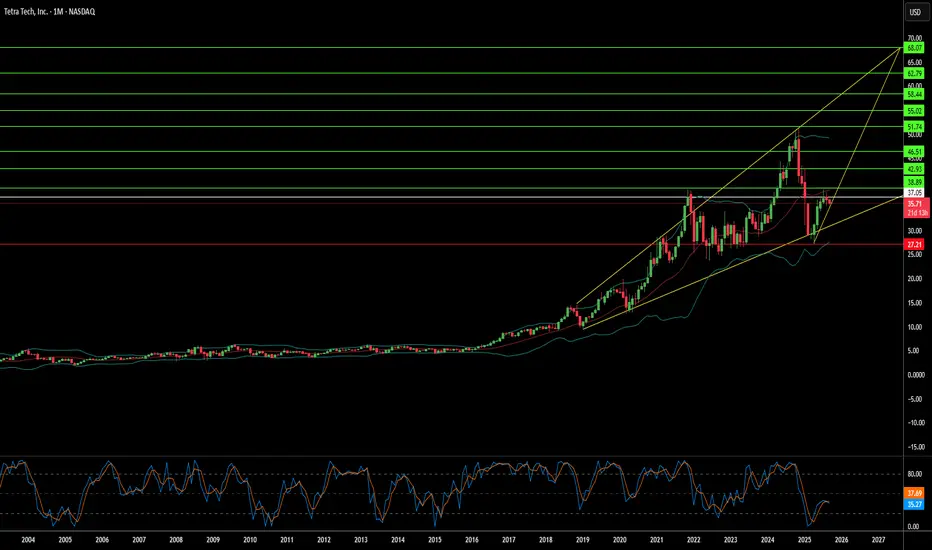

Tetra Tech's remarkable market surge represents a confluence of technological innovation and geopolitical opportunity that positions the Pasadena-based engineering firm at the epicenter of global reconstruction efforts. The company has distinguished itself through substantial intellectual property holdings—over 500 global patents across infrastructure and environmental technologies—and cutting-edge capabilities, including an AI innovation lab focused on robotics, cloud migration, and cognitive systems that automate complex engineering workflows. This technological foundation has translated into impressive financial performance, with the company reporting approximately 11% revenue growth year-over-year in Q3 2025 and maintaining a record backlog of $4.15 billion while earning "Moderate Buy" ratings from analysts with price targets in the low $40s.

The strategic value proposition extends far beyond traditional engineering services into the realm of conflict-zone reconstruction, where Tetra Tech's four decades of experience in war-torn regions uniquely position it for emerging opportunities. The company already maintains USAID contracts in conflict areas, including a $47 million project in the West Bank and Gaza, and has demonstrated critical capabilities in Ukraine through generator deployment, power grid restoration, and explosive ordnance clearance operations. These competencies align precisely with the skill sets required for large-scale reconstruction efforts, from debris removal and pipeline repair to the engineering of essential infrastructure systems, including roads, power plants, and water treatment facilities.

Gaza's reconstruction represents a potentially transformative business opportunity that could fundamentally alter Tetra Tech's trajectory. Conservative estimates place Gaza's infrastructure rebuilding needs at $18-50 billion over approximately 14 years, with immediate priorities including roads, bridges, power generation, water treatment systems, and even airport reconstruction. A major contract in this range—potentially $10-20 billion—would dwarf Tetra Tech's current market capitalization of approximately $9.4 billion and could significantly increase the company's annual revenue. The strategic importance is amplified by broader geopolitical initiatives, including proposed Gaza trade corridors linking Asia and Europe as part of U.S.-led stability plans that envision Gaza as a revived commercial hub.

Institutional investors have recognized this potential, with 93.9% of shares held by institutional owners and recent substantial position increases by firms like Paradoxiom Capital, which acquired 140,955 shares worth $4.1 million in Q1 2025. The convergence of global infrastructure demand—estimated at $64 trillion over the next 25 years—with Tetra Tech's proven expertise in high-stakes reconstruction projects creates a compelling investment thesis. The company's combination of advanced technology capabilities, extensive patent portfolio, and demonstrated success in complex geopolitical environments positions it as a primary beneficiary of the intersection between global instability and the massive capital deployment required for post-conflict reconstruction.

The strategic value proposition extends far beyond traditional engineering services into the realm of conflict-zone reconstruction, where Tetra Tech's four decades of experience in war-torn regions uniquely position it for emerging opportunities. The company already maintains USAID contracts in conflict areas, including a $47 million project in the West Bank and Gaza, and has demonstrated critical capabilities in Ukraine through generator deployment, power grid restoration, and explosive ordnance clearance operations. These competencies align precisely with the skill sets required for large-scale reconstruction efforts, from debris removal and pipeline repair to the engineering of essential infrastructure systems, including roads, power plants, and water treatment facilities.

Gaza's reconstruction represents a potentially transformative business opportunity that could fundamentally alter Tetra Tech's trajectory. Conservative estimates place Gaza's infrastructure rebuilding needs at $18-50 billion over approximately 14 years, with immediate priorities including roads, bridges, power generation, water treatment systems, and even airport reconstruction. A major contract in this range—potentially $10-20 billion—would dwarf Tetra Tech's current market capitalization of approximately $9.4 billion and could significantly increase the company's annual revenue. The strategic importance is amplified by broader geopolitical initiatives, including proposed Gaza trade corridors linking Asia and Europe as part of U.S.-led stability plans that envision Gaza as a revived commercial hub.

Institutional investors have recognized this potential, with 93.9% of shares held by institutional owners and recent substantial position increases by firms like Paradoxiom Capital, which acquired 140,955 shares worth $4.1 million in Q1 2025. The convergence of global infrastructure demand—estimated at $64 trillion over the next 25 years—with Tetra Tech's proven expertise in high-stakes reconstruction projects creates a compelling investment thesis. The company's combination of advanced technology capabilities, extensive patent portfolio, and demonstrated success in complex geopolitical environments positions it as a primary beneficiary of the intersection between global instability and the massive capital deployment required for post-conflict reconstruction.

Penafian

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Penafian

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.