📘 Mastering the Double Top Pattern — Structure, Psychology & How Smart Money Uses It

- The Double Top is one of the most powerful reversal patterns in technical analysis. When used correctly, it helps traders catch the transition from bullish momentum → bearish reversal with high accuracy.

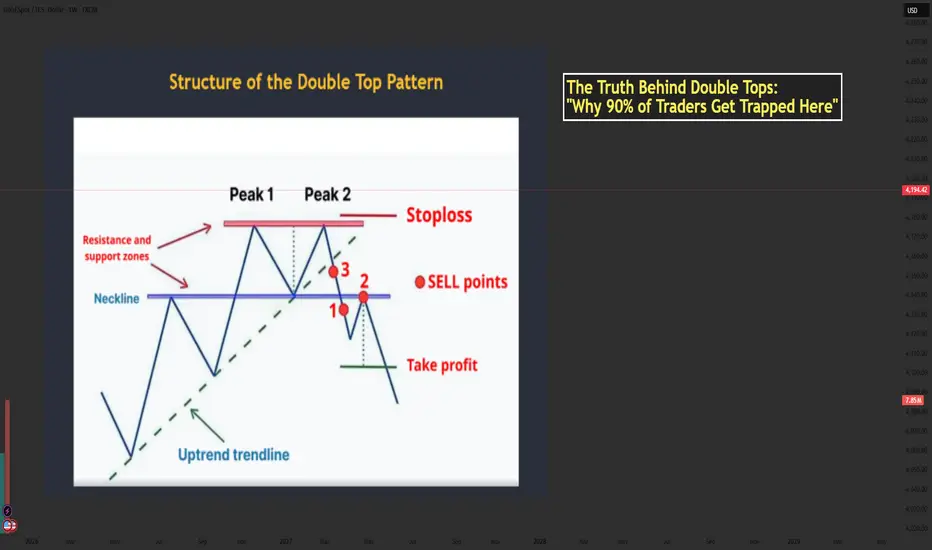

- Let’s break down the structure using the chart you provided and enhance it with professional-level insights.

🔶 1. Structure of the Double Top

1️⃣ The First Top

- Price pushes upward strongly during an uptrend.

- Buyers are in full control and create the first peak.

- After reaching resistance, price pulls back → forming the neckline.

This pullback is normal and represents the market taking profits.

2️⃣ The Second Top

- Price rallies again but fails to break above Peak 1.

- This failure is extremely important — it shows bulls are losing strength.

- The second top traps late buyers who expect a breakout.

3️⃣ The Neckline Break

- Once price breaks below the neckline, the structure is officially confirmed.

- This represents sellers overwhelming buyers.

- A break of structure → shift in market control.

📌 Professional traders only consider the pattern valid AFTER the neckline break.

🔶 2. Market Psychology Behind the Double Top

Understanding the pattern’s psychology is what separates beginners from professional traders.

1️⃣ At Peak 1

Bulls believe the trend will continue.

Retail traders buy aggressively.

2️⃣ Pullback to Neckline

A healthy correction occurs; no one expects a reversal yet.

3️⃣ At Peak 2

This is where emotions start to shift:

- Retail buyers expect a breakout.

- Smart Money uses this area as a liquidity zone to trigger buy stops.

- Institutions often sell into this liquidity, creating the foundation for reversal.

4️⃣ Neckline Break

Panic begins:

Buyers trapped at Peak 2 start closing positions.

Sellers enter aggressively.

Momentum shifts — the trend has reversed.

5️⃣ Retest

The retest is a psychological trap:

- Trapped buyers hope for “one more push up.”

- Sellers add positions at better prices.

- When price rejects the neckline → the downtrend accelerates.

💡 This is why the retest is the safest sell entry.

🔶 3. Conditions for a High-Quality Double Top

To avoid fake patterns, check these criteria:

✔️ Must appear after a clear uptrend

✔️ Both tops should be similar in height

✔️ Volume should decrease on the second top

✔️ Neckline breakout must be decisive and clean

✔️ Better if second peak creates a stop-hunt wicking above Peak 1

✔️ Even more powerful when aligned with:

- HTF resistance

- Institutional zones

- Liquidity sweeps

- Overbought RSI

- Divergence

🔶 4. How to Trade the Double Top

1️⃣ Entry (Sell Zone)

Best Entry:

👉 SELL on the neckline retest after the breakout.

