🚀 Realio ( RIO) — The 1,000x Crypto Sleeper That Wall Street Will Never See Coming

RIO) — The 1,000x Crypto Sleeper That Wall Street Will Never See Coming

The Setup is Complete. The Catalyst is Here. The Ascent is Inevitable.

Realio ( RIO) isn’t just another RWA token. It’s the infrastructure play for the entire private equity industry to go fully on-chain. And after today, the door just blew open for a tidal wave of capital to pour in. Let me explain.

RIO) isn’t just another RWA token. It’s the infrastructure play for the entire private equity industry to go fully on-chain. And after today, the door just blew open for a tidal wave of capital to pour in. Let me explain.

🔥 The Catalyst: Trump’s Executive Order Just Flipped the Switch

On August 7th, 2025, President Trump signed a game-changing executive order allowing 401(k) accounts to allocate into private equity vehicles — a $13.7 trillion U.S. retirement market now primed for tokenized disruption.

📰 Read the Executive Order Coverage on CNN

This policy shift isn’t just massive — it’s historic.

Why? Because private equity has long been out of reach for most retail investors. Now, with regulatory greenlights and the rails to make it accessible, Realio stands as the infrastructure play for onboarding this massive wall of money into tokenized private equity assets.

🧠 What is Realio ( RIO)?

RIO)?

Realio is a layer-1 compliant platform purpose-built for tokenized real-world assets, with a deep focus on:

Private equity

Tokenized real estate

Permissioned DeFi

Accredited investor access controls

Website: realio.network

It’s already live, already KYC-compliant, and uniquely positioned as the infrastructure backbone for tokenizing, distributing, and managing private equity fund access.

💰 The Math: How RIO 1,000x Becomes a Conservative Base Case

📊 401(k) Market Size:

Total U.S. 401(k) assets (2025): ~$13.7 trillion

Let’s run some penetration scenarios of that market allocating to tokenized private equity through Realio’s ecosystem.

🧮 Scenario 1: Conservative Penetration

0.1% of 401(k)s allocated to private equity via Realio = $13.7 billion

Current RIO market cap: ~$13 million

RIO share of this inflow (20%) = $2.74B

Multiplier: 210x from current prices

🧮 Scenario 2: Moderate Penetration

0.5% allocation = $68.5 billion

RIO share (25%) = $17.1B

Multiplier: 1,300x

🧮 Scenario 3: Aggressive Upside Case

1% allocation = $137 billion

RIO share (30%) = $41.1B

Multiplier: 3,162x

And this doesn’t even include:

Global retirement markets ($50T+)

Tokenized real estate and infrastructure

Secondary trading fees across the Realio network

Their proprietary tokens (RST, LMX) and expansion into emerging markets

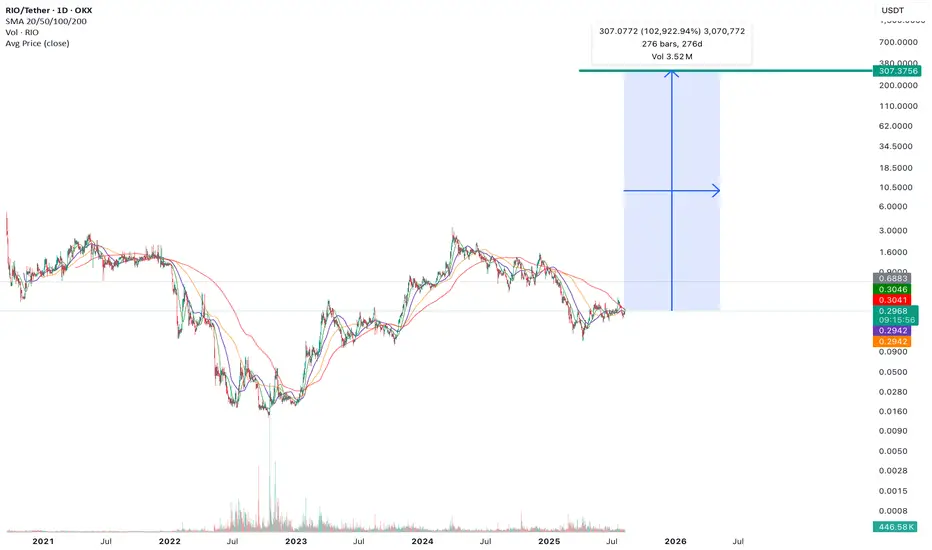

📈 Chart: RIO's Imminent Breakout

From $0.04 lows to $0.41 resistance breakout… and then into price discovery. The next leg targets $4.10 short term, and $41+ midterm — backed by a parabolic macro setup.

