EUR/USD is once again in the spotlight as the Federal Reserve prepares to meet this week. The backdrop is a perceived convergence between Fed and ECB rate paths, narrowing a differential that had long favored the dollar. The euro has regained lost ground after the summer, trading around strategic levels supported by a more balanced macro environment and relative eurozone resilience. A combined reading of fundamentals, technicals, sentiment, and options flows helps refine potential scenarios for the weeks ahead.

Fundamental Analysis

Two main narratives drive EUR/USD. On the U.S. side, inflation has remained stickier than expected. The August CPI rose +0.4% m/m, pushing headline inflation to 2.9% and the core to 3.1%. This persistence reflects tariff- and food-driven pressures, leaving the Fed juggling inflation control with signs of weakening in the labor market. Job creation has slowed, and unemployment claims have edged higher, complicating the policy mix.

Markets expect a 25bp rate cut in September, which would mark the start of a cautious easing cycle. Beyond that, uncertainty dominates: some see another move before year-end, others expect a pause as the Fed reassesses inflation and growth dynamics.

In Europe, the ECB has held its deposit rate steady at 2%, underscoring that disinflation is in progress while acknowledging inflation will remain slightly above target in 2025 (2.1% forecast). President Christine Lagarde described the economy as “in a good place,” lowering the likelihood of aggressive cuts. As a result, the policy spread between the Fed and ECB is shrinking, undermining the dollar’s yield advantage and lending structural support to the euro.

Technical Analysis

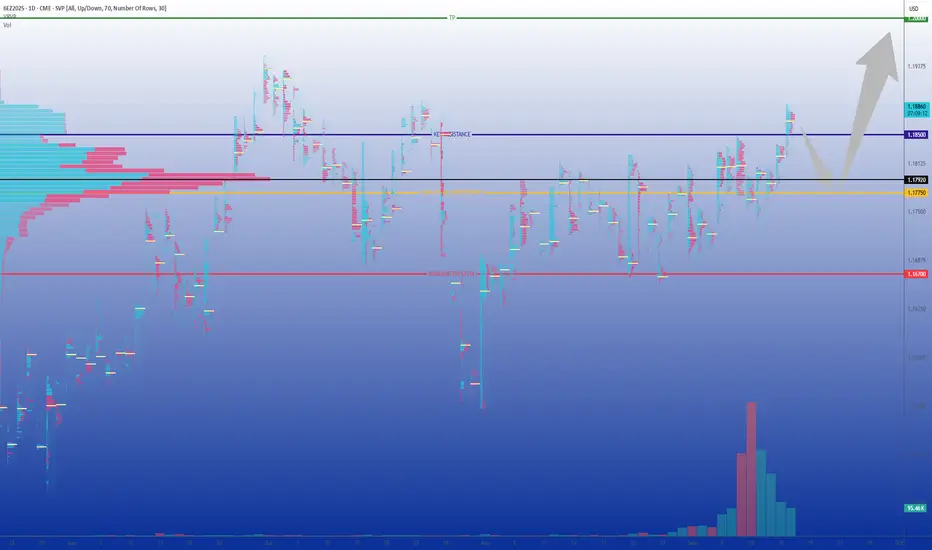

The December 2025 Euro FX futures contract (6EZ5) is currently challenging resistance at the upper boundary of a tight 1.1650–1.1850 range. The volume profile highlights a dense cluster between 1.1775 and 1.1800, forming key short-term support. As long as this zone holds, the technical bias leans higher.

A clean break above 1.1850 would likely accelerate momentum toward the psychological 1.20–1.2050 zone, already cited by technical analysts as the next upside target.

On the downside, 1.1670 is the pivot for validation. A sustained move below would undermine the bullish scenario and risk a return toward sub-1.1600 levels. For now, however, support continues to attract buyers, keeping the uptrend intact.

Sentiment Analysis

Broker positioning data shows retail traders remain heavily short EUR/USD, a contrarian indicator favoring further gains. Importantly, the rally is not built on a fragile short squeeze but on steady accumulation, which makes it more sustainable.

Commitments of Traders (COT) reports reinforce this: asset managers remain long euro, dealers are short for hedging, and leveraged funds sit closer to neutral. Institutional flows, in other words, lean supportive.

Low implied volatility further highlights the lack of market conviction in a sharp downside break. Investors appear more concerned with missing an upside move than with protecting against euro weakness, which strengthens the bullish tilt.

Options Activity

In the OTC market, risk reversals are slightly skewed in favor of euro calls, suggesting more demand for upside protection. This fits neatly with both fundamentals and positioning.

At the CME, open interest paints a similar picture:

Altogether, this suggests that 1.1850 is the immediate gravitational level, with room for extension toward 1.20 if momentum persists.

Trade Idea: Long 6EZ5

Directional setup:

This strategy combines institutional support visible in COT reports, option flows skewed toward the upside, strong technical zones, and narrowing Fed–ECB spreads that erode the dollar’s advantage.

Final Thoughts

The Fed’s September decision is more than a routine policy update. It could mark a turning point for global FX dynamics. U.S. inflation remains uncomfortably sticky, but weakening jobs data points toward gradual easing. In contrast, the ECB is signaling stability and relative confidence. This policy convergence narrows the rate gap, historically a pillar of dollar strength, and bolsters the medium-term case for euro appreciation.

