🔹 4H Timeframe (Intraday to Short-Term Swing)

Current Price: ~24,807

Price is consolidating inside a liquidity pocket just below a Fair Value Gap (FVG) zone.

Sell-side liquidity has already been swept; signs of accumulation are visible.

Three internal FVGs identified—market is respecting these inefficiencies.

Volume imbalance + EQ (Equal Lows) and previous OB (Order Block) show that price may be building a base.

Market Structure: Minor BOS (Break of Structure) observed, but no new HH yet — compression inside a range.

✅ Bullish Bias IF price breaks above the FVG range and mitigates the supply.

📌 Long Setup Idea:

Entry: Above 24,900

Stop Loss: Below EQ/FVG (~24,650)

Target: 25,200–25,400 (Buy-side liquidity/weak high zone)

📛 Invalidation: Clean break below EQ zone + OB → indicates bearish continuation.

🔹 Daily Timeframe (Swing View)

Price respected the sell-side liquidity grab and is now consolidating within a bearish FVG range.

Minor BOS confirms short-term bullish correction, but macro context is mixed.

PWL (Previous Week Low) has been swept, giving confluence to bullish short-term reversal.

Upper FVG near 25,100–25,200 remains unmitigated.

🧠 Key Observation: Smart money often reverses price after sweeping liquidity → the VI (Volume Imbalance) zone may act as a launchpad.

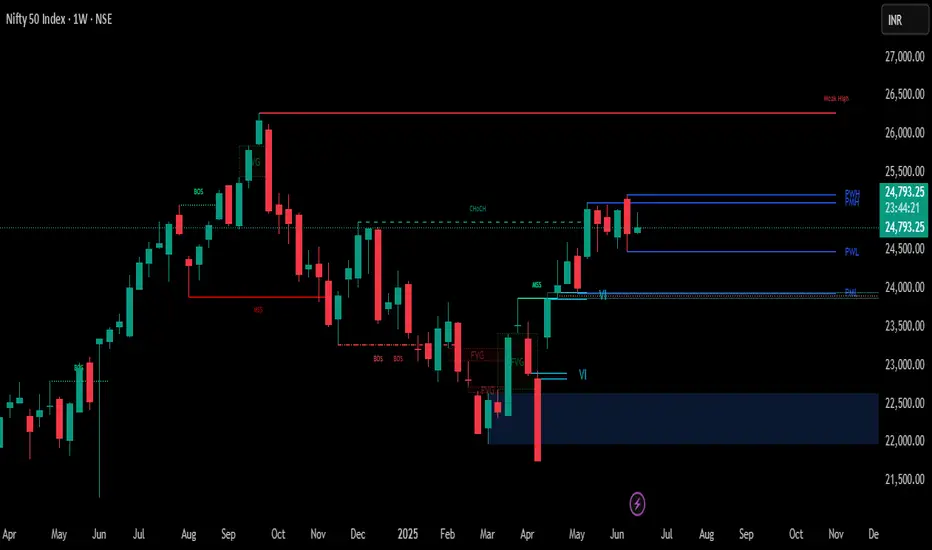

🔹 Weekly Timeframe (Macro Structure)

Structure remains bullish with strong upside momentum since the March-April reversal.

Change of Character (ChoCH) in April is confirmed with multiple BOS candles.

Current price is holding above the weekly FVG + VI.

A large bullish OB sits between 22,400–22,800, indicating massive institutional accumulation.

📈 Weekly Bias: As long as price stays above 24,400, bullish targets of 25,600 are possible in coming weeks.

🧩 Conclusion & Trade Idea Summary (ICT-based)

Bias: Bullish (Short-term accumulation, preparing for expansion)

Entry: Break and close above 24,900 on 4H or Daily

Stop Loss: 24,640 (Below EQ zone/FVG boundary)

TP1: 25,200 (Buy-side liquidity)

TP2: 25,400–25,600 (Weekly premium zone/weak high)

Current Price: ~24,807

Price is consolidating inside a liquidity pocket just below a Fair Value Gap (FVG) zone.

Sell-side liquidity has already been swept; signs of accumulation are visible.

Three internal FVGs identified—market is respecting these inefficiencies.

Volume imbalance + EQ (Equal Lows) and previous OB (Order Block) show that price may be building a base.

Market Structure: Minor BOS (Break of Structure) observed, but no new HH yet — compression inside a range.

✅ Bullish Bias IF price breaks above the FVG range and mitigates the supply.

📌 Long Setup Idea:

Entry: Above 24,900

Stop Loss: Below EQ/FVG (~24,650)

Target: 25,200–25,400 (Buy-side liquidity/weak high zone)

📛 Invalidation: Clean break below EQ zone + OB → indicates bearish continuation.

🔹 Daily Timeframe (Swing View)

Price respected the sell-side liquidity grab and is now consolidating within a bearish FVG range.

Minor BOS confirms short-term bullish correction, but macro context is mixed.

PWL (Previous Week Low) has been swept, giving confluence to bullish short-term reversal.

Upper FVG near 25,100–25,200 remains unmitigated.

🧠 Key Observation: Smart money often reverses price after sweeping liquidity → the VI (Volume Imbalance) zone may act as a launchpad.

🔹 Weekly Timeframe (Macro Structure)

Structure remains bullish with strong upside momentum since the March-April reversal.

Change of Character (ChoCH) in April is confirmed with multiple BOS candles.

Current price is holding above the weekly FVG + VI.

A large bullish OB sits between 22,400–22,800, indicating massive institutional accumulation.

📈 Weekly Bias: As long as price stays above 24,400, bullish targets of 25,600 are possible in coming weeks.

🧩 Conclusion & Trade Idea Summary (ICT-based)

Bias: Bullish (Short-term accumulation, preparing for expansion)

Entry: Break and close above 24,900 on 4H or Daily

Stop Loss: 24,640 (Below EQ zone/FVG boundary)

TP1: 25,200 (Buy-side liquidity)

TP2: 25,400–25,600 (Weekly premium zone/weak high)

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.