This gives:

- Best accuracy

- Best risk–reward

- Confirmation that the market has shifted bearish

2️⃣ Stop Loss Placement

Place SL:

- Above Peak 2

- Or above Peak 1 (more conservative)

🛑 SL must sit outside the structure to avoid fake moves.

3️⃣ Take Profit Target

The classic measurement:

- Distance from Peak → Neckline

- Projected downward

This gives the first TP.

TP2 can be placed at:

Next support zone

- Fib 1.618 extension

- HTF demand area

🔶 5. Real Market Example

Your image shows:

- Two clear peaks forming under a resistance zone

- Neckline support holding price

- A strong break below the neckline

- Sell entries at the ideal points:

+ Point 1 → aggressive breakout trader

+ Point 2 → safest retest entry

+ Point 3 → early anticipation entry (riskier)

The downward projection after the pattern aligns perfectly with the expected target zone.

🔶 6. Trader Psychology: Why People Lose with Double Tops

Most traders get trapped because they:

❌ Sell too early (before neckline break)

❌ Expect the second top to drop immediately

❌ Ignore volume or candle strength

❌ Enter without waiting for retest

❌ Fear missing out and chase price after the big drop

Smart Money uses these emotions:

- Greed → traps buyers at Peak 2

- Fear → forces panic selling at neckline break

- FOMO → attracts late sellers at the worst price

Your job is to stay patient and enter only at the retest, where probability is highest.

🔶 7. Professional Tips to Master the Double Top

✔️ Wait for structure confirmation → neckline break

✔️ Don’t sell inside the range between the two peaks

✔️ Use RSI divergence to strengthen accuracy

✔️ Look for stop-hunt wicks above Peak 2

✔️ Combine with trendline breaks for timing

✔️ Use a top-down approach (H4 + H1 → M15 entry)

✨ Final Message for Traders

The Double Top is not just a pattern it is a reflection of fear, greed, and trapped liquidity.

Master the psychology behind it, and it becomes one of your most reliable reversal tools.

If this helped your trading, drop a comment and share your thoughts!

Let’s grow together. ❤️📈

- The Double Top is one of the most powerful reversal patterns in technical analysis. When used correctly, it helps traders catch the transition from bullish momentum → bearish reversal with high accuracy.

- Let’s break down the structure using the chart you provided and enhance it with professional-level insights.

🔶 1. Structure of the Double Top

1️⃣ The First Top

- Price pushes upward strongly during an uptrend.

- Buyers are in full control and create the first peak.

- After reaching resistance, price pulls back → forming the neckline.

This pullback is normal and represents the market taking profits.

2️⃣ The Second Top

- Price rallies again but fails to break above Peak 1.

- This failure is extremely important — it shows bulls are losing strength.

- The second top traps late buyers who expect a breakout.

3️⃣ The Neckline Break

- Once price breaks below the neckline, the structure is officially confirmed.

- This represents sellers overwhelming buyers.

- A break of structure → shift in market control.

📌 Professional traders only consider the pattern valid AFTER the neckline break.

🔶 2. Market Psychology Behind the Double Top

Understanding the pattern’s psychology is what separates beginners from professional traders.

1️⃣ At Peak 1

Bulls believe the trend will continue.

Retail traders buy aggressively.

2️⃣ Pullback to Neckline

A healthy correction occurs; no one expects a reversal yet.

3️⃣ At Peak 2

This is where emotions start to shift:

- Retail buyers expect a breakout.

- Smart Money uses this area as a liquidity zone to trigger buy stops.

- Institutions often sell into this liquidity, creating the foundation for reversal.

4️⃣ Neckline Break

Panic begins:

Buyers trapped at Peak 2 start closing positions.

Sellers enter aggressively.

Momentum shifts — the trend has reversed.

5️⃣ Retest

The retest is a psychological trap:

- Trapped buyers hope for “one more push up.”

