UBER Technologies Stock Looks Cheap

Uber Technologies, Inc. (UBER) reported strong Q2 revenue and free cash flow (FCF) results on August 6. UBER stock closed at $89.22 on Aug. 6 with a $186.57 billion market cap. That may be too low, based on its strong free cash flow (FCF) and FCF margins. This article will show why.

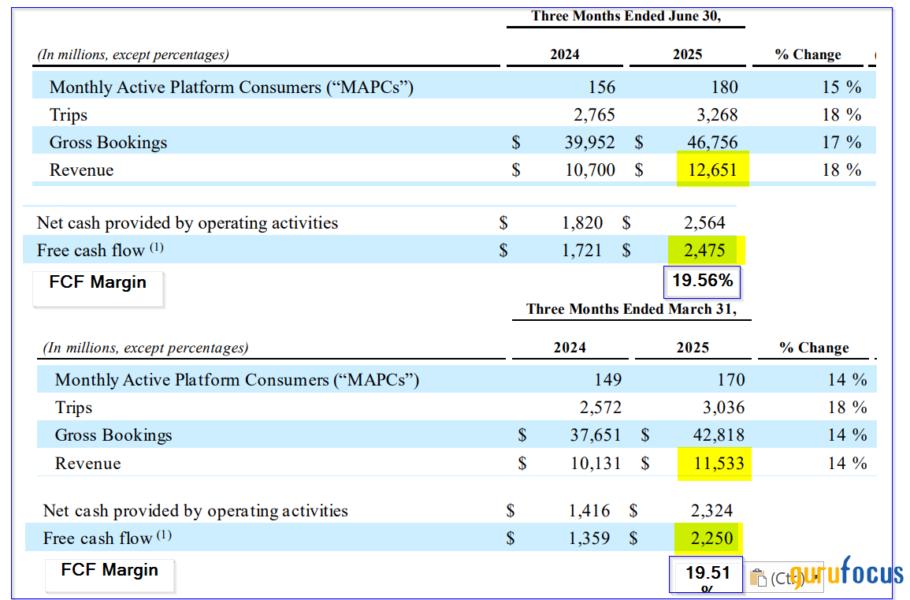

Revenue rose 18.2% YoY to $12.65 billion in Q2 from $10.7 billion last year. It was up almost 10% (+9.69%) from Q1's $11.533 billion revenue.

Uber is gaining popularity. It now has 180 million active users each quarter, up +15% Y/Y and +5.88% from last quarter's 170 million. At this pace, it could end up with over +23.5% higher number of users next year, so growth may be accelerating.

This has led to significantly more trips and bookings using Uber vehicles. For example, in Q2 Uber had 18% more trips and 17% more bookings than a year ago.

There is reason to believe its growth in bookings is accelerating. For example, in Q1 it booked 42.818 billion trips, but that rose +9.43% in Q2 to $46.856 billion. In other words, that represents an annual run rate of +37.7% (before any seasonal effects).

The point is that revenue forecasts may be significantly too low.

For example, the midpoint of Uber management's booking guidance last quarter (Q1) was 46.5 billion bookings for Q2. But Q2 came in at $46.856, or +0.76% higher.

Uber does not provide estimates for 2025 revenue, but there appears to be a strong correlation between bookings growth and revenue growth. This means its growth seems to be accelerating.

For example, analysts are now projecting $50.62 billion revenue for 2025, according to a survey of 49 analysts by Yahoo! Finance. But that implies H2 revenue will be 9.34% higher than H1 revenue of $24.184 billion:

$50.62b 2025 est. - $24.184b H1 = $26.442 b H2 revenue

$26.442b H2 / $24.184b H1 = 1.0933 -1 = +9.34% run rate growth

That puts revenue on an annual run rate growth of +18.67%, which is faster than its Q2 Y/Y growth rate of 18.2%. So, revenue growth may be accelerating.

Moreover, for 2026, analysts are projecting $58.17 billion in revenue, implying a +14.9% Y/Y growth rate over 2025. That may be too low now. So, analysts may have to raise their 2026 projections to be closer to an 18% to 19% growth rate.

