Current Scenario:

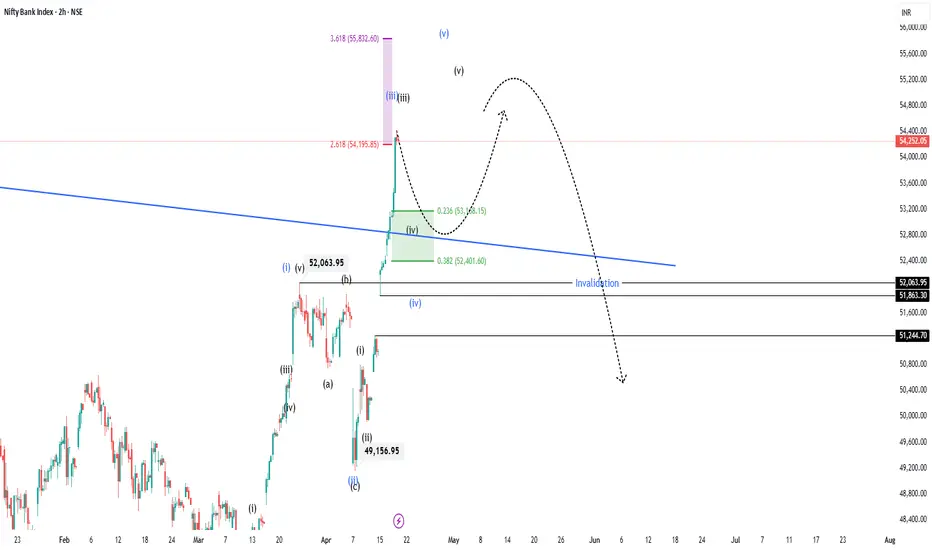

Wave 3 is actively in progress, showing strong bullish momentum characterized by price gaps—typical traits of an impulse Wave 3.

The ongoing move has already extended precisely up to the 2.618 Fibonacci extension, reflecting strong impulsiveness and market participation.

Trading Recommendations:

Do not initiate short positions until the critical support level of 52,064 is convincingly breached on the downside.

Currently, the risk-to-reward ratio does not favor initiating fresh longs at these elevated levels.

Optimal Entry Strategy:

Bank Nifty (BN) recently broke above a significant trendline resistance, validating bullish momentum.

Await a pullback into the corrective retracement zone (between 23.6% at 53,168 and 38.2% at 52,401) of the Wave 3 advance.

Enter fresh long positions within this retracement zone for a high-probability setup.

Next Steps:

Identify completion of Wave 4 correction. Only after this confirmation will precise projections for Wave 5 be accurately calculable.

Key Takeaway:

Maintain a bullish bias; however, wait for better entry levels on pullbacks. Prioritize risk management and patiently wait for Wave 4's completion before calculating precise targets for Wave 5.

Wave 3 is actively in progress, showing strong bullish momentum characterized by price gaps—typical traits of an impulse Wave 3.

The ongoing move has already extended precisely up to the 2.618 Fibonacci extension, reflecting strong impulsiveness and market participation.

Trading Recommendations:

Do not initiate short positions until the critical support level of 52,064 is convincingly breached on the downside.

Currently, the risk-to-reward ratio does not favor initiating fresh longs at these elevated levels.

Optimal Entry Strategy:

Bank Nifty (BN) recently broke above a significant trendline resistance, validating bullish momentum.

Await a pullback into the corrective retracement zone (between 23.6% at 53,168 and 38.2% at 52,401) of the Wave 3 advance.

Enter fresh long positions within this retracement zone for a high-probability setup.

Next Steps:

Identify completion of Wave 4 correction. Only after this confirmation will precise projections for Wave 5 be accurately calculable.

Key Takeaway:

Maintain a bullish bias; however, wait for better entry levels on pullbacks. Prioritize risk management and patiently wait for Wave 4's completion before calculating precise targets for Wave 5.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.