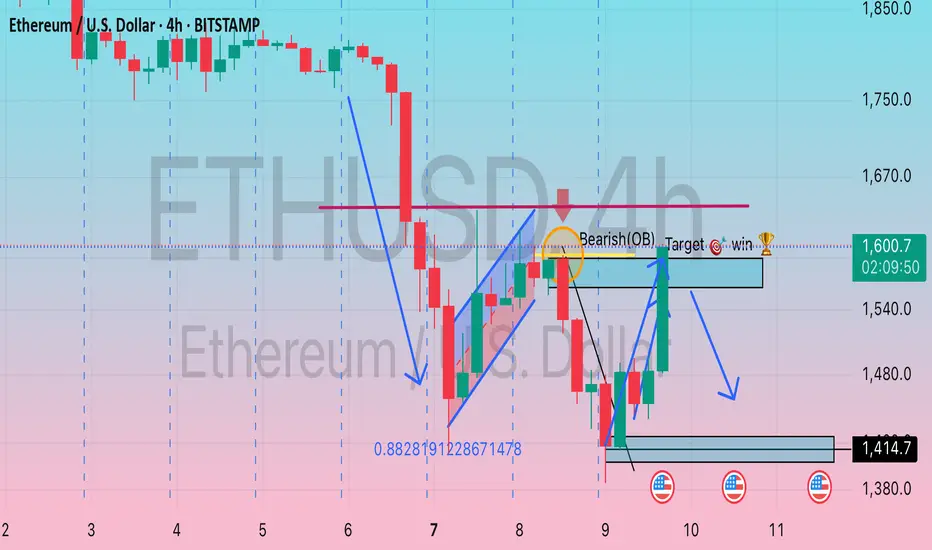

Bearish Order Block (OB): Identified near the $1,590–$1,600 zone, this region represents institutional selling pressure. Price has recently revisited this OB, marking it as a retest level for potential short entries.

• Bearish Pattern Formation: After a corrective upward channel (bear flag), price met resistance at the OB zone and sharply rejected, forming a target zone labeled “Target 🎯 win”. This signifies a successful bearish entry, confirming the OB’s validity.

• Fibonacci Level: The price bounce aligns closely with the 0.882 retracement level, reinforcing this as a strong area of confluence prior to the downward continuation.

• Projected Move: Based on the chart’s arrows and price structure, a further decline is expected, targeting the demand zone near $1,414.7, which aligns with previous support and liquidity accumulation zones.

• Technical Sentiment: Bearish bias remains dominant while ETH stays below the $1,600 resistance. A breakdown below intermediate support around $1,480 may accelerate the move toward the $1,414 target.

• Bearish Pattern Formation: After a corrective upward channel (bear flag), price met resistance at the OB zone and sharply rejected, forming a target zone labeled “Target 🎯 win”. This signifies a successful bearish entry, confirming the OB’s validity.

• Fibonacci Level: The price bounce aligns closely with the 0.882 retracement level, reinforcing this as a strong area of confluence prior to the downward continuation.

• Projected Move: Based on the chart’s arrows and price structure, a further decline is expected, targeting the demand zone near $1,414.7, which aligns with previous support and liquidity accumulation zones.

• Technical Sentiment: Bearish bias remains dominant while ETH stays below the $1,600 resistance. A breakdown below intermediate support around $1,480 may accelerate the move toward the $1,414 target.

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.