Please note :

I am self-taught and the information below is just my understanding/thoughts on the topic. I am open to debate in the comments if I have either misjudged something or have missed something altogether.

Pinbars

I wanted to publish something abit more educational regarding reading of candlesticks.The ‘pinbar’ is a crowd favourite and you don’t have to surf anything chart related for too long before running into a pinbar strategy. While I agree with the premise of it, there is an obvious lack of information out there regarding pinbars & hopefully I can do my bit and clarify some situations in which the pinbar is better used – in my opinion.

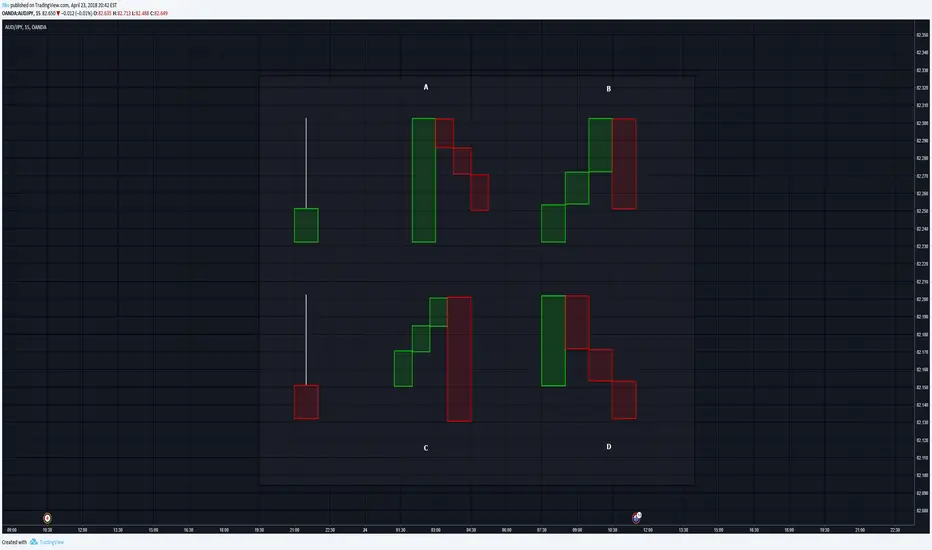

The chart here illustrates what many will categorize as ‘bearish’ pinbars . The word ‘rejection’ has begun to be thrown around too loosely. The truth of the matter is that some of these pinbars signal ‘relief’ or ‘retracement’ rather than ‘rejection’. While I recognise that there are thousands of other ways the breakdowns may occur, you can definitely relate most breakdowns back to the 4 here in one way or another.

While the context (ie location,trend etc) of the pinbar plays a major role, for the purposes of this post, we will put that aside.

For example, you see a pinbar form at the top of an up move on the 4hrly and decide to take a short. If I asked you to go down to the hrly and look at its breakdown, would you still short if its makeup was pinbar breakdown A? I wouldn’t as this breakdown signals a pause in the up move before continuation to me. If we were to talk about the order in which I would place the breakdowns for considerations of a short trade, it would be C,D,B,A.

This brings me to my next point, the colour of the pinbar you are trading matters. I have read several articles/guides online that either make no mention of the colour of the pinbar, or even say it is not important. Both C & D show a violation of the previously upward move, this signals that it is MORE LIKELY that price moves down rather than continue to the upside – this is pretty much the only edge we need in trading.

I urge you to go through your charts and mark down all the 4 hr pinbars you can find at appealing locations (like I said, context matters) & zoom into the 1hr to have a look at their breakdowns to see which ones succeed more often. While I have not fully tested these myself, I can pretty much guarantee with 100% certainty breakdown C will be way more successful than breakdown A.

