Hey whats up traders today it will be a short one in the bullet points but I believe a valuable points to think about. The setup matters, but the real foundation is how much you risk per trade. If you don’t control this, nothing else works. Your edge collapses. Your psychology collapses. And your results become completely random.

If you are not gambler you most likely risk between 0.5 -2% risk per trade. Good, but why?

Many traders use this risk because it's kind of well known and recommended value risk per trade. Ok, it's relatively safe, but if you don't have it build based on your statistical data. You can be also risking to low while you could make more. So In this post is not about why we should use risk management and calculate if for each position based on SL distance. I already did this post below 👇Click the picture to learn more In this post I will try to give advice how you can calculate best risk per trade for you based on your strategy and risk.

In this post I will try to give advice how you can calculate best risk per trade for you based on your strategy and risk.

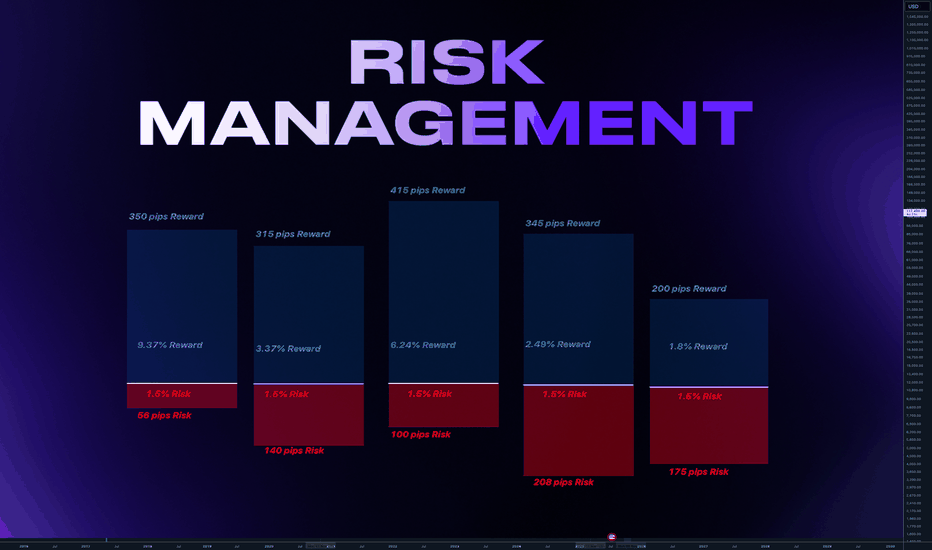

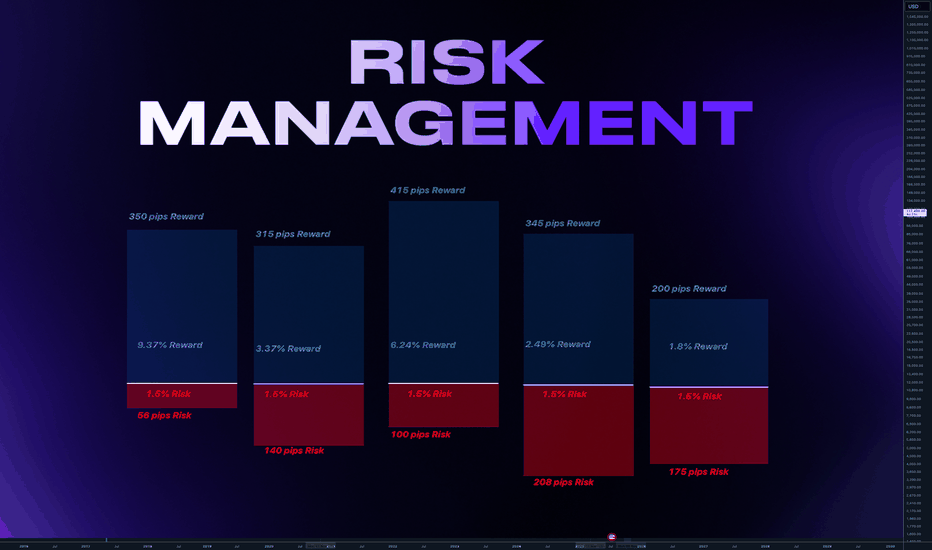

I always recommend backtest at least 300 examples of strategy. When you do that, you know your average win rate on average target. From the tab bellow you can see how many % of trades you need to win with the specific risk reward. Here is also important to consider your ability to hold in the trade. Its amazing to catch 1:5 risk reward trades, but it mostly comes with low win ratio in other words, you will get stopped out few times until you get big trade. Also 1:5 risk reward usually has a pullback during the move. Can you face it without emotions being affected?