- Sellers add positions at better prices.

- When price rejects the neckline → the downtrend accelerates.

💡 This is why the retest is the safest sell entry.

🔶 3. Conditions for a High-Quality Double Top

To avoid fake patterns, check these criteria:

✔️ Must appear after a clear uptrend

✔️ Both tops should be similar in height

✔️ Volume should decrease on the second top

✔️ Neckline breakout must be decisive and clean

✔️ Better if second peak creates a stop-hunt wicking above Peak 1

✔️ Even more powerful when aligned with:

- HTF resistance

- Institutional zones

- Liquidity sweeps

- Overbought RSI

- Divergence

🔶 4. How to Trade the Double Top

1️⃣ Entry (Sell Zone)

Best Entry:

👉 SELL on the neckline retest after the breakout.

This gives:

- Best accuracy

- Best risk–reward

- Confirmation that the market has shifted bearish

2️⃣ Stop Loss Placement

Place SL:

- Above Peak 2

- Or above Peak 1 (more conservative)

🛑 SL must sit outside the structure to avoid fake moves.

3️⃣ Take Profit Target

The classic measurement:

- Distance from Peak → Neckline

- Projected downward

This gives the first TP.

TP2 can be placed at:

Next support zone

- Fib 1.618 extension

- HTF demand area

🔶 5. Real Market Example

Your image shows:

- Two clear peaks forming under a resistance zone

- Neckline support holding price

- A strong break below the neckline

- Sell entries at the ideal points:

+ Point 1 → aggressive breakout trader

+ Point 2 → safest retest entry

+ Point 3 → early anticipation entry (riskier)

The downward projection after the pattern aligns perfectly with the expected target zone.

🔶 6. Trader Psychology: Why People Lose with Double Tops

Most traders get trapped because they:

❌ Sell too early (before neckline break)

❌ Expect the second top to drop immediately

❌ Ignore volume or candle strength

❌ Enter without waiting for retest

❌ Fear missing out and chase price after the big drop

Smart Money uses these emotions:

- Greed → traps buyers at Peak 2

- Fear → forces panic selling at neckline break

- FOMO → attracts late sellers at the worst price

Your job is to stay patient and enter only at the retest, where probability is highest.

🔶 7. Professional Tips to Master the Double Top

✔️ Wait for structure confirmation → neckline break

✔️ Don’t sell inside the range between the two peaks

✔️ Use RSI divergence to strengthen accuracy

✔️ Look for stop-hunt wicks above Peak 2

✔️ Combine with trendline breaks for timing

✔️ Use a top-down approach (H4 + H1 → M15 entry)

✨ Final Message for Traders

The Double Top is not just a pattern it is a reflection of fear, greed, and trapped liquidity.

Master the psychology behind it, and it becomes one of your most reliable reversal tools.

If this helped your trading, drop a comment and share your thoughts!

Let’s grow together. ❤️📈

MY COMMUNITY GROUP FREE SIGNAL

✅ 100% Free — I don’t take a penny from anyone

✅ Free Signal: 4 - 6 signals

✅ Trading Idea / Setup / Technical

✅ JOIN MY COMMUNITY GROUP IN Telegram:

t.me/+2pCKgjf_zxplMmQ1

✅ 100% Free — I don’t take a penny from anyone

✅ Free Signal: 4 - 6 signals

✅ Trading Idea / Setup / Technical

✅ JOIN MY COMMUNITY GROUP IN Telegram:

t.me/+2pCKgjf_zxplMmQ1

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

MY COMMUNITY GROUP FREE SIGNAL

✅ 100% Free — I don’t take a penny from anyone

✅ Free Signal: 4 - 6 signals

✅ Trading Idea / Setup / Technical

✅ JOIN MY COMMUNITY GROUP IN Telegram:

t.me/+2pCKgjf_zxplMmQ1

✅ 100% Free — I don’t take a penny from anyone

✅ Free Signal: 4 - 6 signals

✅ Trading Idea / Setup / Technical

✅ JOIN MY COMMUNITY GROUP IN Telegram:

t.me/+2pCKgjf_zxplMmQ1

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.