Commerce Bancshares (CBSH) Reports Q2: Everything You Need To Know Ahead Of Earnings

Regional banking company Commerce Bancshares CBSH will be reporting earnings this Wednesday before market open. Here’s what to look for.

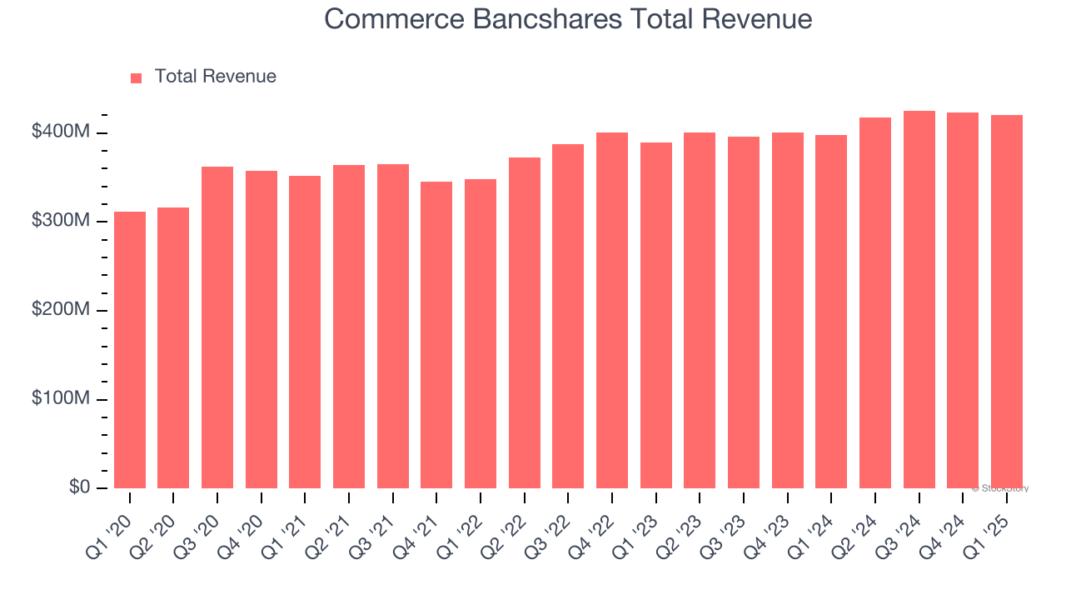

Commerce Bancshares beat analysts’ revenue expectations by 0.7% last quarter, reporting revenues of $420.5 million, up 5.8% year on year. It was a satisfactory quarter for the company, with an impressive beat of analysts’ net interest income estimates but EPS in line with analysts’ estimates.

Is Commerce Bancshares a buy or sell going into earnings? Read our full analysis here, it’s free.

This quarter, analysts are expecting Commerce Bancshares’s revenue to grow 3.9% year on year to $434.2 million, in line with the 4.3% increase it recorded in the same quarter last year. Adjusted earnings are expected to come in at $1.05 per share.

Analysts covering the company have generally reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. Commerce Bancshares has a history of exceeding Wall Street’s expectations, beating revenue estimates every single time over the past two years by 1.9% on average.

Looking at Commerce Bancshares’s peers in the banks segment, only FB Financial has reported results so far. It missed analysts’ revenue estimates by 43.5%, posting year-on-year sales declines of 40.1%. Read our full analysis of FB Financial’s earnings results here.

There has been positive sentiment among investors in the banks segment, with share prices up 11.6% on average over the last month. Commerce Bancshares is up 8.1% during the same time and is heading into earnings with an average analyst price target of $67.25 (compared to the current share price of $65.77).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.