Here is also important to consider your ability to hold in the trade. Its amazing to catch 1:5 risk reward trades, but it mostly comes with low win ratio in other words, you will get stopped out few times until you get big trade. Also 1:5 risk reward usually has a pullback during the move. Can you face it without emotions being affected?

Most importantly, you finally understand something every professional lives by: you don’t know the distribution of the trades.

You may have a 65% percent win rate. It still means that you can have 35 losses out of 100 traders. Remember distribution of wins and losses is random , you never know outcome of next trade.

It could be win win loss win. Or loss loss loss win win. Or a brutal streak of seven losses before the market pays you back.

✅✅❌✅❌❌✅✅✅✅❌✅

When wins and losses are evenly distributed it's quite comfortable to continue in opening new trades. You still believe your strategy and it's simply normal to have loss time to time.

✅❌❌❌✅❌❌❌❌❌✅✅

But what you gonna do when such a streak comes? Are you gonna doubt your strategy? Are you gonna look for different strategy? Remember 65% success rate means 35 possible losses out of 100. If 20 losses comes in a row your long term statistics still was not broken.

Dont think this cant happen to you. If this didnt happen to you yet, you are not trading for long enough. It will come and its better to be prepared.

📌Lets look at the Monte Carlo simulation with our 65% win ratio and 2RR

As we can see on the picture below if you start with 10K and follow your strategy in a short period of one month we can face drawdown and end unprofitable even when we did everything right. Why? We did everything right and we have positive winning ratio and Risk reward

Why? We did everything right and we have positive winning ratio and Risk reward

📌Random distribution of the trades

I don't win every trade, you don't win every trade. No one does. Trading is longterm game and short term result can be a bit random. Because you are might trend trader and market can stay in the range during some months or you are a reversal trader and its still trading against you. So how to beat it - Time.

📌 Lets have a look at the same setup 65% Win rate and 2 RR

But now let's have look at the long-term results. As we can see on chart below. after some time even the worst case distribution is getting in to the profit. However there still was 3 months around break even - Frustrating but its the reality 📌 Lets improve Risk reward to 2.3

📌 Lets improve Risk reward to 2.3

You will be getting slightly bigger wins so every loosing streak will be recovered faster.

And you should not stay in the prolonged drawdowns for long periods

📌 Lets improve win ration to 70%

📌 Lets improve win ration to 70%

And its even better less often you got loss and 2.3 RR recover slightly better.

📌 So what should be my risk per trade

📌 So what should be my risk per trade

First done look on how much you want to make, trading is mainly about protecting capital. After you got your statistical data. Run Monte Carlo simulations and try to model the worst case distribution of the trades.

For example if you got 70% win rate - means you can lose 30 trades out of 100. Be ready that it can happen, even its unlikely and if that really happens it means something is wrong with your strategy or you made too much mistakes. But count with it that it can happen.. Setup your risk per trade in such % that you would be comfortable if that happens.

📍0.25% Risk - 30x Loss = - 7.5%

📍0.5% Risk - 30 x Loss = - 15%

📍1% Risk - 30 x Loss = -30%

📍2% Risk - 30x Loss = - 60%

📍3% Risk - 30x Loss = - 90%

Define what would you be able to accept and be comfortable even during a loosing streak.

📌 Have more accounts

This will give you flexibility. Im running 3x personal accounts. Each with different risk. with copy trading system to distribute my positions. 🎯 Account 1: Here Im opening all trades which I has well defined risk and its A+Setups. If I open a trade on this account they goes automatically to the other 2 accounts. So I got proportionaly this positions on whole capital with 1% risk.

🎯 Account 1: Here Im opening all trades which I has well defined risk and its A+Setups. If I open a trade on this account they goes automatically to the other 2 accounts. So I got proportionaly this positions on whole capital with 1% risk.

🎯 Account 2: Here are running copied trades from Account 1 + Im opening another positions when I want to add or increase the risk also used for short terms setups. Its 3% risk only form this one specific account and its not copied to other accounts.

🎯 Account 3: Here are running trades from account 1 + This account is also used mainly for the crypto trades and news trading. Trades are also isolated just for this account and not copied to the whole portfolio.

🎯 Prop Firm Trading

For the prop trading where more strict rules Im using completely different approach which I described in this post below 👇Click the picture to learn more Final tip: Try to have strategy with win rate between 65 - 70% and 2 - 2.5 RR.

