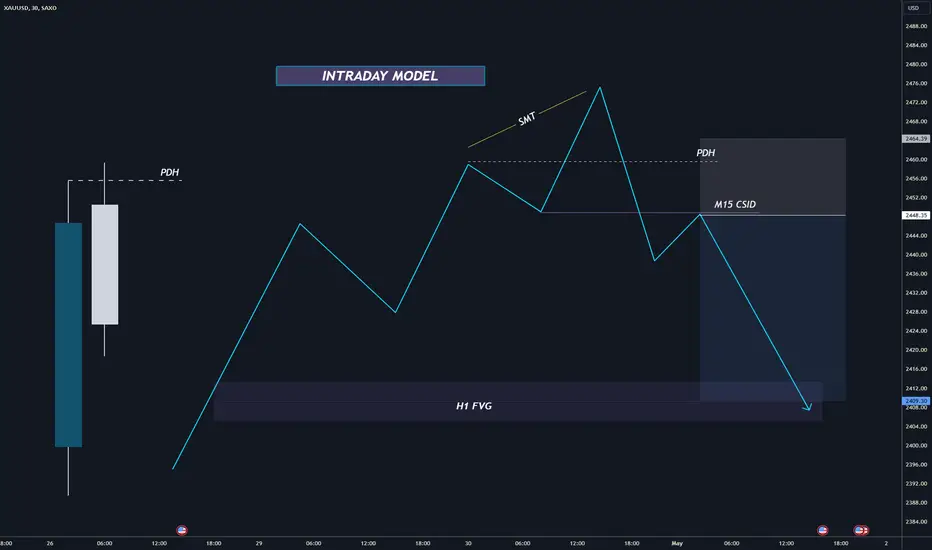

Hello traders this is a just simple visual of an effective intraday trading model. It is simple and effective but it must meet specific conditions.

🟣 Conditions

1) Price must sweep external liquidity PDH - The previous day's high

2) We need to see rejection, which means the price will return below the previous day's high level.

3) CSID on M15 must be created - Change In the State of Delivery

4) SMT as confirmation of the divergence

4) We are entering on the pullback to the CSID

5) Targeting H1 FVG

6) Must be traded during

🟢Example 1:

D1 external liquidity taken

Spot H1 FVG

Execute on M15 Pullback

This setup doesn't appear every day, also day-trading doesn't mean trading every day. But if you look at the example below where it appears you will see that it's mainly on the major swings which can give you even more RR than just +3R

“Adapt what is useful, reject what is useless, and add what is specifically your own.”

Dave FX Hunter ⚔

🟣 Conditions

1) Price must sweep external liquidity PDH - The previous day's high

2) We need to see rejection, which means the price will return below the previous day's high level.

3) CSID on M15 must be created - Change In the State of Delivery

4) SMT as confirmation of the divergence

4) We are entering on the pullback to the CSID

5) Targeting H1 FVG

6) Must be traded during

🟢Example 1:

D1 external liquidity taken

Spot H1 FVG

Execute on M15 Pullback

This setup doesn't appear every day, also day-trading doesn't mean trading every day. But if you look at the example below where it appears you will see that it's mainly on the major swings which can give you even more RR than just +3R

“Adapt what is useful, reject what is useless, and add what is specifically your own.”

Dave FX Hunter ⚔

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.