Introduction:

Radhika Jeweltech Ltd is engaged in the manufacturing and trading of gold, diamond & platinium jewellery. RJL is a jewelry retailer based out of Rajkot, Gujarat. The company has served 20 lakh+ customers to date. RJL offers services that include jewelry repairs, resizing, and cleaning.

Fundamentals:

Market Cap: ₹ 1,157 Cr.;

Stock P/E: 20.0 (Ind. P/E: 35.60) 👍;

ROCE: 24.6% 👍;

ROE: 20.6% 👍;

3 Years Sales Growth: 58% 👍;

3 Years Profit Growth: 30% 👍;

3 Years Stock Price CAGR: 43% 👍

Pros: The company has delivered good profit growth of 48.8% CAGR over last 5 years

The stock has

Technicals:

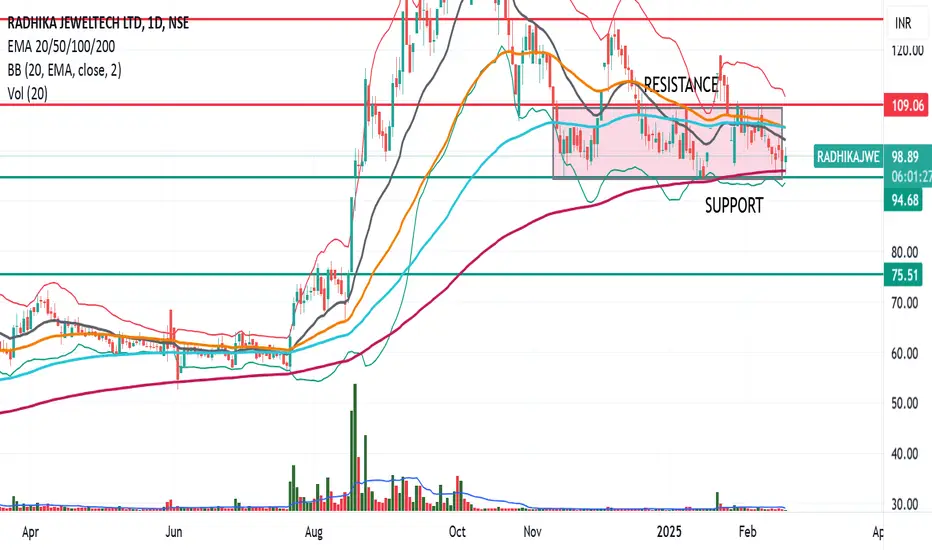

Radhika Jeweltech Ltd has been in a downtrend since attaining a peak level of 157.

It is trading in a strong consolidation range between 95 and 105 levels.

20 EMA (Black line) is just below 50 EMA (Orange line), indicating the weakness in the trend.

More than 35% down from all-time high price of 157 level.

Resistance levels: 109, 126, 139, 157

Support levels: 95, 76

Radhika Jeweltech Ltd is engaged in the manufacturing and trading of gold, diamond & platinium jewellery. RJL is a jewelry retailer based out of Rajkot, Gujarat. The company has served 20 lakh+ customers to date. RJL offers services that include jewelry repairs, resizing, and cleaning.

Fundamentals:

Market Cap: ₹ 1,157 Cr.;

Stock P/E: 20.0 (Ind. P/E: 35.60) 👍;

ROCE: 24.6% 👍;

ROE: 20.6% 👍;

3 Years Sales Growth: 58% 👍;

3 Years Profit Growth: 30% 👍;

3 Years Stock Price CAGR: 43% 👍

Pros: The company has delivered good profit growth of 48.8% CAGR over last 5 years

The stock has

Technicals:

Radhika Jeweltech Ltd has been in a downtrend since attaining a peak level of 157.

It is trading in a strong consolidation range between 95 and 105 levels.

20 EMA (Black line) is just below 50 EMA (Orange line), indicating the weakness in the trend.

More than 35% down from all-time high price of 157 level.

Resistance levels: 109, 126, 139, 157

Support levels: 95, 76

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.