ChartWatch ASX Scans: Defence stocks bonanza! Droneshield, Austal, Electro Optic Systems, Elsight, Titomic

- Interesting uptrends in today's Scans: 4DMEDICAL (4DX), Austal (ASB), Bellevue Gold (BGL), Brazilian Rare Earths (BRE), Droneshield (DRO), Dateline Resources (DTR), Electro Optic Systems (EOS), Harvey Norman (HVN), Westgold (WGX), Yandal Resources (YRL).

- Alpha HPA (A4N), Appen (APX), Domino's Pizza Enterprises (DMP), Flight Centre Travel (FLT), IPH (IPH), Premier Investments (PMV), Sonic Healthcare (SHL), Talga Group (TLG), Woolworths (WOW).

ChartWatch *LIVE* Webinar

ChartWatch *LIVE* Webinars are back and they're coming to Wednesday lunchtimes WEEKLY 💪

Learn more about technical analysis and trend following through real case studies on ASX stocks. Australia's premier technical analyst, Carl Capolingua, shares his unique insights on stocks as requested by viewers. Ask about a company in your portfolio or anything related to trading and investing and get Carl's seasoned specialist perspective.

Places are limited so >REGISTER NOW!<

Scroll down to today's Uptrends Scan List and you'll find no fewer than 5 ASX defence industry stocks. Each has been the subject of substantial and growing investor attention as the world grapples with new ways countries and other potential "bad actors" may inflict malicious damage and harm against sovereign nations.

Austal ASB

Austal is a shipbuilder and defence prime contractor designing, building, and supporting naval vessels for Australia, the U.S., and other clients. Its defence arm focuses on producing Tier-2 surface combatants and landing craft, with long-term agreements in place to deliver vessels for the Commonwealth.

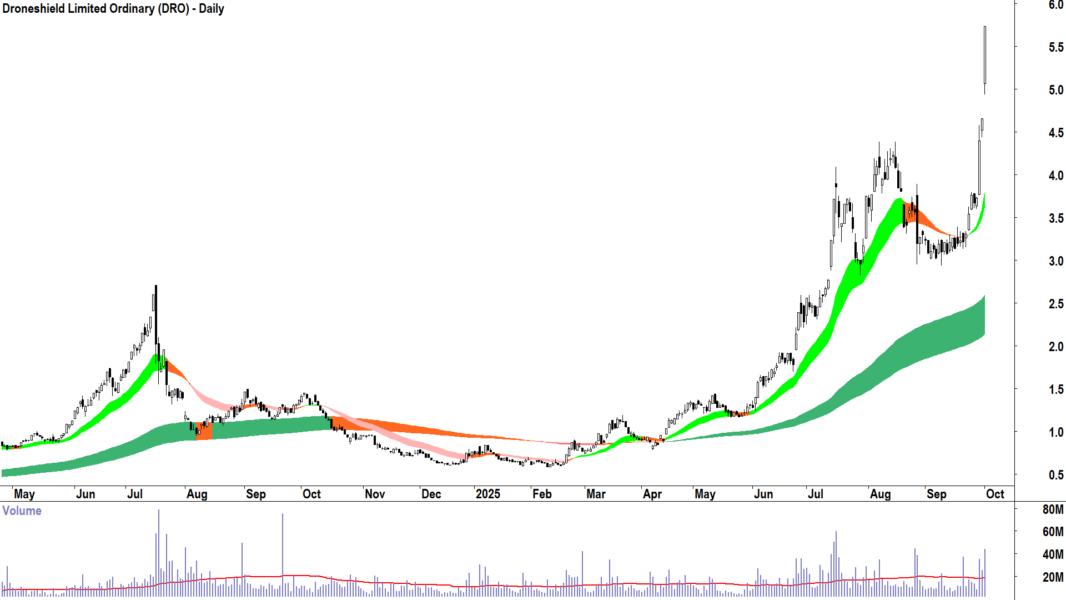

Droneshield Ltd DRO

DroneShield develops counter-drone, electronic warfare, and sensor systems for military, security, and border protection. Defence work represents the bulk of its revenue, with contracts spanning the Australian Defence Force, U.S. Department of Defense (DoD), and other allied customers. It is positioned within the AUKUS export framework.

