Evening Wrap: ASX 200 sets fresh record as Pilbara Minerals jumps 20%, Mineral Resources 12%, in lithium's big day out

The S&P/ASX 200 closed 37.7 points higher, up 0.43%.

The floodgates opened for lithium stocks today as markets responded to media reports that China's Contemporary Amperex Technology Co. (CATL) had suspended production at its large scale Jianxiawo operation in Jiangxi Provence for at least three months. CATL is the world's biggest producer of EV batteries, but it's also a major marginal lithium producer from its high cost Chinese lepidolite mines.

To make sense of all the above, I have detailed technical analysis on the Nasdaq Composite, S&P/ASX 200, and Gold in today's ChartWatch.

Be sure to click/scroll through for the usual reporting of the major sector and stock-specific moves, the broker responses to them, as well as all the key economic data in tonight's Evening Wrap.

Let's dive in!

Today in Review

Mon 11 Aug 25, 5:02pm (AEST)

| Name | Value | % Chg |

|---|---|---|

| Major Indices | ||

| ASX 200 | 8,844.8 | +0.43% |

| All Ords | 9,117.6 | +0.45% |

| Small Ords | 3,458.0 | +0.10% |

| All Tech | 4,202.7 | -0.63% |

| Emerging Companies | 2,496.6 | +1.04% |

| Currency | ||

| AUD/USD | 0.6526 | +0.06% |

| US Futures | ||

| S&P 500 | 6,425.5 | +0.19% |

| Dow Jones | 44,387.0 | +0.25% |

| Nasdaq | 23,748.5 | +0.15% |

| Name | Value | % Chg |

|---|---|---|

| Sector | ||

| Materials | 17,604.3 | +1.58% |

| Consumer Staples | 12,267.2 | +0.95% |

| Health Care | 44,311.0 | +0.55% |

| Financials | 9,396.0 | +0.43% |

| Energy | 9,356.0 | +0.41% |

| Industrials | 8,478.1 | +0.30% |

| Communication Services | 1,898.4 | +0.25% |

| Real Estate | 4,102.0 | +0.23% |

| Utilities | 9,843.8 | -0.19% |

| Information Technology | 2,982.4 | -0.73% |

| Consumer Discretionary | 4,333.9 | -1.63% |

Markets

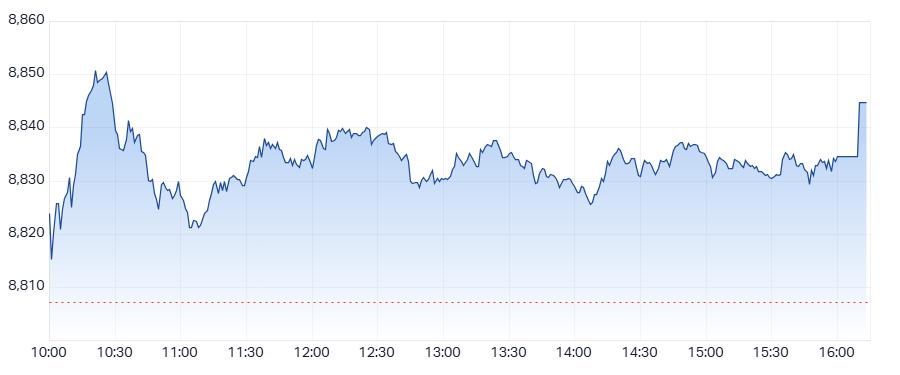

ASX 200 Session Chart

The S&P/ASX 200 (XJO) finished 37.7 points higher at 8,844.8, 0.34% from its session low and just 0.08% from its high. In the broader-based S&P/ASX 300 (XKO) advancers beat decliners by 149 to 128.

The floodgates opened for lithium stocks today as markets responded to media reports that China's Contemporary Amperex Technology Co. (CATL) had suspended production at its large scale Jianxiawo operation in Jiangxi Provence for at least three months. CATL is the world's biggest producer of EV batteries, but it's also a major marginal lithium producer from its high cost Chinese lepidolite mines.

Whilst likely only temporary, and with only a modest negative impact to supply expected from most brokers, a tinderbox of improving news (China's anti-involution push, today's announcement, and threats of other mine closures due to regulatory hurdles), improving sentiment (as reported here, lithium minerals prices have been steadily improving over the last 6-weeks), plus massive short positioning – all combined to trigger a major explosion in the share prices of most lithium stocks today.

I'll let you check the Movers section below for details.

The euphoria spread into other battery metals plays, and the prevailing run in rare earths / critical minerals stocks extended. What a great day to be an ASX mining stocks punter! 🥳

Outside of the above, 0.34% to the better overall... was a little yawn-worthy... but still a very solid session with 8 of the 11 major sectors rising.