Final tip: Try to have strategy with win rate between 65 - 70% and 2 - 2.5 RR.

If you got anything lower than that you can go thru some dark periods, but you will survive if stick to your plan based on the statistics. If you don't have statistical data of your strategy, stop trading for while , step back and do a bit of backtesting Tradingview has great backtesting features.

David Perk aka Dave FX Hunter

If you are not gambler you most likely risk between 0.5 -2% risk per trade. Good, but why?

Many traders use this risk because it's kind of well known and recommended value risk per trade. Ok, it's relatively safe, but if you don't have it build based on your statistical data. You can be also risking to low while you could make more. So In this post is not about why we should use risk management and calculate if for each position based on SL distance. I already did this post below 👇Click the picture to learn more

I always recommend backtest at least 300 examples of strategy. When you do that, you know your average win rate on average target. From the tab bellow you can see how many % of trades you need to win with the specific risk reward.

Most importantly, you finally understand something every professional lives by: you don’t know the distribution of the trades.

You may have a 65% percent win rate. It still means that you can have 35 losses out of 100 traders. Remember distribution of wins and losses is random , you never know outcome of next trade.

It could be win win loss win. Or loss loss loss win win. Or a brutal streak of seven losses before the market pays you back.

✅✅❌✅❌❌✅✅✅✅❌✅

When wins and losses are evenly distributed it's quite comfortable to continue in opening new trades. You still believe your strategy and it's simply normal to have loss time to time.

✅❌❌❌✅❌❌❌❌❌✅✅

But what you gonna do when such a streak comes? Are you gonna doubt your strategy? Are you gonna look for different strategy? Remember 65% success rate means 35 possible losses out of 100. If 20 losses comes in a row your long term statistics still was not broken.

Dont think this cant happen to you. If this didnt happen to you yet, you are not trading for long enough. It will come and its better to be prepared.

📌Lets look at the Monte Carlo simulation with our 65% win ratio and 2RR

As we can see on the picture below if you start with 10K and follow your strategy in a short period of one month we can face drawdown and end unprofitable even when we did everything right.

📌Random distribution of the trades

I don't win every trade, you don't win every trade. No one does. Trading is longterm game and short term result can be a bit random. Because you are might trend trader and market can stay in the range during some months or you are a reversal trader and its still trading against you. So how to beat it - Time.

📌 Lets have a look at the same setup 65% Win rate and 2 RR

But now let's have look at the long-term results. As we can see on chart below. after some time even the worst case distribution is getting in to the profit. However there still was 3 months around break even - Frustrating but its the reality

You will be getting slightly bigger wins so every loosing streak will be recovered faster.

And you should not stay in the prolonged drawdowns for long periods

And its even better less often you got loss and 2.3 RR recover slightly better.

First done look on how much you want to make, trading is mainly about protecting capital. After you got your statistical data. Run Monte Carlo simulations and try to model the worst case distribution of the trades.

For example if you got 70% win rate - means you can lose 30 trades out of 100. Be ready that it can happen, even its unlikely and if that really happens it means something is wrong with your strategy or you made too much mistakes. But count with it that it can happen.. Setup your risk per trade in such % that you would be comfortable if that happens.

📍0.25% Risk - 30x Loss = - 7.5%

📍0.5% Risk - 30 x Loss = - 15%

📍1% Risk - 30 x Loss = -30%

📍2% Risk - 30x Loss = - 60%

📍3% Risk - 30x Loss = - 90%

Define what would you be able to accept and be comfortable even during a loosing streak.

📌 Have more accounts

This will give you flexibility. Im running 3x personal accounts. Each with different risk. with copy trading system to distribute my positions.

🎯 Account 2: Here are running copied trades from Account 1 + Im opening another positions when I want to add or increase the risk also used for short terms setups. Its 3% risk only form this one specific account and its not copied to other accounts.

🎯 Account 3: Here are running trades from account 1 + This account is also used mainly for the crypto trades and news trading. Trades are also isolated just for this account and not copied to the whole portfolio.

🎯 Prop Firm Trading

For the prop trading where more strict rules Im using completely different approach which I described in this post below 👇Click the picture to learn more

If you got anything lower than that you can go thru some dark periods, but you will survive if stick to your plan based on the statistics. If you don't have statistical data of your strategy, stop trading for while , step back and do a bit of backtesting Tradingview has great backtesting features.

David Perk aka Dave FX Hunter

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.