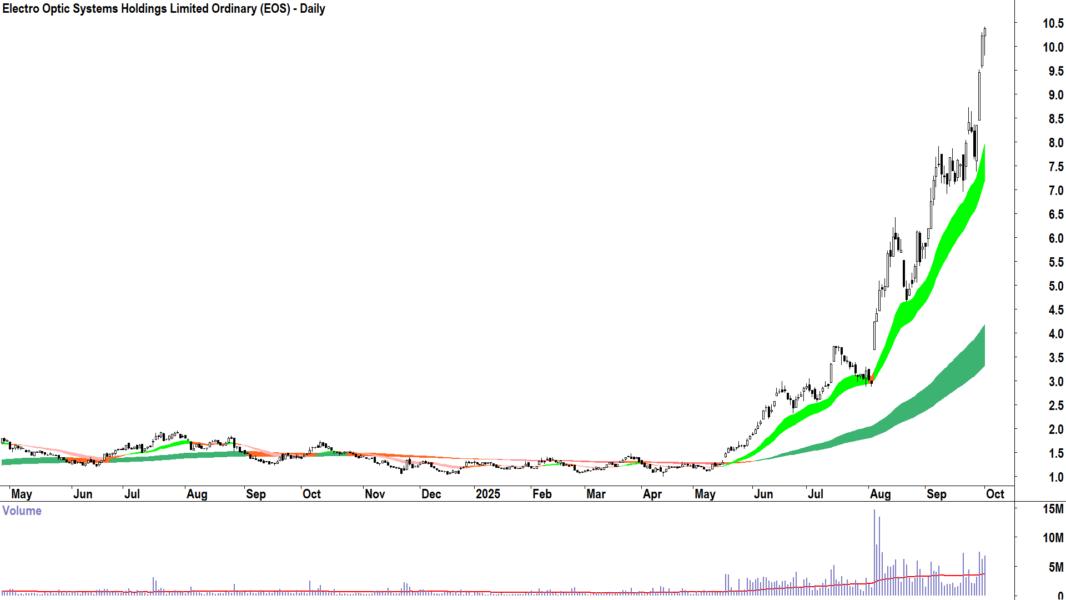

Electro Optic Systems EOS

Electro Optic Systems supplies advanced optical, laser, and remote weapon systems for land, maritime, and aerospace defence applications. Its defence division is active in counter-drone technology, directed energy weapons, and integration of remote weapon platforms. It is also a system integration partner on Australia’s major counter-drone program.

Elsight ELS

Elsight develops secure communications and connectivity solutions for unmanned systems, particularly drones operating beyond visual line of sight. Its flagship product, Halo, provides a resilient and encrypted link that enables continuous command and control, even in contested or remote environments. Halo is deployed by defence organisations and domestic security agencies worldwide, supporting missions such as border patrol, emergency response, and law enforcement, in addition to military surveillance and tactical operations.

Titomic TTT

Titomic specialises in cold spray and metal additive manufacturing, applying its technology to defence and aerospace. It delivers high-performance titanium and multi-metal parts, and provides in-field repair capabilities for land, sea, air, and space platforms. Sensitive defence contracts include producing advanced components for global military applications.

Welcome to my ChartWatch Daily ASX Scans series. Here, I present scan lists based on my trend following technical analysis methodology. My goal is to alert you to the best uptrends and downtrends on the ASX.

Feel free to get your favourite AI to convert the tables below into lists you can upload to your favourite trading platform like TradingView. Then you'll be able to skip from chart to chart and quickly and easily see the best uptrends and downtrends on the ASX.

Some investors prefer to buy those stocks in strong uptrends, and avoid, sell, or short sell those stocks in strong downtrends – but how you use the lists is really up to you!

Note, many stocks in both lists have appeared there many times before. As long as they keep meeting my criteria – they'll keep appearing. But note, there won't be any notifications when they don't – so you'll have to do your own research on when a particular trend changes!

