Fundamental

Price: ~IDR 4,140 per share.

Earnings: EPS ~376, showing good profit generation.

Dividend Yield: ~8.4%, quite attractive.

Assets & Equity: Growing steadily, though debt is also increasing.

Strength: Strong in micro/SME lending, wide customer base.

Risk: Economic slowdown, rising interest rates, and loan defaults (NPL).

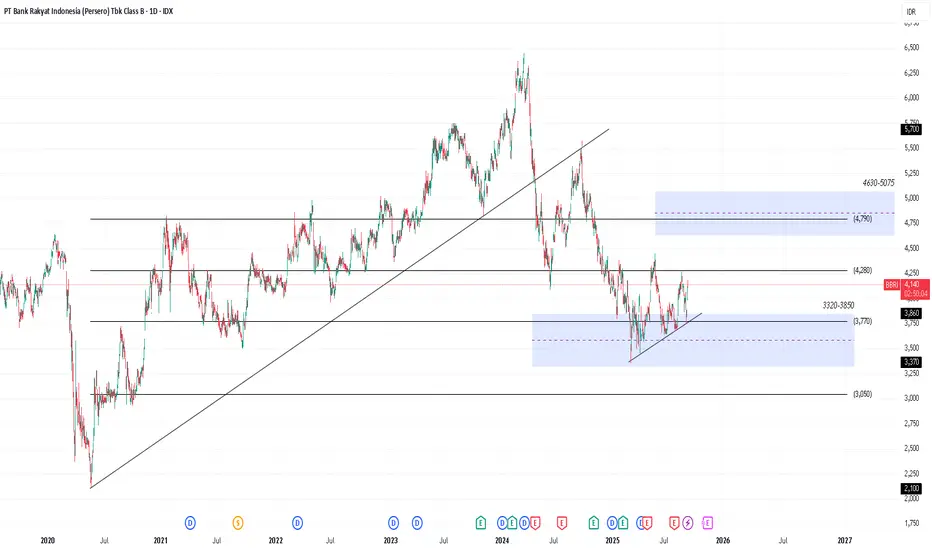

Technical

Support: IDR 3,740–3,900

Resistance: IDR 4,290–4,380

Trend: Short-term downtrend, but near oversold → possible rebound.

Current Action: Price is consolidating (sideways).

Outlook

For long-term investors: Good for dividend and growth exposure.

For short-term traders: Buy near support, sell near resistance.

Risks: Economy, regulation, and loan quality.

Price: ~IDR 4,140 per share.

Earnings: EPS ~376, showing good profit generation.

Dividend Yield: ~8.4%, quite attractive.

Assets & Equity: Growing steadily, though debt is also increasing.

Strength: Strong in micro/SME lending, wide customer base.

Risk: Economic slowdown, rising interest rates, and loan defaults (NPL).

Technical

Support: IDR 3,740–3,900

Resistance: IDR 4,290–4,380

Trend: Short-term downtrend, but near oversold → possible rebound.

Current Action: Price is consolidating (sideways).

Outlook

For long-term investors: Good for dividend and growth exposure.

For short-term traders: Buy near support, sell near resistance.

Risks: Economy, regulation, and loan quality.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.