.

Now the trade is risk-free for those who followed the rules.

📌 Next Focus:

Trail properly

Manage position size

Track price behavior around 5250–5270 zone.

(Please follow and boost)

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.