Uptrends Scan List

Company | Code | Last Price | 1mo % | 1yr % |

4DMEDICAL | 4DX | $2.26 | +193.5% | +258.7% |

Acusensus | ACE | $1.300 | +30.0% | +52.9% |

ALS | ALQ | $20.18 | +9.9% | +43.1% |

American Rare Earths | ARR | $0.425 | +16.4% | +54.5% |

Austal | ASB | $8.19 | +8.0% | +187.4% |

Baby Bunting Group | BBN | $3.10 | +3.7% | +71.3% |

Bellevue Gold | BGL | $1.175 | +32.8% | +4.9% |

Benz Mining Corp. | BNZ | $1.815 | +56.5% | +1352.0% |

Brazilian Rare Earths | BRE | $3.87 | +58.0% | +42.8% |

Beetaloo Energy Australia | BTL | $0.345 | +9.5% | +53.3% |

Capricorn Metals | CMM | $13.36 | +17.2% | +123.8% |

Dyno Nobel | DNL | $3.25 | +6.9% | +3.8% |

Droneshield | DRO | $5.74 | +85.8% | +334.8% |

Dateline Resources | DTR | $0.500 | +92.3% | +8990.9% |

Duratec | DUR | $2.15 | +22.5% | +53.0% |

EDU | EDU | $0.610 | +14.0% | +306.7% |

Elsight | ELS | $2.16 | +23.1% | +535.3% |

Emyria | EMD | $0.068 | +51.1% | +78.9% |

Encounter Resources | ENR | $0.395 | +16.2% | -9.2% |

Electro Optic Systems | EOS | $10.37 | +67.8% | +643.4% |

Focus Minerals | FML | $1.210 | +110.4% | +764.3% |

Fleetwood | FWD | $3.17 | +2.6% | +71.4% |

G50 Corp | G50 | $0.400 | +42.9% | +158.1% |

Great Boulder Resources | GBR | $0.081 | +22.7% | +68.8% |

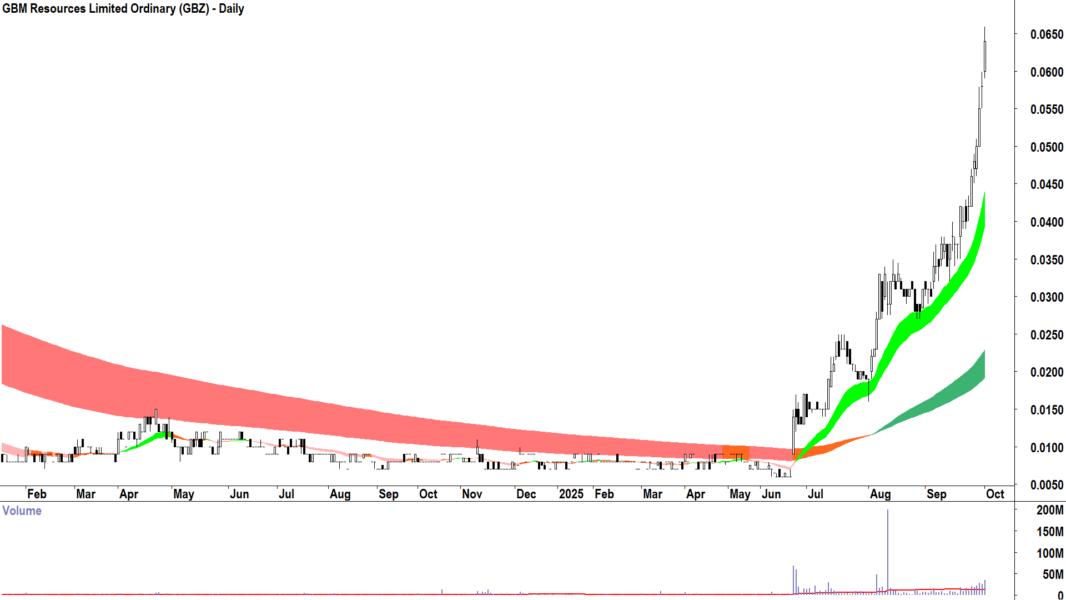

GBM Resources | GBZ | $0.064 | +106.5% | +540.0% |

