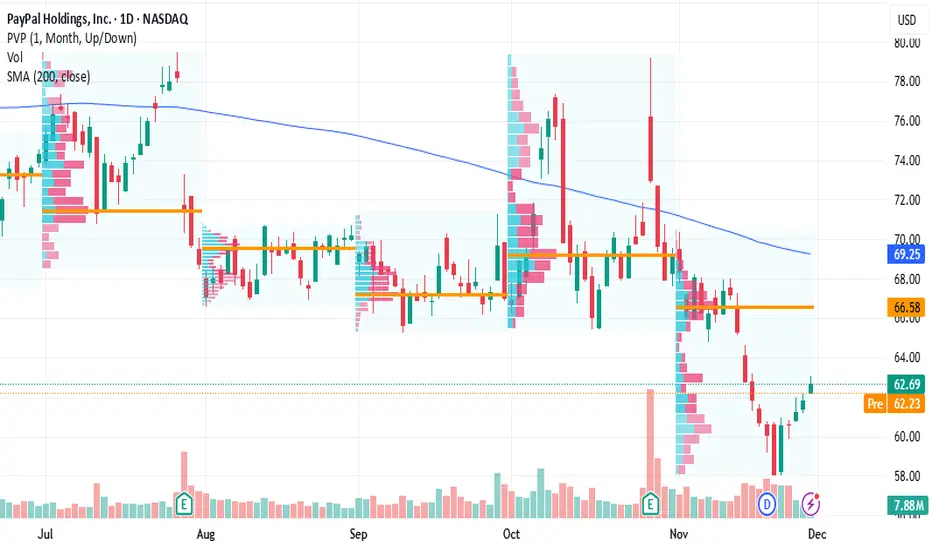

Current Price: $58.81

Direction: LONG

Confidence Level: 62% (I'm assigning a moderate confidence because while the direct trader analysis is sparse, the sentiment we do see leans bullish, and price is sitting close to recently mentioned support levels)

Targets:

- T1 = $60.50

- T2 = $62.50

Stop Levels:

- S1 = $57.50

- S2 = $56.80

**Wisdom of Professional Traders:**

This analysis combines what multiple professional traders are saying and what’s currently buzzing across X’s trading circles. Even though PayPal wasn’t the focal point in all clips, the traders who did speak about it pointed to accumulation patterns and defined support zones. The collective sentiment is leaning towards a near-term push higher. Within the trading community, the buy-now-pay-later adoption trend and steady engagement with PayPal’s payment ecosystem are seen as signs of consistent user demand, underpinning technical setups.

**Key Insights:**

Here’s what I’m watching: in one breakdown, several traders highlighted that as long as $62.50 isn’t lost on the chart, PayPal has room to make a short-term upside run. That $62.50 level is a clear weekly resistance target, but with current price under $59, there’s room for a test without overstretching. On the sentiment side, X data, while limited, was exclusively bullish in recent posts, which adds to the bias. The snippets show talk of “accumulation” rather than distribution, which is a strong upside hint—especially with price consolidating just above broader market support.

This all ties into the bigger view: PayPal’s current chart positioning is more about grinding off lows than breaking down. Traders like to take longs in these accumulation channels if there’s a clear stop line, and here that stop line appears to be just under $57.50. The confluence of technical and sentiment signals suggests we lean into the long side this week.

**Recent Performance:**

PayPal has been in a grinding sideways-to-slightly-up motion over the past few sessions. After failing to break above $62.50 a couple of weeks ago, price pulled back and found footing around $58. Bulls stepped in to defend against deeper declines, which aligns with the accumulation talk from traders. This stability contrasts with the more volatile broader NASDAQ moves, showing the stock is holding relative strength in choppy market conditions.

**Expert Analysis:**

The collective trader analysis points out that $62.50 is the near-term ceiling and $57.50 is the key floor. Holding above that floor is critical for maintaining the bullish setup. Several traders described this as an “accumulation zone,” with the logic being that a push through $60.50 in the next few sessions could trigger momentum buys toward the $62 handle. Technically, PayPal’s moving averages are curling upwards slightly, providing mechanical support to the bullish case.

