So on Friday,  NIFTY fell as profit booking started after that sharp rally which we spotted earlier on October 9.

NIFTY fell as profit booking started after that sharp rally which we spotted earlier on October 9.

Big congrats to all the ones who trusted the analysis and traded it well.

Now, on Friday we saw both-side buildup on the index, but sellers’ volume was higher — that’s important to note.

For tomorrow, we only need to focus on one thing — whether Nifty breaks above 25850 or below 25750. These two levels hold massive OI buildups and will decide the next move.

If Nifty breaks above 25850, expect a sharp short rally (sharp because the PP is tight) that could push the index to new highs in the coming days.

But if it breaks below 25750 and sustains for one hour, we could see a drop toward 25666 / 25445.

However, my view stays Sell-on-Rise unless the index gives a strong close above 25850.

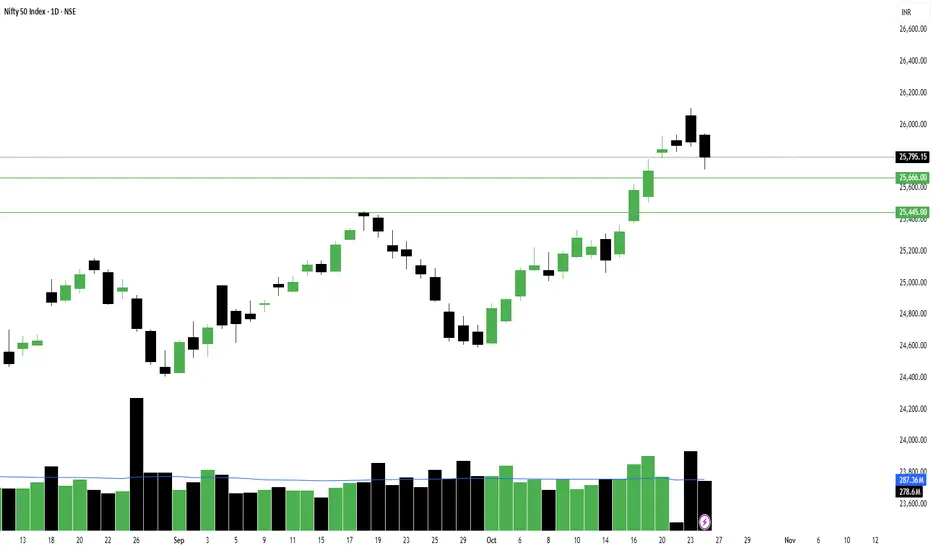

Why? Look at the attached chart — Friday’s candle was a clear shakeout candle, and there’s visible selling pressure buildup. This combination suggests that while accumulation is happening, buyers still lack the strength to dominate the sellers.

This weakness might reflect tomorrow. And remember — this view fails if Nifty breaks 25850 and sustains above it for one hour.

In trading, execution always beats opinion. So I’ll execute based on how the market behaves tomorrow — because I’d rather lose my view than lose my money.

Pivot stays at 25819, you guys already know what to do with that information.

On the sectoral front, CNXFINANCE ,

CNXFINANCE ,  BANKNIFTY , and

BANKNIFTY , and  CNXMETAL continue to look strong.

CNXMETAL continue to look strong.

That’s all for today. Take care and have a profitable tomorrow.

📊Levels at a glance:

Pivot: 25819

Support: 25750 (below = 25666 / 25445)

Resistance: 25850 (above = sharp short rally to new highs)

Pivot Percentile: Tight (volatile breakout/breakdown possible)

Bias: Sell-on-Rise until close above 25850

Market view: Shakeout candle with selling buildup

Sectors to watch: Financials, Banks, Steel

Big congrats to all the ones who trusted the analysis and traded it well.

Now, on Friday we saw both-side buildup on the index, but sellers’ volume was higher — that’s important to note.

For tomorrow, we only need to focus on one thing — whether Nifty breaks above 25850 or below 25750. These two levels hold massive OI buildups and will decide the next move.

If Nifty breaks above 25850, expect a sharp short rally (sharp because the PP is tight) that could push the index to new highs in the coming days.

But if it breaks below 25750 and sustains for one hour, we could see a drop toward 25666 / 25445.

However, my view stays Sell-on-Rise unless the index gives a strong close above 25850.

Why? Look at the attached chart — Friday’s candle was a clear shakeout candle, and there’s visible selling pressure buildup. This combination suggests that while accumulation is happening, buyers still lack the strength to dominate the sellers.

This weakness might reflect tomorrow. And remember — this view fails if Nifty breaks 25850 and sustains above it for one hour.

In trading, execution always beats opinion. So I’ll execute based on how the market behaves tomorrow — because I’d rather lose my view than lose my money.

Pivot stays at 25819, you guys already know what to do with that information.

On the sectoral front,

That’s all for today. Take care and have a profitable tomorrow.

📊Levels at a glance:

Pivot: 25819

Support: 25750 (below = 25666 / 25445)

Resistance: 25850 (above = sharp short rally to new highs)

Pivot Percentile: Tight (volatile breakout/breakdown possible)

Bias: Sell-on-Rise until close above 25850

Market view: Shakeout candle with selling buildup

Sectors to watch: Financials, Banks, Steel

TrendX INC

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

TrendX INC

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.