CRM Provider EAERA Adds Social Trading Features Through Brokeree Deal

EAERA, which provides CRM and back-office technology for financial firms, has integrated Brokeree's copy trading platform into its system, the companies announced today (Wednesday). The move allows brokers to monitor copy trading activity directly from their CRM dashboards rather than switching between separate platforms.

The integration lets brokers track performance metrics for both signal providers and followers, including trading volumes and activity patterns. Brokers can access this data in real-time through EAERA's interface, potentially helping them adjust services based on client trading behavior.

EAERA Partners with Brokeree for Copy Trading CRM Integration

The partnership centers on Brokeree's Social Trading platform, which enables copy trading across MetaTrader 4, MetaTrader 5, and cTrader servers. The system includes performance analytics and risk management features designed to help both experienced traders sharing signals and novice traders following them.Quan Ta, CEO of EAERA

“By combining EAERA's customizable CRM and smart automation with Brokeree's advanced trade mirroring technology, we enable brokers to scale faster, engage traders more effectively, and create seamless investor experiences,” said Quan Ta, CEO of EAERA.

The companies claim integrated system supports automated onboarding processes for copy trading participants and simplified account linking. Brokers gain access to role-based controls and compliance tools, along with Power BI integration for analytics and reporting.

For EAERA, this is not the first collaboration with technology firms supporting the CFD industry. In April, FinanceMagnates.com reported that Centroid Solutions had joined its roster of CRM providers. Later, at the end of June, Devexperts, the creator of the popular DXtrade platform, also started using the company’s services.

Copy Trading Gains Popularity

Copy trading has grown popular among retail forex traders, allowing less experienced participants to automatically replicate trades from more successful traders.

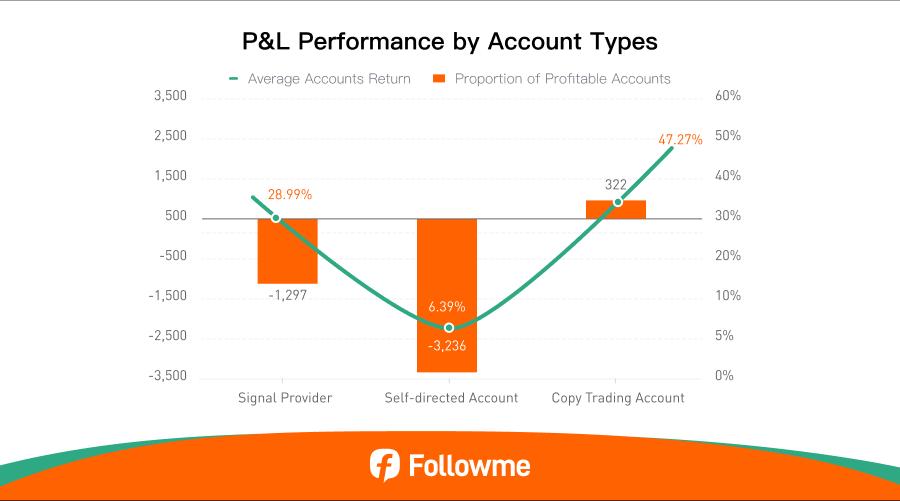

For example, Followme has released its 2025 Mid-Year Trading Report showing that 47.27% of copy trading accounts ended in profit, compared to heavy losses in self-directed accounts.

However, managing these services often requires brokers to juggle multiple software platforms.

The new integration attempts to consolidate these functions into a single interface. Brokers can now view copy trading performance alongside other client data in their existing CRM system.Tatiana Pilipenko, Regional Head of Business Development at Brokeree Solutions, Source: LinkedIn

“This collaboration with EAERA brings our Social Trading solution into a broader infrastructure, enabling brokers to enhance automation, transparency, and client engagement,” said Tatiana Pilipenko, Regional Head of Business Development at Brokeree Solutions.

You may also like: FXBO Adds Brokeree’s PAMM Enabling Shared Accounts for Retail Traders on cTrader

Technical Features and Compliance

The system includes several technical components designed for broker operations. Automated workflows handle the setup process for traders wanting to become signal providers or followers. Risk management tools allow brokers to set parameters for copy trading activities.

The integration also includes compliance features, though specific regulatory requirements vary by jurisdiction. Brokers can access customizable reports through the Power BI integration, potentially helping with regulatory reporting needs.

Both companies indicated that the integration is currently available for brokers using MT4 and MT5 trading platforms, with potential expansion to other systems in the future.