**News Impact:**

There hasn’t been a major corporate headline in the last few days, but macro sentiment and seasonal factors—like increased end-of-year consumer spending—are supportive of digital payment platforms. Traders across platforms are quietly factoring in that PayPal’s BNPL product usage, mentioned in one discussion, has staying power in the holiday transaction mix. This could lead to incremental upside as transaction volume data trickles in.

**Trading Recommendation:**

Here’s my take: I’d consider going long at current levels with a target to scale out partially at $60.50 and leave a runner toward $62.50, keeping stops tight under $57.50 with a safety net at $56.80. This approach uses the recent accumulation zone to lean into probable bullish follow-through without risking too much if support fails. Keep position sizing moderate given the only moderate confidence from limited data, but with sentiment and chart positioning tilted bullish, there’s a decent case for a short-term upside trade in PayPal.

Direction: LONG

Confidence Level: 62% (I'm assigning a moderate confidence because while the direct trader analysis is sparse, the sentiment we do see leans bullish, and price is sitting close to recently mentioned support levels)

Targets:

- T1 = $60.50

- T2 = $62.50

Stop Levels:

- S1 = $57.50

- S2 = $56.80

**Wisdom of Professional Traders:**

This analysis combines what multiple professional traders are saying and what’s currently buzzing across X’s trading circles. Even though PayPal wasn’t the focal point in all clips, the traders who did speak about it pointed to accumulation patterns and defined support zones. The collective sentiment is leaning towards a near-term push higher. Within the trading community, the buy-now-pay-later adoption trend and steady engagement with PayPal’s payment ecosystem are seen as signs of consistent user demand, underpinning technical setups.

**Key Insights:**

Here’s what I’m watching: in one breakdown, several traders highlighted that as long as $62.50 isn’t lost on the chart, PayPal has room to make a short-term upside run. That $62.50 level is a clear weekly resistance target, but with current price under $59, there’s room for a test without overstretching. On the sentiment side, X data, while limited, was exclusively bullish in recent posts, which adds to the bias. The snippets show talk of “accumulation” rather than distribution, which is a strong upside hint—especially with price consolidating just above broader market support.

This all ties into the bigger view: PayPal’s current chart positioning is more about grinding off lows than breaking down. Traders like to take longs in these accumulation channels if there’s a clear stop line, and here that stop line appears to be just under $57.50. The confluence of technical and sentiment signals suggests we lean into the long side this week.

**Recent Performance:**

PayPal has been in a grinding sideways-to-slightly-up motion over the past few sessions. After failing to break above $62.50 a couple of weeks ago, price pulled back and found footing around $58. Bulls stepped in to defend against deeper declines, which aligns with the accumulation talk from traders. This stability contrasts with the more volatile broader NASDAQ moves, showing the stock is holding relative strength in choppy market conditions.

**Expert Analysis:**

The collective trader analysis points out that $62.50 is the near-term ceiling and $57.50 is the key floor. Holding above that floor is critical for maintaining the bullish setup. Several traders described this as an “accumulation zone,” with the logic being that a push through $60.50 in the next few sessions could trigger momentum buys toward the $62 handle. Technically, PayPal’s moving averages are curling upwards slightly, providing mechanical support to the bullish case.

**News Impact:**

There hasn’t been a major corporate headline in the last few days, but macro sentiment and seasonal factors—like increased end-of-year consumer spending—are supportive of digital payment platforms. Traders across platforms are quietly factoring in that PayPal’s BNPL product usage, mentioned in one discussion, has staying power in the holiday transaction mix. This could lead to incremental upside as transaction volume data trickles in.

**Trading Recommendation:**

Here’s my take: I’d consider going long at current levels with a target to scale out partially at $60.50 and leave a runner toward $62.50, keeping stops tight under $57.50 with a safety net at $56.80. This approach uses the recent accumulation zone to lean into probable bullish follow-through without risking too much if support fails. Keep position sizing moderate given the only moderate confidence from limited data, but with sentiment and chart positioning tilted bullish, there’s a decent case for a short-term upside trade in PayPal.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.