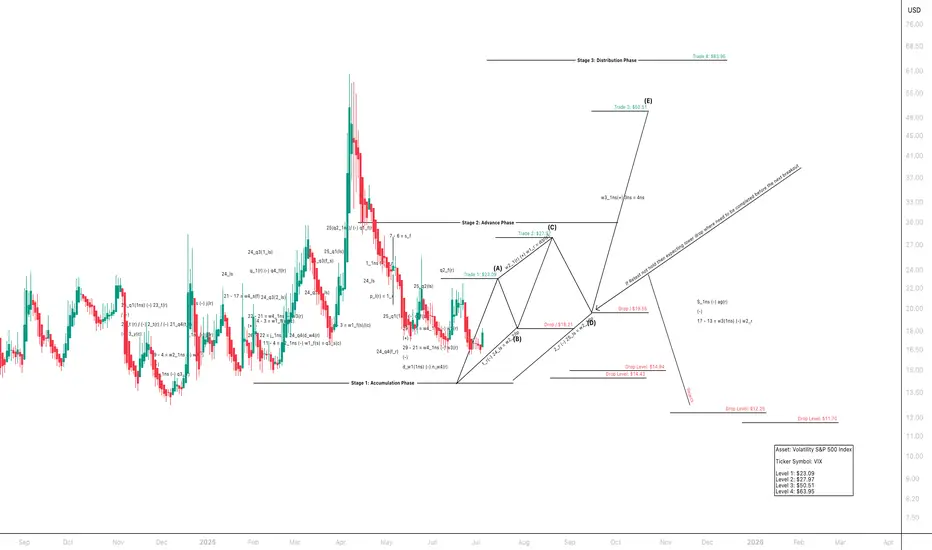

📊 VIX Forecasting Summary

Asset: CBOE Volatility Index (VIX)

Forecast Type: Multi-level structural roadmap (Wave + Distribution Model)

Next Distribution Level:

Level 1: $23.09

Level 2: $27.97

Level 3: $50.51

Level 4: $63.95

🔹 Forecast Model Highlights:

Structured in 3 Phases:

• Stage 1: Accumulation Phase

• Stage 2: Advance Phase

• Stage 3: Distribution Phase

Wave Construction:

• Precise multi-wave pattern analysis incorporating nested wave symmetry and pivot validation.

• Strategic pullbacks identified as necessary retracement points before next breakout.

• Clear support at $14.43 and $14.94 identified as baseline cyclical lows.

📉 Drop Zones Mapped (Support Levels):

• $19.55 (initial retracement warning)

• $18.21 (critical interim support)

• $14.94 and $14.43 (cyclical reset base)

• Primary drop if mid support failed, $11.70 , $12.25

Asset: CBOE Volatility Index (VIX)

Forecast Type: Multi-level structural roadmap (Wave + Distribution Model)

Next Distribution Level:

Level 1: $23.09

Level 2: $27.97

Level 3: $50.51

Level 4: $63.95

🔹 Forecast Model Highlights:

Structured in 3 Phases:

• Stage 1: Accumulation Phase

• Stage 2: Advance Phase

• Stage 3: Distribution Phase

Wave Construction:

• Precise multi-wave pattern analysis incorporating nested wave symmetry and pivot validation.

• Strategic pullbacks identified as necessary retracement points before next breakout.

• Clear support at $14.43 and $14.94 identified as baseline cyclical lows.

📉 Drop Zones Mapped (Support Levels):

• $19.55 (initial retracement warning)

• $18.21 (critical interim support)

• $14.94 and $14.43 (cyclical reset base)

• Primary drop if mid support failed, $11.70 , $12.25

Institutional Note:

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Institutional Note:

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.