**BTC Analysis**

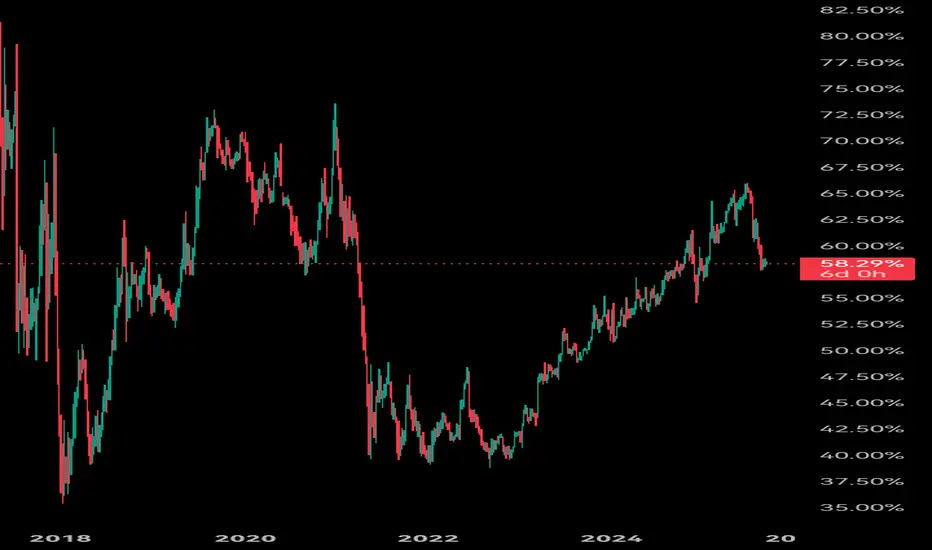

Current market sentiment for Bitcoin is cautiously optimistic. A key technical support level has formed around $60,000. If this level holds, it could attempt another rally towards previous highs. However, strong resistance exists in the $68,000-$70,000 zone, and a breakout would require significant capital inflow. Macro-wise, the market is assessing Federal Reserve rate cut expectations and ETF flows, which are the primary short-term drivers. The price will likely consolidate at high levels to absorb profit-taking and accumulate energy. Traders should closely monitor volume and the battle at key levels, guarding against false breakouts. The overall trend remains intact, but volatility is expected to increase.

Current market sentiment for Bitcoin is cautiously optimistic. A key technical support level has formed around $60,000. If this level holds, it could attempt another rally towards previous highs. However, strong resistance exists in the $68,000-$70,000 zone, and a breakout would require significant capital inflow. Macro-wise, the market is assessing Federal Reserve rate cut expectations and ETF flows, which are the primary short-term drivers. The price will likely consolidate at high levels to absorb profit-taking and accumulate energy. Traders should closely monitor volume and the battle at key levels, guarding against false breakouts. The overall trend remains intact, but volatility is expected to increase.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.