This coincides with management's projections for bookings in Q3 to rise between 17% and 21% on a Y/Y basis.

If revenue growth keeps pace with this, it could come in at the 18.67% annual growth rate implied by analysts' forecasts for H2.

The bottom line is that with an ever increasing number of user and higher bookings, Uber's revenue outlook looks very strong. It may continue to surprise analysts on the upside.

Full Year Free Cash Flow (FCF)

Uber is now very profitable on a free cash flow (FCF) basis. It generated $2.475 billion in FCF for Q2, which was +43.8% over last year's $1.721 billion in FCF.

That is also +10% higher than last quarter (Q1) $2.25 billion in free cash flow (implying an annualized growth rate of 40%).

Source: Uber Technologies Q2 and Q1 earnings releases and Hake analysis of FCF margins.

However, a better way to look at FCF projections is to use a FCF margin analysis. For example, in Q2, its FCF/revenue was:

$2.475b / $12.651b revenue = 0.1965 = 19.65% FCF margin

That was similar to what happened in Q1 (i.e., $2.25b / $11.533 b revenue = 19.5% FCF margin).

In fact, based on data from Stock Analysis, which shows that quarterly FCF margins, the company has now had two full quarters over 19.5% FCF margins each quarter.

For example, in Q4 2024, the FCF margin was 14.27% and in Q3 2024, it was 18.85%.

That shows that Uber's FCF profitability is accelerating as well. We can use its most recent 2 quarters' FCF margins to project future FCF.

For example, using analysts 2026 forecasts of $58.17 billion in revenue (which may be too low, as I have shown), FCF could come in at over $11.3 billion next year:

$58.17b 2026 revenue x 19.5% FCF margin = $11.34 billion FCF 2026

That implies that it would be +18.1% higher than the Q2 run rate FCF:

$11.34 b FCF / ($2.475b FCF x 4) = $11.34b / $9.9b = 1.18125 -1 = +18.1% growth rate

This could lead to a significantly higher target price for UBER stock. Here is why.

Target Price for UBER Stock

Uber's valuation can be measured using FCF yield as a metric. This method assumes that the market values the FCF as if it was paid out to shareholders and the payout is seen as a dividend yield.

For example, in the last 12 months (LTM), Uber has generated $8.45 billion in FCF, according to Stock Analysis.

That represents 4.58% of its market cap today:

$8.45b LTM FCF / $186.57 billion market cap today = 0.04577

That gives the stock a 4.58% FCF yield. Rounding that up to 4.60% is one way to forecast its future market value.

For example, using the $11.34 billion 2026 FCF forecast (above):

$11.34 billion FCF 2026 / 0.046 = $246.5 billion target market cap

That is almost 32% higher than its market cap today:

$246.5b target mkt cap / $186.57 billion today =1.32 -1 = +32.1% upside

In other words, UBER is worth 32% more than its price of $89.22 on Aug. 6:

1.321 x $89.22 p/sh = $117.86 Target price

Potential investors in UBER stock should keep in mind that this $118 target price assumes 2026 revenue will rise only 14.9%. That's even though the run rate going forward is projected to be between 18% and 19%.

Moreover, its FCF margins could rise over 20% from the 19.5% rate used in this forecast (in Q2 it was 19.65%, up from 19.5% in Q1).

Summary and Conclusion

Uber's growth rate appears to be accelerating and this is reflected in its higher free cash flow margins.

The point is that with higher revenue growth and fairly stable operating cost margins, Uber is showing operating leverage. Operating leverage occurs when a company's revenue accelerates as its costs rise at a slower rate.

That can be seen in the company's last two quarters, where FCF margins rose to almost 20%.

That could lead to the company producing a 19.5% FCF margin next year on 15% higher revenue. Moreover, analysts are likely to raise their forecasts.

The bottom line for investors is that, using a 4.6% FCF yield metric, UBER stock could be worth almost a third higher at $118 per share over the next year.