FA Analysis:

1- We know that the FED opened the door for a rate cut in September (Next week). The FED gave priority to address Employment Mandate issue and considered the higher inflation data as one time shot.

2- Hence, the Inflation (the second FED mandate) the most relevant data this week with both PPI and CPI to validate the FED view of one time shot. Another higher inflation will destroy this narrative and the FED might revise the way forward.

The story is simple: Higher Inflation data will send NQ down and vice-versa for inline and softer inflation.

TA Analysis:

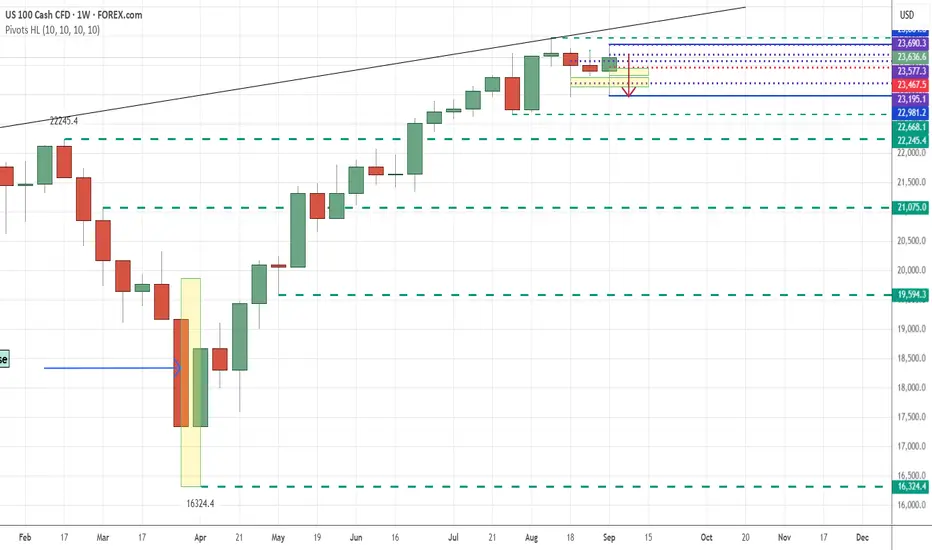

Weekly TF:

The weekly close expresses really the incertitude regarding the direction. No clear direction; both direction are open; all will depend on inflation data.

Daily TF:

The daily close was bearish. NFP data provided an inline inflation data but a very negative employment data. As mentioned, bad data data is bad for NQ and vice-versa.

From daily perspective, price might retest Friday high or just NFP low (magenta dotted line) and continue down towards TP1, TP2 and TP3 particularly if Inflation data comes strong.

H4 TF:

H4 provided a break down. Inline with daily analysis, the least resistance is that price continues down after a short retrace up.

GL Everyone!

1- We know that the FED opened the door for a rate cut in September (Next week). The FED gave priority to address Employment Mandate issue and considered the higher inflation data as one time shot.

2- Hence, the Inflation (the second FED mandate) the most relevant data this week with both PPI and CPI to validate the FED view of one time shot. Another higher inflation will destroy this narrative and the FED might revise the way forward.

The story is simple: Higher Inflation data will send NQ down and vice-versa for inline and softer inflation.

TA Analysis:

Weekly TF:

The weekly close expresses really the incertitude regarding the direction. No clear direction; both direction are open; all will depend on inflation data.

Daily TF:

The daily close was bearish. NFP data provided an inline inflation data but a very negative employment data. As mentioned, bad data data is bad for NQ and vice-versa.

From daily perspective, price might retest Friday high or just NFP low (magenta dotted line) and continue down towards TP1, TP2 and TP3 particularly if Inflation data comes strong.

H4 TF:

H4 provided a break down. Inline with daily analysis, the least resistance is that price continues down after a short retrace up.

GL Everyone!

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.