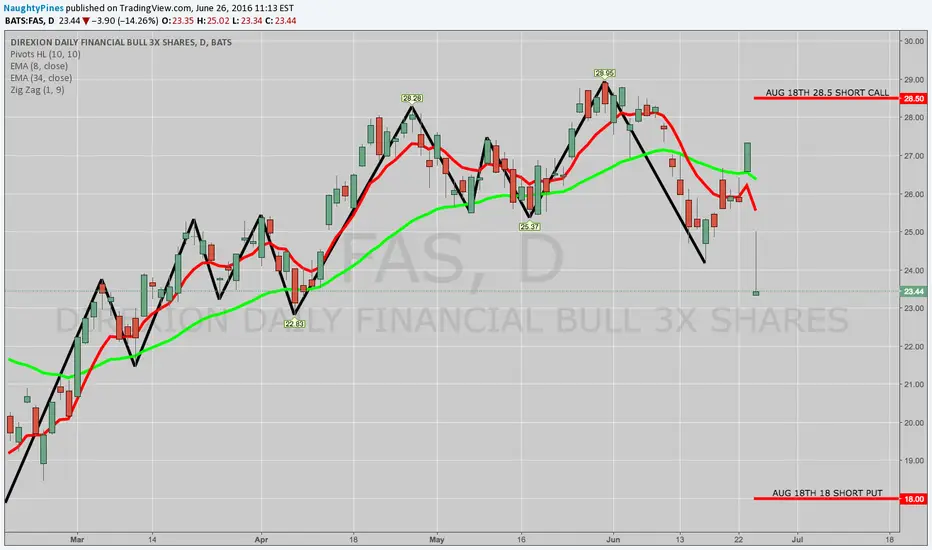

Truth be told, I'm not a huge of fan of leveraged instruments, but when a $23 underlying has the potential to yield a $100 or more worth of credit, I'll briefly overlook the warts these instruments have as an "investment" tool ... .

Here are the metrics for the play:

Probability of Profit: 77%

P50: 81%

Max Profit: $127/contract at the mid (this is off hours pricing; we'll have to see whether that's possible at NY open)

Max Loss/Buying Power Effect: Undefined/$232/contract (estimated/off hours)

Break Evens: 16.73/29.77

Notes: I'll look to get a fill for anything north of $100/contract, given the price of the underlying. As usual, I'll look to take this off at 50% max profit.

Here are the metrics for the play:

Probability of Profit: 77%

P50: 81%

Max Profit: $127/contract at the mid (this is off hours pricing; we'll have to see whether that's possible at NY open)

Max Loss/Buying Power Effect: Undefined/$232/contract (estimated/off hours)

Break Evens: 16.73/29.77

Notes: I'll look to get a fill for anything north of $100/contract, given the price of the underlying. As usual, I'll look to take this off at 50% max profit.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.