GOLD: Technical Analysis based on price structure, key levels

Hello Everyone

Let's start ... Next week's BUY/SELL Scenario for GOLD (30 Jun- 4 Jul).

before this make sure to go and check my previous Analysis as they were more than perfect.

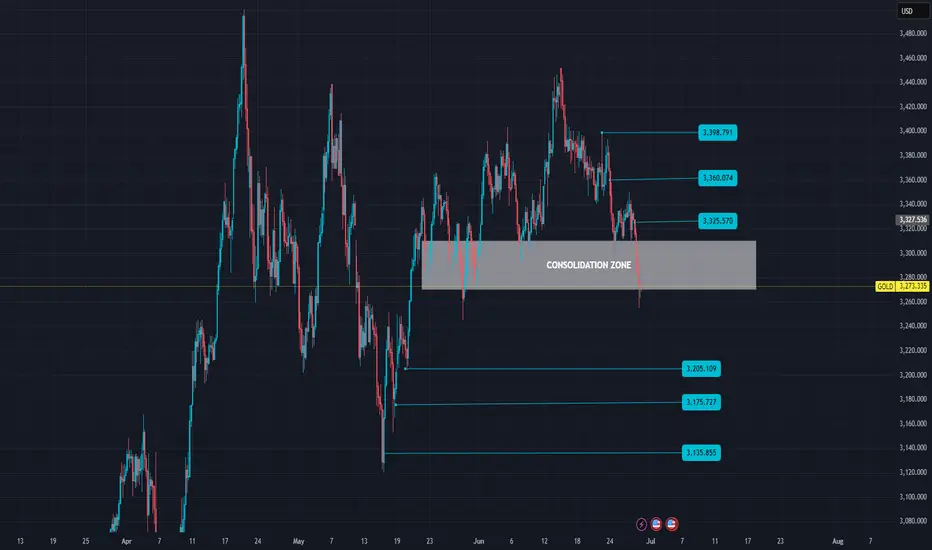

Recent Trend: Gold has broken down from a local consolidation zone near $3,325–$3,340.

Structure: Market has formed a lower high and now a lower low — bearish short-term structure.

Key Support Zone: Price has just touched a strong previous horizontal support near $3,270, which acted multiple times as a demand zone.

📈 Bullish Scenario (Buy Setup):

🟢 Buy if price shows reversal signals around $3,270–$3,250 zone.

This zone is historical support. If a bullish engulfing or double bottom forms, it could lead to a bounce.

wait for 4hr/ Daily candle closure above 3,280.

Target Prices will be:

TP1: $3,325 (minor resistance)

TP2: $3,360 (previous structure high)

TP3: $3,398 GOLD https://www.tradingview.com/x/eSesG8w3/

GOLD https://www.tradingview.com/x/eSesG8w3/

SL: $3,230 (recent swing low)

Probability: 🔹 55–60% (if clear bullish candle confirms; otherwise lower)

Confirmation Needed: Bullish divergence (e.g., RSI or Stoch), or volume spike reversal

---

📉 Bearish Scenario (Sell Setup):

🔴 (Risky Entry) Sell on retracement back to $3,310–$3,325, if rejection occurs (SL @3,345)

This area is now potential resistance after the recent breakdown.

(Safe Entry) Otherwise You can Sell After a 4hr/daily candle closure below 3,245

Target Prices will be:

TP1: $3,220 (deeper move into next demand)

TP2: 3,205

TP3: 3,175

TP4: 3,135 ( why not!)

Careful: at (3,135-3,170 : A strong rejection is valid to move up again).

Probability: 🔹65–70% — structure and momentum are favoring downside

Pro Advice: 🧭 Bonus – Neutral/Wait Zone:

Between $3,270 and $3,310 — price could consolidate here.

Wait for breakout or rejection before taking positions.

Good Luck

GOLD https://www.tradingview.com/x/VQfpRDft/

GOLD https://www.tradingview.com/x/VQfpRDft/

Let's start ... Next week's BUY/SELL Scenario for GOLD (30 Jun- 4 Jul).

before this make sure to go and check my previous Analysis as they were more than perfect.

Recent Trend: Gold has broken down from a local consolidation zone near $3,325–$3,340.

Structure: Market has formed a lower high and now a lower low — bearish short-term structure.

Key Support Zone: Price has just touched a strong previous horizontal support near $3,270, which acted multiple times as a demand zone.

📈 Bullish Scenario (Buy Setup):

🟢 Buy if price shows reversal signals around $3,270–$3,250 zone.

This zone is historical support. If a bullish engulfing or double bottom forms, it could lead to a bounce.

wait for 4hr/ Daily candle closure above 3,280.

Target Prices will be:

TP1: $3,325 (minor resistance)

TP2: $3,360 (previous structure high)

TP3: $3,398

SL: $3,230 (recent swing low)

Probability: 🔹 55–60% (if clear bullish candle confirms; otherwise lower)

Confirmation Needed: Bullish divergence (e.g., RSI or Stoch), or volume spike reversal

---

📉 Bearish Scenario (Sell Setup):

🔴 (Risky Entry) Sell on retracement back to $3,310–$3,325, if rejection occurs (SL @3,345)

This area is now potential resistance after the recent breakdown.

(Safe Entry) Otherwise You can Sell After a 4hr/daily candle closure below 3,245

Target Prices will be:

TP1: $3,220 (deeper move into next demand)

TP2: 3,205

TP3: 3,175

TP4: 3,135 ( why not!)

Careful: at (3,135-3,170 : A strong rejection is valid to move up again).

Probability: 🔹65–70% — structure and momentum are favoring downside

Pro Advice: 🧭 Bonus – Neutral/Wait Zone:

Between $3,270 and $3,310 — price could consolidate here.

Wait for breakout or rejection before taking positions.

Good Luck

Dagangan ditutup: sasaran tercapai

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.