🧬 Realio’s Moat: Why It Wins Big

✅ First-mover in tokenized PE infrastructure

✅ KYC-verified, compliant investor onboarding

✅ Real assets, real yield, real compliance

✅ Interoperable across chains and institutions

✅ Backed by VCs, and already used in tokenizing real estate deals and equity offerings

Realio is not trying to be just another “RWA coin.” It is building the pipes that let the biggest capital pools in the world move from TradFi into Crypto.

🧨 Why RIO is the 1,000x Coin for This Cycle

If Ethereum is programmable money, Realio is programmable private equity.

In a cycle where tokenized RWAs, yield-bearing crypto, and institutional-grade infrastructure dominate the narrative — RIO is set to become the BlackRock of Tokenization.

And the market is asleep.

But not for long.

📌 TL;DR

Trump just opened the 401(k) floodgates to private equity

Realio is the infrastructure platform for tokenized PE

Even 0.5% of 401(k) assets flowing into Realio = 1,000x+ upside

Chart is primed for parabolic expansion

RIO is a top asymmetric bet in the entire RWA space

RIO is a top asymmetric bet in the entire RWA space

This is the one they’ll all say was “obvious in hindsight.”

🧠 Be early. Be right. Be rich.

📍RIO: Real World Asset Infrastructure for the Next Trillion Dollar Wave

The Setup is Complete. The Catalyst is Here. The Ascent is Inevitable.

Realio (

🔥 The Catalyst: Trump’s Executive Order Just Flipped the Switch

On August 7th, 2025, President Trump signed a game-changing executive order allowing 401(k) accounts to allocate into private equity vehicles — a $13.7 trillion U.S. retirement market now primed for tokenized disruption.

📰 Read the Executive Order Coverage on CNN

This policy shift isn’t just massive — it’s historic.

Why? Because private equity has long been out of reach for most retail investors. Now, with regulatory greenlights and the rails to make it accessible, Realio stands as the infrastructure play for onboarding this massive wall of money into tokenized private equity assets.

🧠 What is Realio (

Realio is a layer-1 compliant platform purpose-built for tokenized real-world assets, with a deep focus on:

Private equity

Tokenized real estate

Permissioned DeFi

Accredited investor access controls

Website: realio.network

It’s already live, already KYC-compliant, and uniquely positioned as the infrastructure backbone for tokenizing, distributing, and managing private equity fund access.

💰 The Math: How RIO 1,000x Becomes a Conservative Base Case

📊 401(k) Market Size:

Total U.S. 401(k) assets (2025): ~$13.7 trillion

Let’s run some penetration scenarios of that market allocating to tokenized private equity through Realio’s ecosystem.

🧮 Scenario 1: Conservative Penetration

0.1% of 401(k)s allocated to private equity via Realio = $13.7 billion

Current RIO market cap: ~$13 million

RIO share of this inflow (20%) = $2.74B

Multiplier: 210x from current prices

🧮 Scenario 2: Moderate Penetration

0.5% allocation = $68.5 billion

RIO share (25%) = $17.1B

Multiplier: 1,300x

🧮 Scenario 3: Aggressive Upside Case

1% allocation = $137 billion

RIO share (30%) = $41.1B

Multiplier: 3,162x

And this doesn’t even include:

Global retirement markets ($50T+)

Tokenized real estate and infrastructure

Secondary trading fees across the Realio network

Their proprietary tokens (RST, LMX) and expansion into emerging markets

📈 Chart: RIO's Imminent Breakout

From $0.04 lows to $0.41 resistance breakout… and then into price discovery. The next leg targets $4.10 short term, and $41+ midterm — backed by a parabolic macro setup.

🧬 Realio’s Moat: Why It Wins Big

✅ First-mover in tokenized PE infrastructure

✅ KYC-verified, compliant investor onboarding

✅ Real assets, real yield, real compliance

✅ Interoperable across chains and institutions

✅ Backed by VCs, and already used in tokenizing real estate deals and equity offerings

Realio is not trying to be just another “RWA coin.” It is building the pipes that let the biggest capital pools in the world move from TradFi into Crypto.

🧨 Why RIO is the 1,000x Coin for This Cycle

If Ethereum is programmable money, Realio is programmable private equity.

In a cycle where tokenized RWAs, yield-bearing crypto, and institutional-grade infrastructure dominate the narrative — RIO is set to become the BlackRock of Tokenization.

And the market is asleep.

But not for long.

📌 TL;DR

Trump just opened the 401(k) floodgates to private equity

Realio is the infrastructure platform for tokenized PE

Even 0.5% of 401(k) assets flowing into Realio = 1,000x+ upside

Chart is primed for parabolic expansion

This is the one they’ll all say was “obvious in hindsight.”

🧠 Be early. Be right. Be rich.

📍RIO: Real World Asset Infrastructure for the Next Trillion Dollar Wave

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.