Technically, the market is consolidating above robust support levels, while sentiment indicators and option positioning both lean bullish. The December 2025 contract captures this balance: a market with strong foundations, low volatility expectations, and option flows pointing toward a breakout higher.

The key tactical question is whether the Fed provides enough dovish tone to unlock the upside. If EUR/USD breaks decisively above 1.1850, momentum toward 1.20 could unfold quickly. In the short term, caution is warranted heading into the FOMC, but unless an external shock emerges, the combined weight of fundamentals, technicals, and sentiment continues to argue for a stronger euro in the weeks ahead.

---

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: tradingview.com/cme/.

This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Fundamental Analysis

Two main narratives drive EUR/USD. On the U.S. side, inflation has remained stickier than expected. The August CPI rose +0.4% m/m, pushing headline inflation to 2.9% and the core to 3.1%. This persistence reflects tariff- and food-driven pressures, leaving the Fed juggling inflation control with signs of weakening in the labor market. Job creation has slowed, and unemployment claims have edged higher, complicating the policy mix.

Markets expect a 25bp rate cut in September, which would mark the start of a cautious easing cycle. Beyond that, uncertainty dominates: some see another move before year-end, others expect a pause as the Fed reassesses inflation and growth dynamics.

In Europe, the ECB has held its deposit rate steady at 2%, underscoring that disinflation is in progress while acknowledging inflation will remain slightly above target in 2025 (2.1% forecast). President Christine Lagarde described the economy as “in a good place,” lowering the likelihood of aggressive cuts. As a result, the policy spread between the Fed and ECB is shrinking, undermining the dollar’s yield advantage and lending structural support to the euro.

Technical Analysis

The December 2025 Euro FX futures contract (6EZ5) is currently challenging resistance at the upper boundary of a tight 1.1650–1.1850 range. The volume profile highlights a dense cluster between 1.1775 and 1.1800, forming key short-term support. As long as this zone holds, the technical bias leans higher.

A clean break above 1.1850 would likely accelerate momentum toward the psychological 1.20–1.2050 zone, already cited by technical analysts as the next upside target.

On the downside, 1.1670 is the pivot for validation. A sustained move below would undermine the bullish scenario and risk a return toward sub-1.1600 levels. For now, however, support continues to attract buyers, keeping the uptrend intact.

Sentiment Analysis

Broker positioning data shows retail traders remain heavily short EUR/USD, a contrarian indicator favoring further gains. Importantly, the rally is not built on a fragile short squeeze but on steady accumulation, which makes it more sustainable.

Commitments of Traders (COT) reports reinforce this: asset managers remain long euro, dealers are short for hedging, and leveraged funds sit closer to neutral. Institutional flows, in other words, lean supportive.

Low implied volatility further highlights the lack of market conviction in a sharp downside break. Investors appear more concerned with missing an upside move than with protecting against euro weakness, which strengthens the bullish tilt.

Options Activity

In the OTC market, risk reversals are slightly skewed in favor of euro calls, suggesting more demand for upside protection. This fits neatly with both fundamentals and positioning.

At the CME, open interest paints a similar picture:

- A Put/Call ratio tilted toward calls

- Heavy concentrations at 1.1800 and 1.1850 strikes, creating upward magnetism

- Limited put interest between 1.1650–1.1700, only relevant if spot weakens sharply

- Low implied volatility, signaling no expectation of outsized moves before the Fed meeting

Altogether, this suggests that 1.1850 is the immediate gravitational level, with room for extension toward 1.20 if momentum persists.

Trade Idea: Long 6EZ5

Directional setup:

- Entry: Buy on dips toward 1.1775

- Invalidation: Close below 1.1670

- Take Profit: 1.1975–1.2000 (psychological milestone and measured target)

This strategy combines institutional support visible in COT reports, option flows skewed toward the upside, strong technical zones, and narrowing Fed–ECB spreads that erode the dollar’s advantage.

Final Thoughts

The Fed’s September decision is more than a routine policy update. It could mark a turning point for global FX dynamics. U.S. inflation remains uncomfortably sticky, but weakening jobs data points toward gradual easing. In contrast, the ECB is signaling stability and relative confidence. This policy convergence narrows the rate gap, historically a pillar of dollar strength, and bolsters the medium-term case for euro appreciation.

Technically, the market is consolidating above robust support levels, while sentiment indicators and option positioning both lean bullish. The December 2025 contract captures this balance: a market with strong foundations, low volatility expectations, and option flows pointing toward a breakout higher.

The key tactical question is whether the Fed provides enough dovish tone to unlock the upside. If EUR/USD breaks decisively above 1.1850, momentum toward 1.20 could unfold quickly. In the short term, caution is warranted heading into the FOMC, but unless an external shock emerges, the combined weight of fundamentals, technicals, and sentiment continues to argue for a stronger euro in the weeks ahead.

---

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: tradingview.com/cme/.

This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Founder of Satelys Ltd, which specializes in developing automated trading systems for the FX market, and a consultant for CME Group.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Founder of Satelys Ltd, which specializes in developing automated trading systems for the FX market, and a consultant for CME Group.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.