⚡ Bitcoin bulls are stepping back in at a critical level!

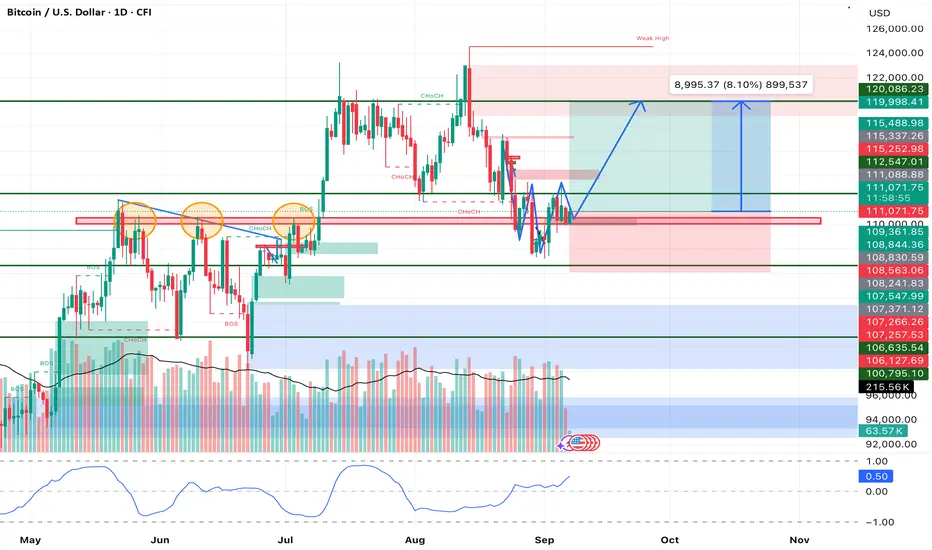

After a sharp correction, BTC has successfully defended the $111K–$112K demand zone 🛡️, which has acted as a strong liquidity pocket in recent weeks. This reaction could be the base for a renewed bullish push targeting the liquidity resting above $120K 🎯.

Here’s the breakdown of my analysis 👇

📌 Market Structure

• Price swept liquidity below $111K before bouncing, creating a higher-low formation 🔑.

• Structure remains bullish as long as the $111K level holds.

• A clean break above $115.5K–$116K resistance ⚔️ will confirm continuation.

📌 Volume Profile

• Increasing buy volume 📊 indicates demand absorption after the correction.

• Smart money positioning suggests accumulation in this range.

📌 Key Levels

• Entry Zone: $111K–$112.5K 🟢

• Stop Loss: $106.6K ❌ (below the invalidation level)

• Target: $120,086 🎯 (8.1% upside move toward the weak high)

📌 Risk Management

• Risk/Reward ratio sits at ~1:1.8 ⚖️, balancing protection and upside potential.

• This setup invalidates ⛔ if BTC closes decisively below $111K support.

⸻

✅ Trade Idea Summary

• Bias: Long BTC/USD

• Setup: Higher-low confirmation at demand zone

• Target: $120K 🎯

• Stop: $106.6K ❌

• R/R: ~1:1.8 ⚖️

Conclusion:

Bitcoin’s rejection of $111K support shows that buyers are still in control 🐂. As long as this level is defended, the path of least resistance points upward 🚀. I expect BTC to test the $115.5K–$116K resistance, and if broken, momentum could carry price toward $120K+ liquidity.

After a sharp correction, BTC has successfully defended the $111K–$112K demand zone 🛡️, which has acted as a strong liquidity pocket in recent weeks. This reaction could be the base for a renewed bullish push targeting the liquidity resting above $120K 🎯.

Here’s the breakdown of my analysis 👇

📌 Market Structure

• Price swept liquidity below $111K before bouncing, creating a higher-low formation 🔑.

• Structure remains bullish as long as the $111K level holds.

• A clean break above $115.5K–$116K resistance ⚔️ will confirm continuation.

📌 Volume Profile

• Increasing buy volume 📊 indicates demand absorption after the correction.

• Smart money positioning suggests accumulation in this range.

📌 Key Levels

• Entry Zone: $111K–$112.5K 🟢

• Stop Loss: $106.6K ❌ (below the invalidation level)

• Target: $120,086 🎯 (8.1% upside move toward the weak high)

📌 Risk Management

• Risk/Reward ratio sits at ~1:1.8 ⚖️, balancing protection and upside potential.

• This setup invalidates ⛔ if BTC closes decisively below $111K support.

⸻

✅ Trade Idea Summary

• Bias: Long BTC/USD

• Setup: Higher-low confirmation at demand zone

• Target: $120K 🎯

• Stop: $106.6K ❌

• R/R: ~1:1.8 ⚖️

Conclusion:

Bitcoin’s rejection of $111K support shows that buyers are still in control 🐂. As long as this level is defended, the path of least resistance points upward 🚀. I expect BTC to test the $115.5K–$116K resistance, and if broken, momentum could carry price toward $120K+ liquidity.

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.