Think about the strategies you can come up with which incorporates pinbars once you apply this info to it. For example,

You trade bearish pinbars (red with preferably breakdowns similar to C) that print with the following confluences :

In line with the overall trend on your higher timeframe

Has retraced to a decent resistance zone (horizontal or sloping) with a Fibonacci level present

Overbought readings on your RSI or stoch etc in order to refine it even more (Be cautious with this as with trading I find less is more & too many filters can cause paralysis)

Another way of taking advantage of this (and I don’t recommend this) is to trade the green pinbars (similar to setup A) to the UPSIDE if the location it appears in is out in the open & nowhere near any feasible resistance (outside the box, I know)

All the above info can be applied to bullish scenarios as well.

So remember, take notice of what the breakdown of the pinbar you wish to trade looks like & you will be able to refine your trading in order to take trades that offer the highest probability of success.

While I realise this was a rough guide, I hope you have found this helpful. If you did, leave an upvote, & share around so that more traders can avoid using pinbar strategies incorrectly. There is a lot of misinformation going around on the internet as a whole. Like I said initially, these are all thoughts I have had based on logic – so I could be mistaken in some way. Let me know your thoughts.

I am self-taught and the information below is just my understanding/thoughts on the topic. I am open to debate in the comments if I have either misjudged something or have missed something altogether.

Pinbars

I wanted to publish something abit more educational regarding reading of candlesticks.The ‘pinbar’ is a crowd favourite and you don’t have to surf anything chart related for too long before running into a pinbar strategy. While I agree with the premise of it, there is an obvious lack of information out there regarding pinbars & hopefully I can do my bit and clarify some situations in which the pinbar is better used – in my opinion.

The chart here illustrates what many will categorize as ‘bearish’ pinbars . The word ‘rejection’ has begun to be thrown around too loosely. The truth of the matter is that some of these pinbars signal ‘relief’ or ‘retracement’ rather than ‘rejection’. While I recognise that there are thousands of other ways the breakdowns may occur, you can definitely relate most breakdowns back to the 4 here in one way or another.

While the context (ie location,trend etc) of the pinbar plays a major role, for the purposes of this post, we will put that aside.

For example, you see a pinbar form at the top of an up move on the 4hrly and decide to take a short. If I asked you to go down to the hrly and look at its breakdown, would you still short if its makeup was pinbar breakdown A? I wouldn’t as this breakdown signals a pause in the up move before continuation to me. If we were to talk about the order in which I would place the breakdowns for considerations of a short trade, it would be C,D,B,A.

This brings me to my next point, the colour of the pinbar you are trading matters. I have read several articles/guides online that either make no mention of the colour of the pinbar, or even say it is not important. Both C & D show a violation of the previously upward move, this signals that it is MORE LIKELY that price moves down rather than continue to the upside – this is pretty much the only edge we need in trading.

I urge you to go through your charts and mark down all the 4 hr pinbars you can find at appealing locations (like I said, context matters) & zoom into the 1hr to have a look at their breakdowns to see which ones succeed more often. While I have not fully tested these myself, I can pretty much guarantee with 100% certainty breakdown C will be way more successful than breakdown A.

Think about the strategies you can come up with which incorporates pinbars once you apply this info to it. For example,

You trade bearish pinbars (red with preferably breakdowns similar to C) that print with the following confluences :

In line with the overall trend on your higher timeframe

Has retraced to a decent resistance zone (horizontal or sloping) with a Fibonacci level present

Overbought readings on your RSI or stoch etc in order to refine it even more (Be cautious with this as with trading I find less is more & too many filters can cause paralysis)

Another way of taking advantage of this (and I don’t recommend this) is to trade the green pinbars (similar to setup A) to the UPSIDE if the location it appears in is out in the open & nowhere near any feasible resistance (outside the box, I know)

All the above info can be applied to bullish scenarios as well.

So remember, take notice of what the breakdown of the pinbar you wish to trade looks like & you will be able to refine your trading in order to take trades that offer the highest probability of success.

While I realise this was a rough guide, I hope you have found this helpful. If you did, leave an upvote, & share around so that more traders can avoid using pinbar strategies incorrectly. There is a lot of misinformation going around on the internet as a whole. Like I said initially, these are all thoughts I have had based on logic – so I could be mistaken in some way. Let me know your thoughts.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.