Don’t Be the Exit Liquidity: The Truth About IPOs

Picture this: a company wants to go public. They don’t just toss shares on the market like a garage sale. No. The sequence is distinct.

First, the company sits down with the sharpest pencils on Wall Street—the underwriters. These aren’t TikTok stock gurus; they’re analysts whose job is to tear apart every balance sheet and market forecast. They value the business, set a price, and—here’s the kicker—they buy the shares themselves. Real money on the line. Then they resell to big funds. Only after that circus is done does the stock finally hit the exchange, where the rest of us can click “buy.”

Now, what happens at the open? Retail traders pile in like it’s Black Friday, paying two or three times the IPO price because “it’s going to the moon.” But who’s on the other side of that trade? The pros. The funds. The people who literally just bought the same shares for half the price. They’re not dumb. They’re happy to sell you their cheap stock at your expensive price.

Look at 2025’s hottest IPOs:

Figma (FIG): Priced at $33. Opened at $85. Shot to $142. Now back near $74.

Circle (CRCL): IPO $31. Opened $69. Spiked to $299. Collapsed to $135.

Chime (CHYM): IPO $27. Opened $43. Two weeks later? $29.

Bullish (BLSH): IPO $37. Opened $95. Peaked $118. Then sagged to $68.

See the theme? If you chased the open, you weren’t investing. You were buying somebody else’s victory dinner.

Here’s the advice your future self will thank you for: trust the underwriters’ homework. These people aren’t perfect, but they’re the best paid risk managers on the planet, and they literally put their own money into the deal. If the IPO is priced at $30, there’s usually a reason. Paying a little premium—maybe 20–30%—is fine. But doubling or tripling that on hype? That’s how you end up holding the bag.

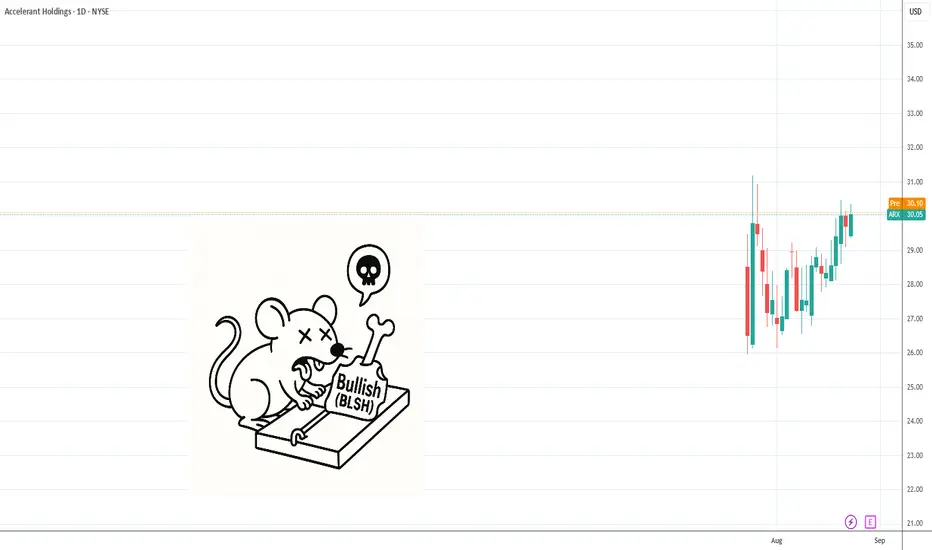

If you want an IPO that’s actually worth leaning into a bit above the ask, keep an eye on Accelerant Holdings. Insurance may sound boring, but boring makes money. They’re disrupting an industry with a clear, scalable model. Unlike some flashy names, Accelerant has a simple story and a real path to growth. Paying 30% above ask for that? Much smarter bet than chasing a crypto stock that just opened at triple.

Final thought: IPO day isn’t a lottery. It’s poker. The pros already know the cards. Don’t sit down at their table without understanding the rules.

First, the company sits down with the sharpest pencils on Wall Street—the underwriters. These aren’t TikTok stock gurus; they’re analysts whose job is to tear apart every balance sheet and market forecast. They value the business, set a price, and—here’s the kicker—they buy the shares themselves. Real money on the line. Then they resell to big funds. Only after that circus is done does the stock finally hit the exchange, where the rest of us can click “buy.”

Now, what happens at the open? Retail traders pile in like it’s Black Friday, paying two or three times the IPO price because “it’s going to the moon.” But who’s on the other side of that trade? The pros. The funds. The people who literally just bought the same shares for half the price. They’re not dumb. They’re happy to sell you their cheap stock at your expensive price.

Look at 2025’s hottest IPOs:

Figma (FIG): Priced at $33. Opened at $85. Shot to $142. Now back near $74.

Circle (CRCL): IPO $31. Opened $69. Spiked to $299. Collapsed to $135.

Chime (CHYM): IPO $27. Opened $43. Two weeks later? $29.

Bullish (BLSH): IPO $37. Opened $95. Peaked $118. Then sagged to $68.

See the theme? If you chased the open, you weren’t investing. You were buying somebody else’s victory dinner.

Here’s the advice your future self will thank you for: trust the underwriters’ homework. These people aren’t perfect, but they’re the best paid risk managers on the planet, and they literally put their own money into the deal. If the IPO is priced at $30, there’s usually a reason. Paying a little premium—maybe 20–30%—is fine. But doubling or tripling that on hype? That’s how you end up holding the bag.

If you want an IPO that’s actually worth leaning into a bit above the ask, keep an eye on Accelerant Holdings. Insurance may sound boring, but boring makes money. They’re disrupting an industry with a clear, scalable model. Unlike some flashy names, Accelerant has a simple story and a real path to growth. Paying 30% above ask for that? Much smarter bet than chasing a crypto stock that just opened at triple.

Final thought: IPO day isn’t a lottery. It’s poker. The pros already know the cards. Don’t sit down at their table without understanding the rules.

Dagangan aktif

I just opened ARX Sep19'25 25 Call for 1.40 USD

Nota

Opened another one ARX Oct17'25 25 Call for 2.00 USDNota

They reported mixed results for Q2 2025. Here’s the breakdown:Earnings per share (EPS): GAAP EPS came in at $0.14, beating consensus of $0.13 by $0.01

Summary: They beat on earnings, missed on revenue.

Nota

Revenue: Total revenue reached $219.1 million, falling short of analyst expectations (about $227.9 million)Nota

As price keep falling, I just opened another one:ARX Oct17'25 25 Call for 1.00 USD

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.