Harvey Norman | HVN | $7.47 | +0.3% | +52.1% |

Iperionx | IPX | $7.70 | +8.6% | +168.3% |

Lindian Resources | LIN | $0.305 | +19.6% | +190.5% |

LTR Pharma | LTP | $0.720 | +35.8% | -58.6% |

Lynas Rare Earths | LYC | $17.00 | +18.5% | +120.8% |

Meeka Metals | MEK | $0.230 | +35.3% | +303.5% |

Minerals 260 | MI6 | $0.250 | +78.6% | +78.6% |

Monadelphous Group | MND | $22.76 | +7.9% | +79.5% |

Vaneck S&P/ASX Midcap ETF | MVE | $46.07 | +2.4% | +13.9% |

NRW | NWH | $4.69 | +16.1% | +35.9% |

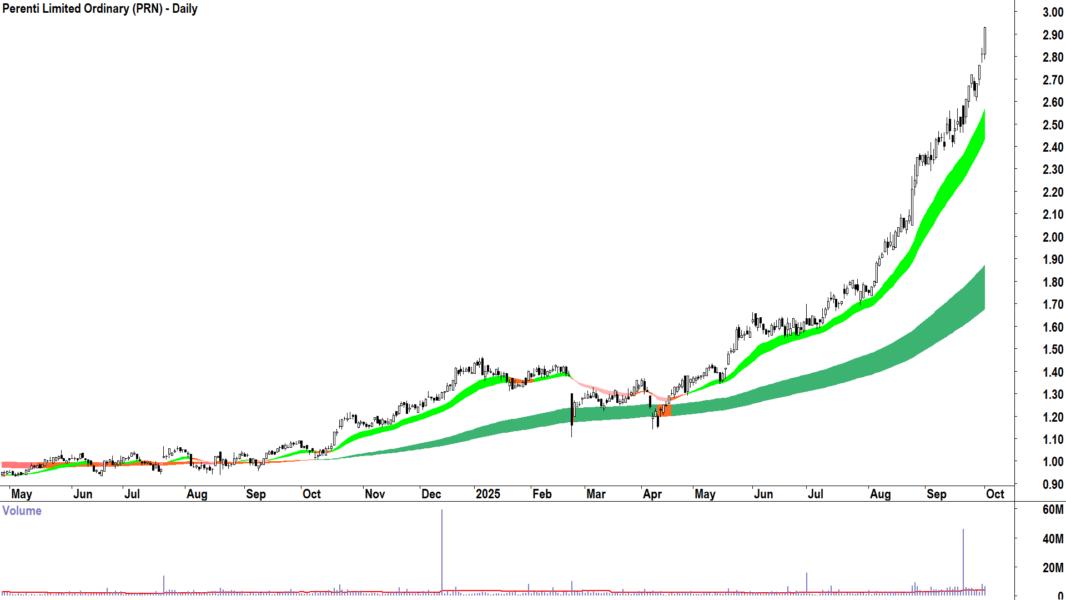

Perenti | PRN | $2.93 | +24.7% | +172.6% |

Qoria | QOR | $0.750 | +22.0% | +92.3% |

Regal Investment Fund | RF1 | $3.40 | +10.4% | +4.9% |

Ramelius Resources | RMS | $3.90 | +14.4% | +71.8% |

Resolute Mining | RSG | $1.050 | +46.9% | +38.2% |

Sandfire Resources | SFR | $14.50 | +17.3% | +35.8% |

Superloop | SLC | $3.55 | +23.7% | +110.1% |

Starpharma | SPL | $0.270 | +125.0% | +170.0% |

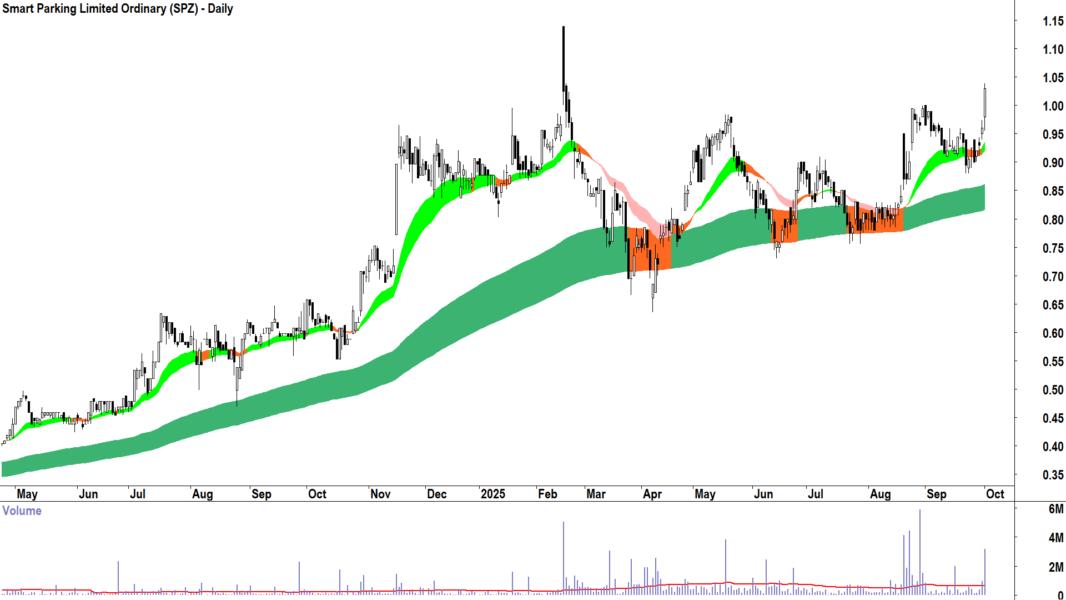

Smart Parking | SPZ | $1.030 | +4.0% | +70.9% |

Sunstone Metals | STM | $0.023 | +9.5% | +360.0% |

Southern Cross Gold | SX2 | $8.50 | +21.4% | 0% |

Southern Cross Electrical Engineering | SXE | $2.12 | +10.1% | +16.8% |

Terra Metals | TM1 | $0.180 | +102.2% | +429.4% |

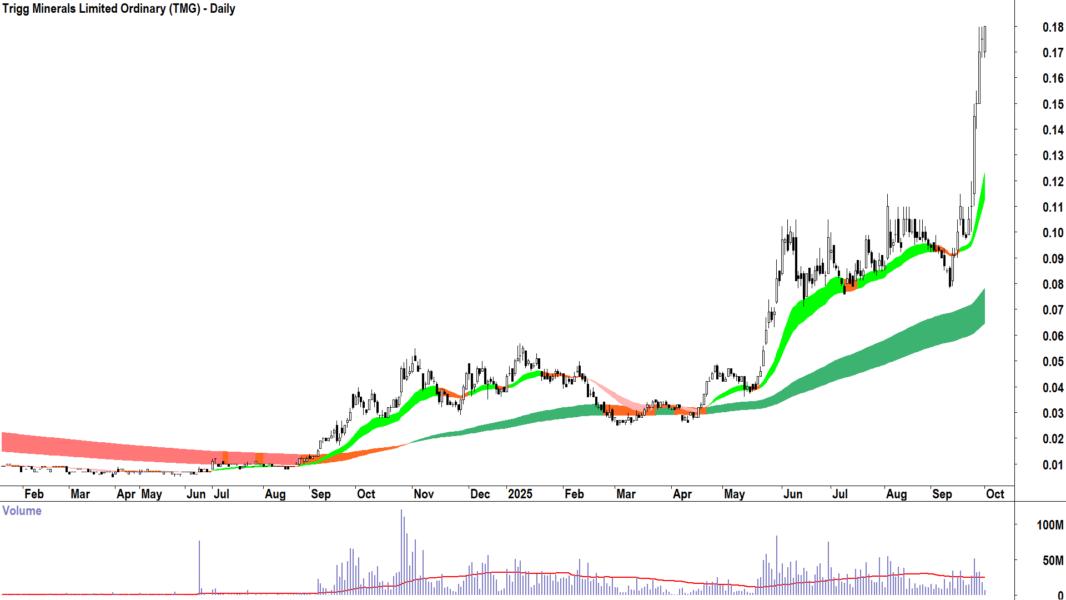

Trigg Minerals | TMG | $0.180 | +89.5% | +1700.0% |

