Hello Traders!

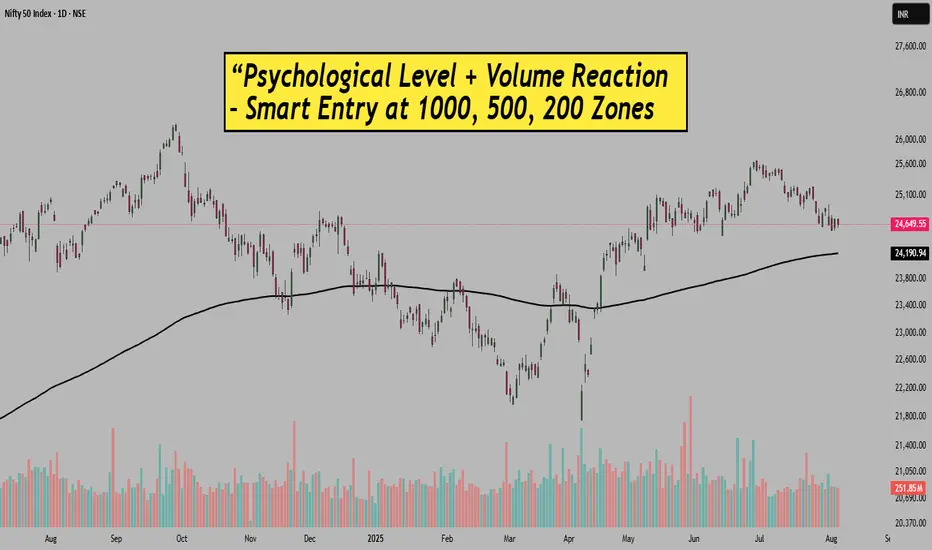

Ever noticed how the market behaves around round numbers like 1000, 200, 500 levels?

There’s something powerful about these zones, not just technically, but psychologically too.

These are the levels where large participants often step in… and smart traders take entry.

Today’s post will help you understand how psychological price levels work — and how to combine them with volume confirmation for better intraday or swing setups.

Why Psychological Levels Matter

Volume Confirmation Makes It Powerful

Rahul’s Tip:

Instead of randomly entering trades, mark round levels like 24500/24750 on your charts.

Then wait patiently, combine volume + price action and let the trade come to you.

Most false moves get filtered out when you use this setup with discipline.

Conclusion:

These psychological levels are used by big players to trap retail traders, but if you learn to read reactions at these levels, you can trade smarter.

No need to chase. Just observe, react, and manage risk.

What’s your experience with psychological levels? Have they helped your trades?

Share your thoughts in comments.

If this post helped, do like, follow and share with your trader friends.

Ever noticed how the market behaves around round numbers like 1000, 200, 500 levels?

There’s something powerful about these zones, not just technically, but psychologically too.

These are the levels where large participants often step in… and smart traders take entry.

Today’s post will help you understand how psychological price levels work — and how to combine them with volume confirmation for better intraday or swing setups.

Why Psychological Levels Matter

- Round numbers attract attention:

Levels like 24500, 25000, 25500 in Nifty or BankNifty act as magnets. Institutions, algos, and even retail traders tend to place orders around these levels. - Buyers or sellers take control at these points:

Price often pauses or reverses here, as it becomes a battleground of supply and demand. Especially if this level is also a previous support/resistance zone. - Self-fulfilling behavior of traders:

Because everyone expects a reaction near these zones, price actually reacts. This creates great opportunities if you can enter with the right confirmation.

Volume Confirmation Makes It Powerful

- Look for unusual volume near these zones:

Let’s say Nifty hits 24600 and suddenly you see a volume spike on a bullish candle — that’s not coincidence. That’s your cue. - Price rejection with volume is key:

Wick-based candles, engulfing patterns, or inside bars rejecting psychological levels with volume boost often lead to clean intraday moves. - Consolidation + Breakout works best:

If price consolidates near these psychological zones with low volume and breaks out with high volume, it often creates strong directional moves.

Rahul’s Tip:

Instead of randomly entering trades, mark round levels like 24500/24750 on your charts.

Then wait patiently, combine volume + price action and let the trade come to you.

Most false moves get filtered out when you use this setup with discipline.

Conclusion:

These psychological levels are used by big players to trap retail traders, but if you learn to read reactions at these levels, you can trade smarter.

No need to chase. Just observe, react, and manage risk.

What’s your experience with psychological levels? Have they helped your trades?

Share your thoughts in comments.

If this post helped, do like, follow and share with your trader friends.

Rahul Pal | BD Manager @CoinW Exchange Dubai

Helping KOLs, Partners earn up to 70% rebate

Recommended Broker: tinyurl.com/RahulCoinW

Free Telegram: spf.bio/c1lkb

Website:realbullstrading.com

Signals:wa.me/919560602464

Helping KOLs, Partners earn up to 70% rebate

Recommended Broker: tinyurl.com/RahulCoinW

Free Telegram: spf.bio/c1lkb

Website:realbullstrading.com

Signals:wa.me/919560602464

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Rahul Pal | BD Manager @CoinW Exchange Dubai

Helping KOLs, Partners earn up to 70% rebate

Recommended Broker: tinyurl.com/RahulCoinW

Free Telegram: spf.bio/c1lkb

Website:realbullstrading.com

Signals:wa.me/919560602464

Helping KOLs, Partners earn up to 70% rebate

Recommended Broker: tinyurl.com/RahulCoinW

Free Telegram: spf.bio/c1lkb

Website:realbullstrading.com

Signals:wa.me/919560602464

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.