Absence of Institutional Liquidity: Retail Liquidity Driven

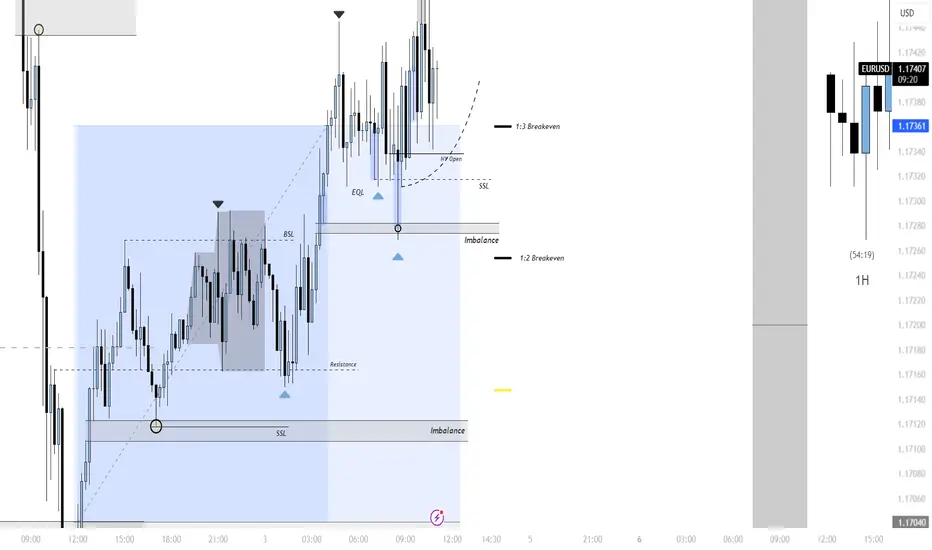

This trade played out cleanly by following the institutional narrative of orderflow and liquidity. Price first dropped into a key demand zone where bullish orderflow emerged, reclaiming imbalance and holding structure. Liquidity was engineered through sweeps of equal lows (SSL/EQL), confirming buyers’ strength before expansion. The move higher was driven by the natural draw on liquidity resting above equal highs and into the Supply + POC zone, providing a clear target. Risk was managed with 1:2 and 1:3 breakeven levels after imbalance mitigation and the New York open alignment, locking in profits while allowing room for continuation. In short, the win came from combining demand absorption, liquidity sweeps, imbalance fills, and auction flow logic to anticipate where institutions would drive price next.

Dagangan ditutup: sasaran tercapai

15m Chart

This trade was a textbook example of auction dynamics combined with orderflow confirmation. Price auctioned lower into an area of prior imbalance and unfinished business, where demand stepped in and value was reestablished. The bullish orderflow was clear as buyers defended the lower end of balance, reclaiming inefficiencies and showing absorption of sell orders at key levels. Liquidity sweeps below equal lows (SSL) created the fuel for the next leg, confirming that smart money had engineered stops to build positions. As the auction developed, value migrated higher with price gravitating toward the supply zone aligned with the point of control (POC), a natural magnet for liquidity. Orderflow confirmed the narrative: trapped shorts and retail panic at the lows provided the liquidity necessary for institutions to push higher into the draw on liquidity resting above equal highs (EQL/BSL). The trade was won by respecting the auction’s balance-to-imbalance shifts, reading where value was accepted or rejected, and anticipating the inevitable orderflow drive toward liquidity pools at the supply + POC zone.

1H Chart

4H Chart

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.