Titomic | TTT | $0.315 | +31.3% | +152.0% |

Vanguard MSCI Australian Small Companies Index ETF | VSO | $77.17 | +3.3% | +10.2% |

Warriedar Resources | WA8 | $0.205 | +17.1% | +266.1% |

Weebit Nano | WBT | $3.37 | +28.1% | +81.2% |

Westgold Resources | WGX | $4.96 | +34.8% | +82.4% |

Waratah Minerals | WTM | $0.775 | +7.6% | +68.5% |

Yandal Resources | YRL | $0.360 | +152.6% | +200.0% |

Zip Co. | ZIP | $4.53 | +6.6% | +62.4% |

Zenith Minerals | ZNC | $0.145 | +137.7% | +190.0% |

Today's Uptrends Scan List

Feature Charts from today's Uptrends List 🔎📈

The stocks that I feel are showing the strongest excess demand from today's Uptrends List are: 4DMEDICAL 4DX, American Rare Earths

ARR, Austal

ASB, Bellevue Gold

BGL, Benz Mining Corp.

BNZ, Brazilian Rare Earths

BRE, Beetaloo Energy Australia

BTL, Capricorn Metals

CMM, Dyno Nobel

DNL, Droneshield

DRO, Dateline Resources

DTR, Duratec

DUR, Emyria

EMD, Electro Optic Systems

EOS, Focus Minerals

FML, Fleetwood

FWD, GBM Resources

GBZ, Harvey Norman

HVN, Lindian Resources

LIN, Lynas Rare Earths

LYC, Monadelphous Group

MND, Perenti

PRN, Qoria

QOR, Resolute Mining

RSG, Superloop

SLC, Starpharma

SPL, Smart Parking

SPZ, Southern Cross Gold

SX2, Southern Cross Electrical Engineering

SXE, Trigg Minerals

TMG, Westgold Resources

WGX, Yandal Resources

YRL.

