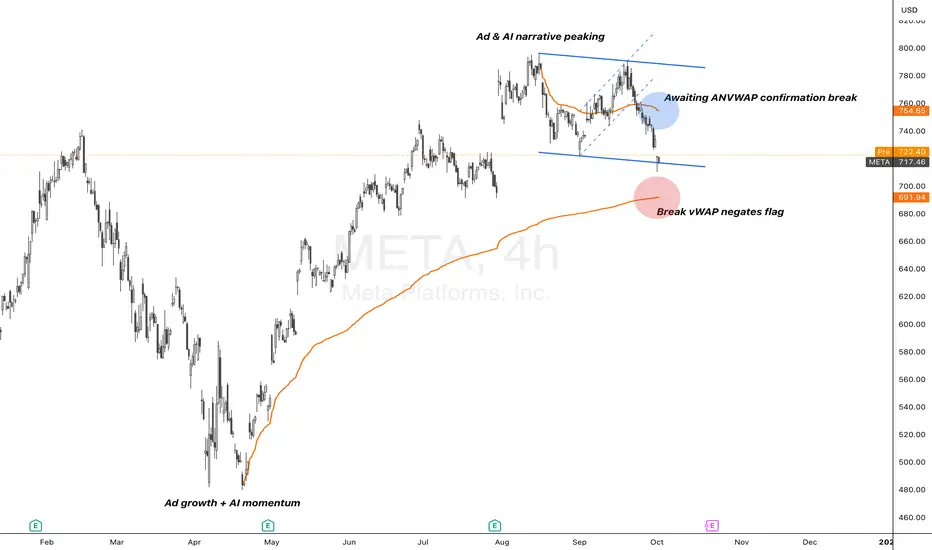

Meta’s recent earnings reinforced the AI and ad monetisation story, with revenue growth, margin expansion, and aggressive capex guidance ($64–72B). Deals like the $14B CoreWeave cloud agreement and plans to personalize ads via AI chats keep the structural AI narrative alive. These catalysts provide fuel for investors to stay engaged with the stock despite higher spend.

On the 4H chart, META’s bullish flag structure has retraced toward anchored VWAP support. The $754 anchored VWAP is the key decision point:

Takeaway: $754 anchored VWAP is the line that separates continuation from correction.

On the 4H chart, META’s bullish flag structure has retraced toward anchored VWAP support. The $754 anchored VWAP is the key decision point:

- If price reclaims and holds above → structure remains constructive with scope for continuation.

- If price stays capped below → flag negation risks deeper correction into VWAP trendline support.

Takeaway: $754 anchored VWAP is the line that separates continuation from correction.

Trading leveraged products carries a high level of risk and may result in losses exceeding your initial investment; ensure you fully understand the risks involved.

-

Use your TradingView charts to trade your Alchemy account: bit.ly/42vUfjL

-

Use your TradingView charts to trade your Alchemy account: bit.ly/42vUfjL

Penafian

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Trading leveraged products carries a high level of risk and may result in losses exceeding your initial investment; ensure you fully understand the risks involved.

-

Use your TradingView charts to trade your Alchemy account: bit.ly/42vUfjL

-

Use your TradingView charts to trade your Alchemy account: bit.ly/42vUfjL

Penafian

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.