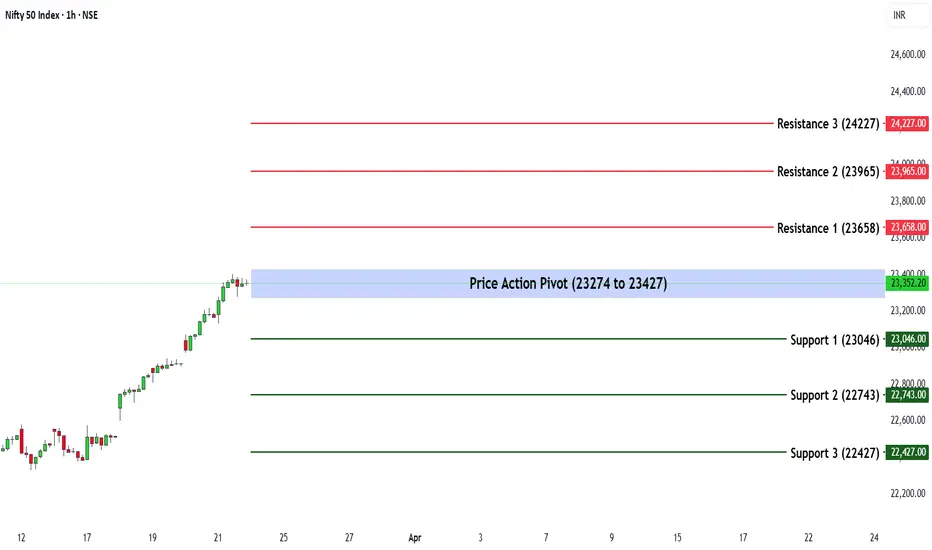

The Nifty 50 ended the week at 23,350.40, recording a notable gain of 4.26%.

Key Levels for the Upcoming Week

🔹 Price Action Pivot Zone:

The critical range to monitor for potential trend reversals or continuation is 23,274 - 23,427.

🔹 Support & Resistance Levels:

Support:

Resistance:

Market Outlook

✅ Bullish Scenario: A sustained breakout above 23,427 may attract buying interest, potentially pushing Nifty towards R1 (23,658) and beyond.

❌ Bearish Scenario: If the index slips below 23,274, selling pressure could increase, driving Nifty towards S1 (23,046) or lower.

Disclaimer: This analysis is for educational purposes only. Investors should conduct their own research before making any trading decisions.

Key Levels for the Upcoming Week

🔹 Price Action Pivot Zone:

The critical range to monitor for potential trend reversals or continuation is 23,274 - 23,427.

🔹 Support & Resistance Levels:

Support:

- S1: 23,046

- S2: 22,743

- S3: 22,427

Resistance:

- R1: 23,658

- R2: 23,965

- R3: 24,227

Market Outlook

✅ Bullish Scenario: A sustained breakout above 23,427 may attract buying interest, potentially pushing Nifty towards R1 (23,658) and beyond.

❌ Bearish Scenario: If the index slips below 23,274, selling pressure could increase, driving Nifty towards S1 (23,046) or lower.

Disclaimer: This analysis is for educational purposes only. Investors should conduct their own research before making any trading decisions.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.