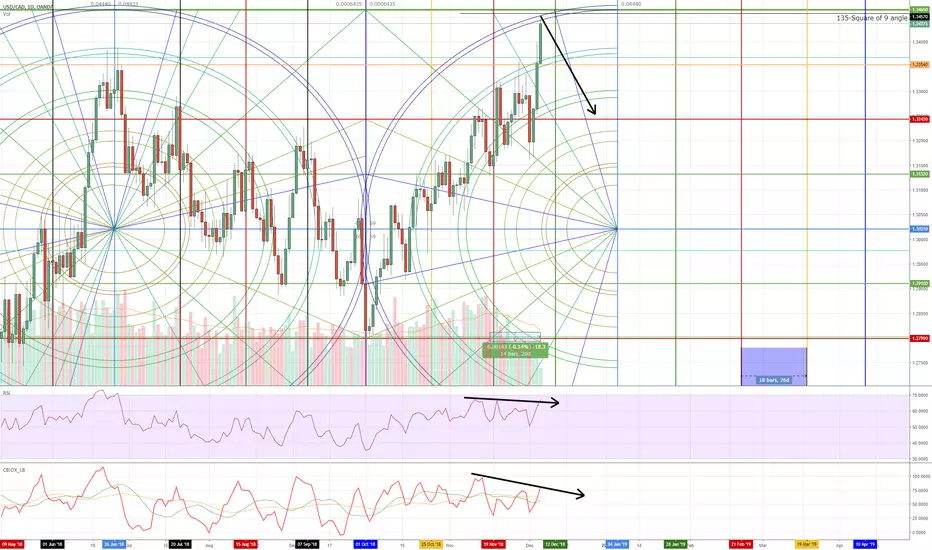

Best short level for USDCAD that I’ve seen in a long time based on the following reasons:

1. Blow-off top move – a parabolic move on low volume.

2. Gann’s 49-day ‘Death Zone’ cycle saw little to no reaction, indicating a extremely overdone move. That 7-week cycle has extended to 10-weeks so a violent pullback should be observed.

3. The major 5/8th harmonic rests at 1.3465 – this is one of the most difficult levels for price to cross above or below, stuff resistance is present, especially given the amount of time it has taken price to reach this level.

4. Square of price and time at the 5/8th Major Harmonic and the time cycle on December 12th. With a strong uptrending market, this convergence zone of time and price should reverse the trend.

5. Bearish divergence between price and the RSI as well as price and the Composite Index.

6. 135-degree Square of 9 angle acts as stiff resistance and rests at the 1.3457 price leve.

7. Price has risen while there have been 14 consecutive days of lower than average volume, with the past 9 trading days showing that volume trading under 50% of the 20-day volume average.

1. Blow-off top move – a parabolic move on low volume.

2. Gann’s 49-day ‘Death Zone’ cycle saw little to no reaction, indicating a extremely overdone move. That 7-week cycle has extended to 10-weeks so a violent pullback should be observed.

3. The major 5/8th harmonic rests at 1.3465 – this is one of the most difficult levels for price to cross above or below, stuff resistance is present, especially given the amount of time it has taken price to reach this level.

4. Square of price and time at the 5/8th Major Harmonic and the time cycle on December 12th. With a strong uptrending market, this convergence zone of time and price should reverse the trend.

5. Bearish divergence between price and the RSI as well as price and the Composite Index.

6. 135-degree Square of 9 angle acts as stiff resistance and rests at the 1.3457 price leve.

7. Price has risen while there have been 14 consecutive days of lower than average volume, with the past 9 trading days showing that volume trading under 50% of the 20-day volume average.

Nota

Forgot, this idea posted at 0503 CSTPenafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.