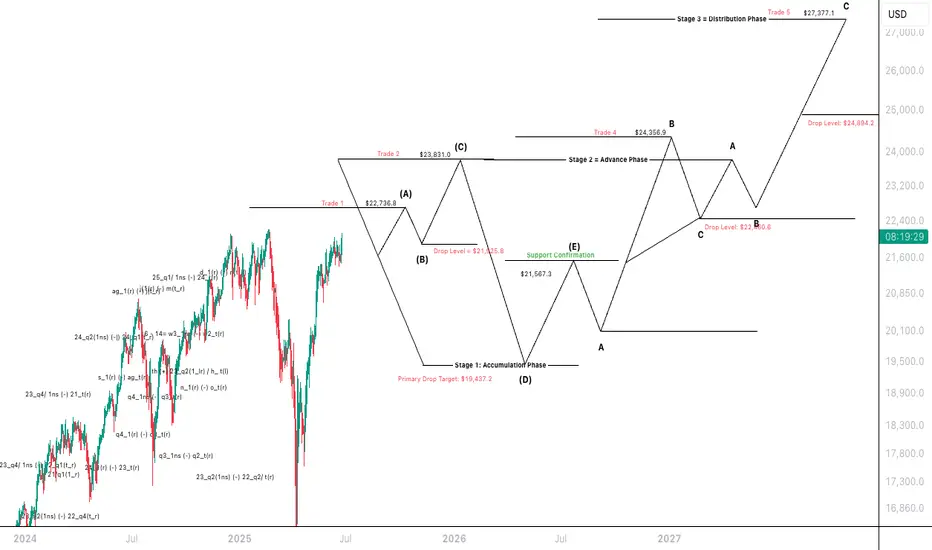

A multi-stage forecast model for the US Tech 100 Cash (NASDAQ) based on price cycles and distribution levels, likely derived from Wyckoff - style market phases. Here’s a structured summary:

NASDAQ 100 – Multi-Stage Price Forecast (USD)

Ticker: NASDAQ | Trading Venue: IG

Market Structure Overview

The model is divided into three main phases:

Stage 1 – Accumulation Phase

Stage 2 – Advance Phase

Stage 3 – Distribution Phase

Forecasted Trade & Price Levels

Stage 1: Accumulation Phase

Primary Drop Target: $19,437.2

Intermediate Drop Level: $21,965.8

Support Confirmation: $21,567.3

This stage ends with an upward movement from point (D) to (E), confirming support.

Stage 2: Advance Phase

Begins after Support Confirmation.

Key upward levels:

$22,736.8 → Trade 1

$23,831.0 → Trade 2

$24,366.9 → Trade 4

Drop Level during this phase: $22,480.6

Stage 3: Distribution Phase

Targets higher price levels before a major drop:

Final high: $27,377.1 → Trade 5

Critical drop level: $24,894.2

Cycle-Level Forecasting

Distribution Phase Trigger Level: $22,736.8

2nd Cycle Distribution Levels

$23,831.0

$24,065.4

$24,366.9

$24,856.5

$27,377.1

$28,925.6

$29,956.5

3rd Cycle Forecast (Higher Projections)

$28,874.1

$29,804.1

$30,610.4

$30,845.1

$31,450.0

$30,770.2

4th Cycle Forecast

$31,317.6

$31,810.6

$32,219.6

$32,682.1

$32,870.6

$32,179.6

Interpretation & Implications

This forecast model suggests a major cyclical rise and fall structure.

Each stage (Accumulation → Advance → Distribution) is followed by price drops at defined levels, signalling strategic trade exits or short positions.

The model maps potential entry/exit trades, labelling them Trade 1 to Trade 5.

Anticipates a strong uptrend towards $27K+, followed by corrections at each drop level (e.g., $24,894.2, $22,480.6).

Disclaimer: The following forecast is derived from a proprietary, hand-crafted mathematical model developed independently over several years. It does not rely on traditional indicators, technical patterns, or third-party frameworks such as Elliott Wave Theory.

This model calculates price action based on distribution phases, economic timing cycles, and natural market imbalances.

NASDAQ 100 – Multi-Stage Price Forecast (USD)

Ticker: NASDAQ | Trading Venue: IG

Market Structure Overview

The model is divided into three main phases:

Stage 1 – Accumulation Phase

Stage 2 – Advance Phase

Stage 3 – Distribution Phase

Forecasted Trade & Price Levels

Stage 1: Accumulation Phase

Primary Drop Target: $19,437.2

Intermediate Drop Level: $21,965.8

Support Confirmation: $21,567.3

This stage ends with an upward movement from point (D) to (E), confirming support.

Stage 2: Advance Phase

Begins after Support Confirmation.

Key upward levels:

$22,736.8 → Trade 1

$23,831.0 → Trade 2

$24,366.9 → Trade 4

Drop Level during this phase: $22,480.6

Stage 3: Distribution Phase

Targets higher price levels before a major drop:

Final high: $27,377.1 → Trade 5

Critical drop level: $24,894.2

Cycle-Level Forecasting

Distribution Phase Trigger Level: $22,736.8

2nd Cycle Distribution Levels

$23,831.0

$24,065.4

$24,366.9

$24,856.5

$27,377.1

$28,925.6

$29,956.5

3rd Cycle Forecast (Higher Projections)

$28,874.1

$29,804.1

$30,610.4

$30,845.1

$31,450.0

$30,770.2

4th Cycle Forecast

$31,317.6

$31,810.6

$32,219.6

$32,682.1

$32,870.6

$32,179.6

Interpretation & Implications

This forecast model suggests a major cyclical rise and fall structure.

Each stage (Accumulation → Advance → Distribution) is followed by price drops at defined levels, signalling strategic trade exits or short positions.

The model maps potential entry/exit trades, labelling them Trade 1 to Trade 5.

Anticipates a strong uptrend towards $27K+, followed by corrections at each drop level (e.g., $24,894.2, $22,480.6).

Disclaimer: The following forecast is derived from a proprietary, hand-crafted mathematical model developed independently over several years. It does not rely on traditional indicators, technical patterns, or third-party frameworks such as Elliott Wave Theory.

This model calculates price action based on distribution phases, economic timing cycles, and natural market imbalances.

Institutional Note:

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Institutional Note:

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.