Exclusive: XM Is Now Regulated in Dubai

XM, a major name in the contracts for differences (CFDs) brokerage industry, has expanded into the Middle East and secured a Category 5 licence from Dubai’s Securities and Commodities Authority (SCA), FinanceMagnates.com has learned.

The broker is planning to start using the licence before the end of 2025.

Join IG, CMC, and Robinhood in London’s leading trading industry event!

XM Joins the Dubai Race

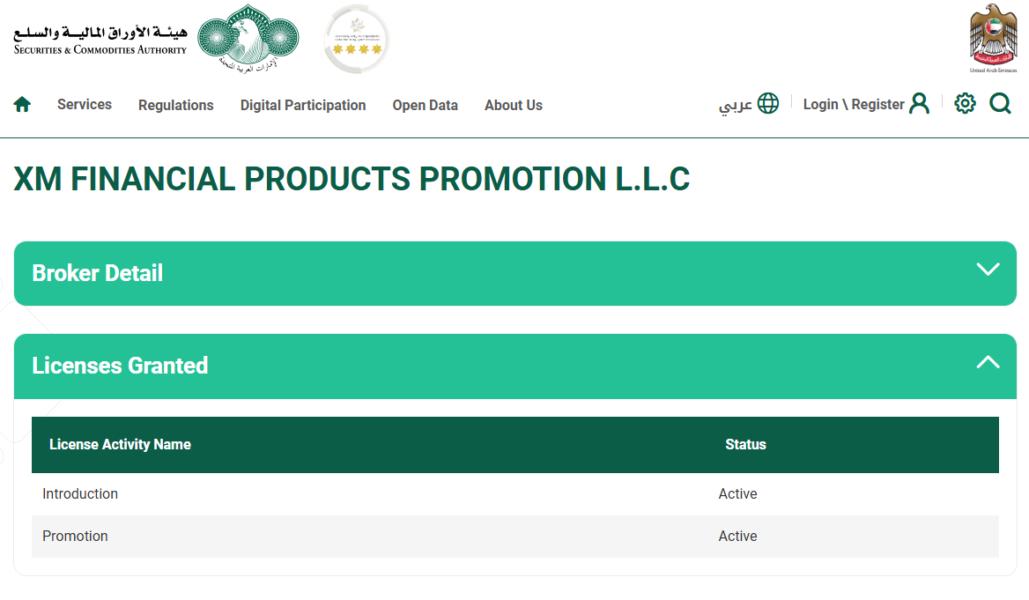

The regulatory register shows that the licence was granted to the locally formed entity, XM Financial Products Promotion, which was established in January this year.

The broker also established its Dubai office in the city’s iconic Opus Building at Business Bay.

Details of XM' SCA license on the regulator's website

Under the Category 5 licence, brokers may operate in a similar way to introducing brokers (IBs) in Dubai. They are permitted to promote their services to potential customers in the UAE and direct them to be onboarded under their non-UAE entities.

However, Category 5 licence holders are not authorised to hold client funds locally or execute trades—activities that require a Category 1 licence.

You may also like: Singapore to Block Access to Octa and XM for Unlicensed Operations

According to XM, the Category 5 licence better aligns with its business model—it only wants to promote products and services to the UAE market. However, it has kept the option open to apply for a Category 1 licence in the future.

Interestingly, XM is already regulated in Dubai, but by the Dubai Financial Services Authority (DFSA), which oversees companies operating from the city’s free-trade zone.

The broker holds other licences from regulators in Cyprus, Belize, Seychelles, Mauritius, and South Africa. Trading.com, which is a sister brand of XM, is also regulated in the US, the UK, Cyprus, and Australia.

Interesting read: XM Owner Buys Cyprus’ Oldest Greek Newspaper After His Interest in a Bank

Deep-Pocket Traders Are Attracting Brokers to Dubai

Several other brokers recently obtained Dubai’s SCA licence, though most opted for Category 5, which enables them to operate as introducing brokers. Exinity, VT Markets, Eightcap, EC Markets, and Taurex are among those with a Category 5 licence.

However, a few names, including Plus500, XTB, and RoboMarkets, went for Dubai’s full brokerage licence.

Brokers’ interest in the Middle East is being driven by the opportunity to tap into the region’s high-value traders. Capital.com recently reported that 52 per cent of its H1 trading volume came from the Middle East, compared to 15 per cent from Europe. The broker had 35,000 MENA traders compared with 61,400 in Europe.

Furthermore, 71.7 per cent of Capital.com's $804.1 billion in trading volume in MENA was generated by UAE-based traders.

CFI Financial, another Middle East-focused CFDs broker, handled a record $1.51 trillion in trading volume during the second quarter of 2025. In comparison, the broker’s trading volume for the entire year of 2024 was $2.79 trillion.