🚨 **EARNINGS TRADE SETUP: APLD (Applied Digital)**

🗓️ Earnings: **July 31 (AMC)**

💥 Confidence: **65% Moderate Bullish**

🔥 Recent Run: **+94% past 3 months**

🧠 AI Infrastructure Hype + High IV = Opportunity

---

### 📊 FUNDAMENTALS SNAPSHOT

🟢 **Revenue Growth**: +22.1% YoY

🔴 **Profit Margin**: -110.4%

🔴 **Operating Margin**: -34.7%

⚠️ Historical EPS Beat Rate: **12% only**

📈 Analyst Target: **\$14.61** (+42.8% upside)

🔎 **Verdict**: High growth, deep losses — speculative with upside

---

### 🧠 OPTIONS FLOW

💣 **High IV Crush Risk**

🟥 **Put Wall**: \$10.00 (6,700 contracts)

🟩 **Speculative Calls**: \$10.50 & \$11.00 loaded

⚖️ Mixed Sentiment → Tilted Bullish

---

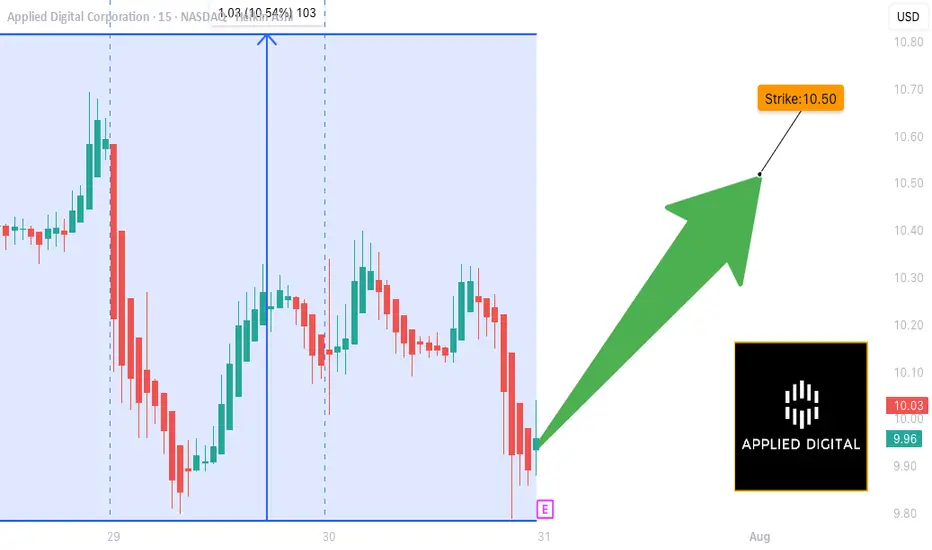

### 📉 TECHNICAL CHECK

💹 Price: **\$10.12**

📉 Below 20D MA (\$10.31)

📌 Support: **\$10.00**

📌 Resistance: **\$10.50**

⚠️ RSI Cooling → Watch for breakout or rejection

---

### 💥 TRADE IDEA

**🎯 Call Option — Strike \$10.50 — Exp 08/01**

💵 Entry: \$0.57

🚀 Profit Target: \$2.28 (200–400% ROI zone)

🛑 Stop Loss: \$0.285

📈 Size: 1 contract (2% of portfolio)

🕓 Exit: 1–2 hours post earnings to avoid IV crush

---

### 🧠 TRADE LOGIC

Risky setup — but technicals + AI narrative + speculative flow = **earnings lotto ticket with strategy.**

💬 *"Speculation with structure beats blind YOLO."*

---

📌 Tag a trader who likes calculated risk 📈

📉 Don’t forget to scale OUT, not just IN.

\#APLD #EarningsPlay #OptionsTrading #TradingView #AIStocks #YOLOWithStops #IVCrushProof #CallOptions #SwingTrade #BullishSetup

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.