10 Randomly chosen Feature Uptrend Charts:

Downtrends Scan List

Company | Code | Last Price | 1mo % | 1yr % |

|---|---|---|---|---|

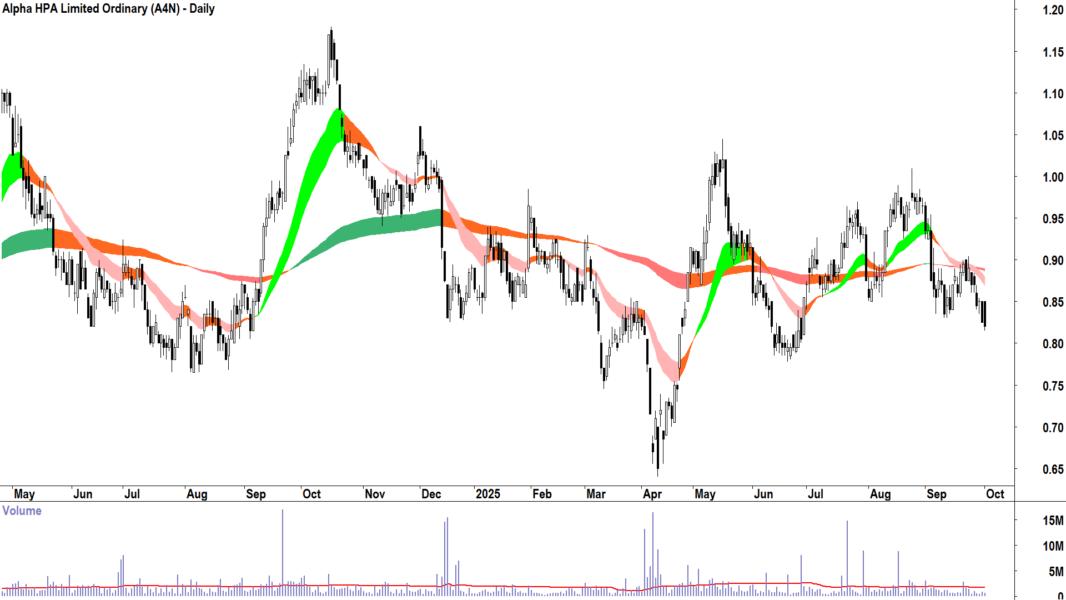

Alpha HPA | A4N | $0.820 | -12.3% | -24.8% |

Atlas Arteria | ALX | $4.84 | -8.2% | -1.2% |

Amcor | AMC | $12.31 | -6.5% | -25.0% |

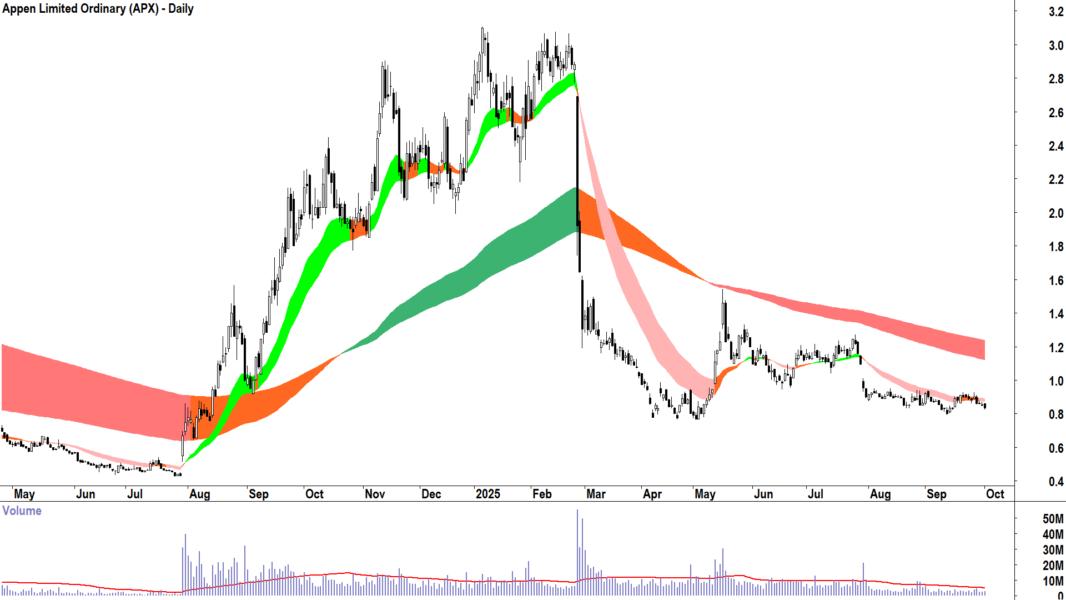

Appen | APX | $0.835 | -7.2% | -55.3% |

Brainchip | BRN | $0.195 | -2.5% | 0% |

CSL | CSL | $198.80 | -4.6% | -30.3% |

Domino's Pizza Enterprises | DMP | $13.25 | -8.7% | -61.4% |

Ebos Group | EBO | $26.16 | -10.9% | -20.7% |

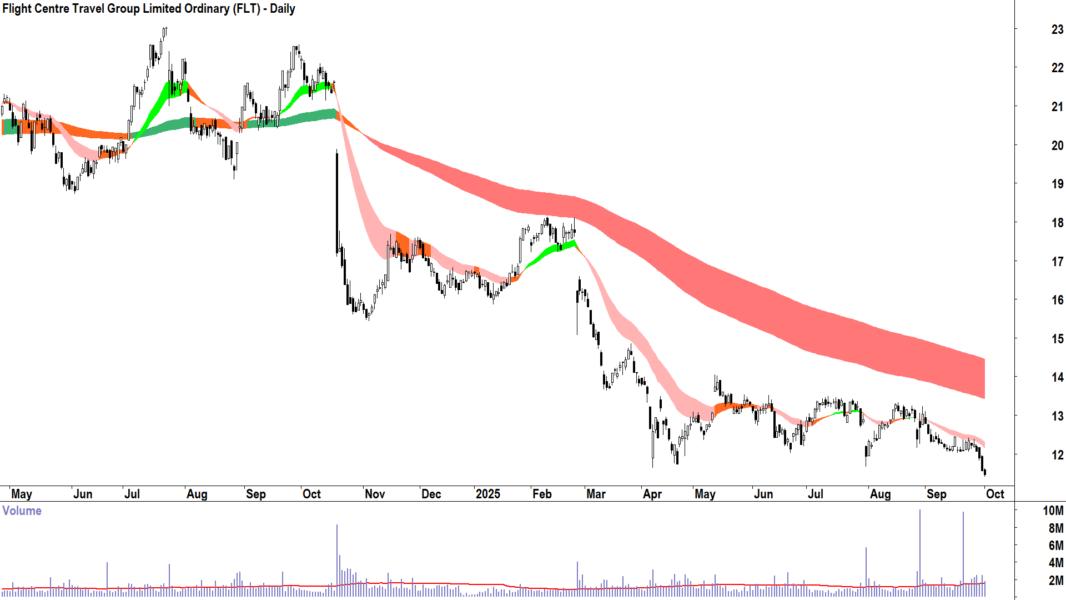

Flight Centre Travel | FLT | $11.47 | -8.5% | -48.9% |

Findi | FND | $3.31 | -7.0% | -16.2% |

Healthco Health & Wellness Reit | HCW | $0.700 | -11.4% | -38.6% |

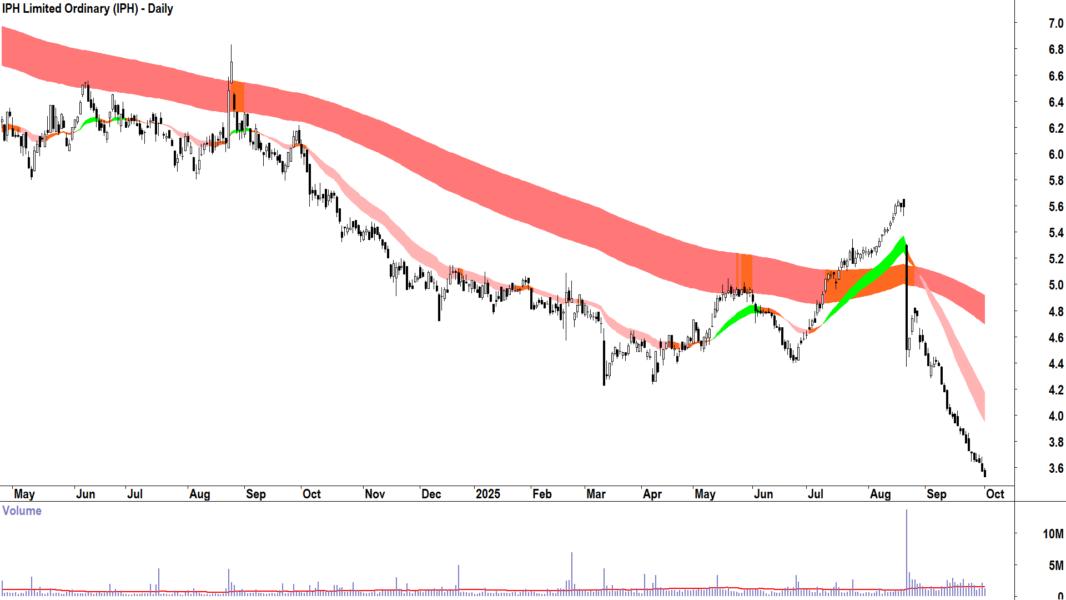

IPH | IPH | $3.53 | -19.4% | -42.8% |

Kogan.Com | KGN | $3.35 | -14.8% | -35.0% |

Lifestyle Communities | LIC | $5.40 | -2.2% | -33.5% |

