Analysis

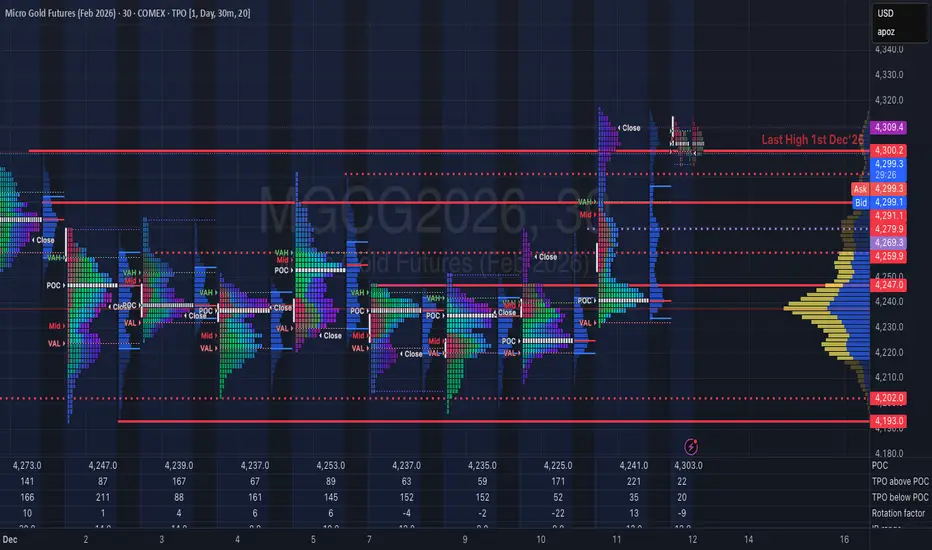

1. Market Context (Transition to Initiative) The Gold auction has evolved significantly. What began as mechanical short covering has transitioned into probable initiative buying (New Money).

Structure: The auction is facilitating trade at higher prices, indicating that buyers are aggressive and willing to pay up.

The Shift: We have moved away from the "emotional" phase into a more sustainable value migration. The market is now seeking to repair the structure and test the extremes.

2. The Road to ATH (4425) We are now within striking distance of the All-Time High (4425 area).

Key Reference (4300): This level has shifted from a psychological barrier to a potential support shelf.

The Setup: If Gold can hold and build acceptance above 4300, it confirms the breakout. We expect the auction to establish a new balance area here before making the final rotation toward the ATH.

Friday Flows: Be mindful of weekend profit-taking, but as long as the structure holds above the breakout point, the medium-term bias remains firmly to the upside.

Plan & Execution

Focus: Watch for acceptance above 4300.

Scenario: If we see a pullback, I am monitoring for responsive buyers to defend the breakout zone (turning old resistance into support).

Talk to you for the next update.

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.