Light & Wonder | LNW | $127.08 | -7.8% | -5.5% |

Nufarm | NUF | $2.28 | -5.0% | -42.6% |

Novonix | NVX | $0.440 | -18.5% | -30.2% |

Premier Investments | PMV | $19.24 | -11.9% | -17.8% |

Sims | SGM | $13.27 | -5.6% | +4.1% |

Star Entertainment | SGR | $0.089 | -15.2% | -82.4% |

Sonic Healthcare | SHL | $21.32 | -10.2% | -20.1% |

Supply Network | SNL | $34.16 | -5.2% | +13.2% |

Spark New Zealand | SPK | $2.05 | -12.4% | -28.3% |

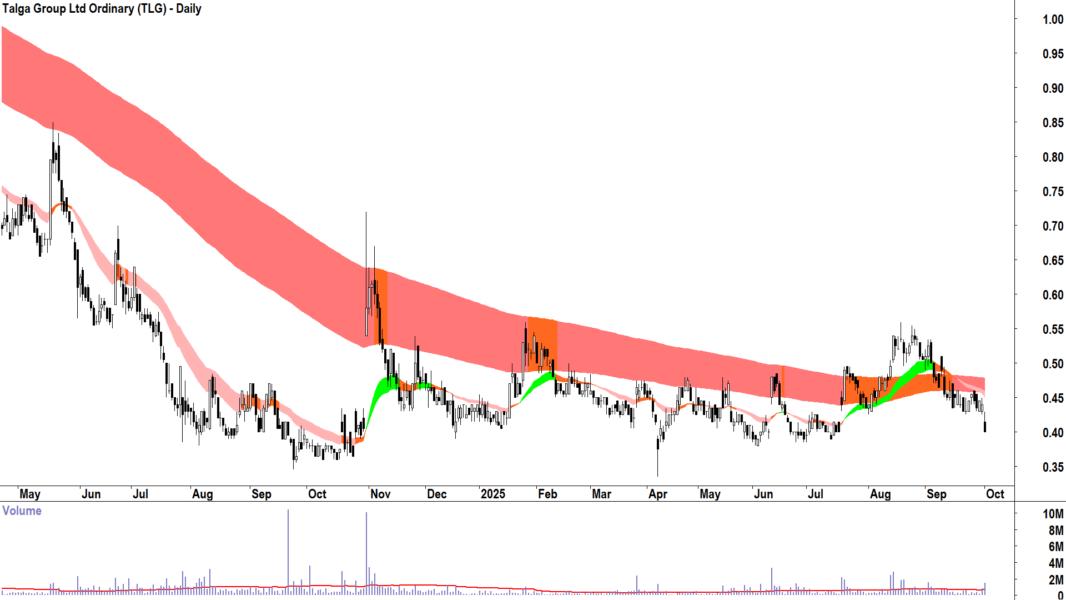

Talga Group | TLG | $0.400 | -23.8% | +9.6% |

Woolworths Group | WOW | $26.47 | -5.0% | -20.8% |

Today's Downtrends Scan List

Feature Charts from today's Downtrends List 🔎📉

The stocks that I feel are showing the strongest excess supply from today's Downtrends List are: Alpha HPA A4N, Appen

APX, Domino's Pizza Enterprises

DMP, Flight Centre Travel Group

FLT, IPH

IPH, Premier Investments

PMV, Sonic Healthcare

SHL, Talga Group

TLG, Woolworths Group

WOW.

Feature Downtrend Charts:

Important considerations when using the ChartWatch Daily ASX Scans:

1. The future is unknown. Anything can happen to change the trends in the lists above. A stock in a perfect uptrend or downtrend may not remain that way by the close of trading today. 2. These lists are not exhaustive, they are curated by Carl. You will find that certain stocks might not appear in a particular list on consecutive days but might reappear when Carl feels it deserves to return to the list. 3. This is not a recommendation service, merely an aid to help you better understand the workings of Carl’s technical analysis model in a practical way. Carl will not alert you to stocks that have dropped off a list because their trend has changed – it's up to you to apply the criteria to determine why a particular stock might not still be included. 4. This is general, educational information only – so always do your own research!!!