Naturally, Resources (XJR) (+1.4%) topped the sector performance list, but a rally defensives like Consumer Staples (XSJ) (+1.0%), Healthcare (XHJ) (+0.6%), and Financials (XFJ) (+0.4%) helped balance losses in Consumer Discretionary (XDJ) (-1.6%), and Technology (XIJ) (-0.7%).

Those losses were largely single-stock related, as JB Hi-Fi (JBH) dropped over 8% after the market reacted poorly to its FY25 results, and Iress (IRE) dipped 7% on similarly poorly received half yearly results.

Today's best blue chip gainers

Company | Last Price | Change $ | Change % | 1mo % | 1yr % |

Pilbara Minerals (PLS) | $2.31 | +$0.38 | +19.7% | +49.0% | -22.5% |

Mineral Resources (MIN) | $38.12 | +$4.14 | +12.2% | +38.7% | -26.8% |

IGO (IGO) | $5.43 | +$0.43 | +8.6% | +18.0% | +4.0% |

IDP Education (IEL) | $4.56 | +$0.33 | +7.8% | +19.1% | -66.2% |

Light & Wonder (LNW) | $123.04 | +$4.29 | +3.6% | -19.1% | -21.6% |

Fortescue (FMG) | $19.42 | +$0.57 | +3.0% | +14.4% | +5.3% |

Ramsay Health Care (RHC) | $38.75 | +$1.08 | +2.9% | +2.3% | -11.5% |

Lynas Rare Earths (LYC) | $12.96 | +$0.34 | +2.7% | +34.0% | +117.8% |

Endeavour Group (EDV) | $4.12 | +$0.08 | +2.0% | -0.5% | -22.8% |

Westpac Banking (WBC) | $34.31 | +$0.65 | +1.9% | +1.5% | +24.2% |

James Hardie Industries (JHX) | $43.72 | +$0.82 | +1.9% | +1.9% | -13.1% |

South32 (S32) | $3.07 | +$0.05 | +1.7% | -1.3% | +6.6% |

BHP Group (BHP) | $40.87 | +$0.66 | +1.6% | +3.8% | -0.4% |

Woolworths Group (WOW) | $31.98 | +$0.47 | +1.5% | +2.8% | -3.8% |

Rio Tinto (RIO) | $115.29 | +$1.67 | +1.5% | +3.8% | -1.2% |

Today's worst blue chip losers

Company | Last Price | Change $ | Change % | 1mo % | 1yr % |

Block (XYZ) | $115.62 | -$11.47 | -9.0% | +11.5% | +31.9% |

JB HI-FI (JBH) | $107.83 | -$9.87 | -8.4% | -0.3% | +63.2% |

AMP (AMP) | $1.740 | -$0.135 | -7.2% | +19.2% | +54.0% |

Telix Pharmaceuticals (TLX) | $16.89 | -$0.75 | -4.3% | -29.9% | -4.7% |

Insurance Australia Group (IAG) | $8.18 | -$0.36 | -4.2% | -3.2% | +17.7% |

Suncorp Group (SUN) | $19.54 | -$0.78 | -3.8% | -4.6% | +22.9% |

Technology One (TNE) | $39.18 | -$1.15 | -2.9% | -0.8% | +89.0% |

Pinnacle Investment Management Group (PNI) | $23.32 | -$0.68 | -2.8% | +10.6% | +45.0% |

Wesfarmers (WES) | $88.61 | -$1.65 | -1.8% | +7.1% | +24.4% |

Northern Star Resources (NST) | $17.75 | -$0.33 | -1.8% | +9.2% | +25.4% |

QBE Insurance Group (QBE) | $21.00 | -$0.39 | -1.8% | -7.4% | +28.3% |

Challenger (CGF) | $8.21 | -$0.14 | -1.7% | +1.6% | +25.0% |

The A2 Milk Company (A2M) | $7.71 | -$0.13 | -1.7% | +5.8% | +16.1% |

Perseus Mining (PRU) | $3.52 | -$0.05 | -1.4% | -0.6% | +43.7% |

Xero (XRO) | $176.54 | -$2.29 | -1.3% | +1.6% | +38.0% |

Pro Medicus (PME) | $304.77 | -$3.73 | -1.2% | -4.0% | +144.6% |

ChartWatch

NASDAQ Composite Index

An interesting chart (click here for full size image)

The zebra run continued on Friday, albeit with acknowledgment Thursday’s black candle was modestly demand-side oriented 🦓.

Nonetheless, it capped a week where not one candle’s colour matched its predecessor’s. As is going to be the case from time to time – even in the best and strongest uptrends – like this one.

And that’s the message: One should carefully consider challenges to a prevailing strong trend, but ultimately, should assume that trend will prevail/continue.

The two candle combo of Thurs 31-Jul/Fri 1-Aug were in my opinion clear and credible supply-side showings, and warranted a raising of alert settings and refraining from the continued addition of long-side risk exposure (as mentioned here: “cool existing long exposure, refrain from adding new long exposure, and to be more open to some strategic shorts for protection”).

But, as the chart above shows... that’s all caution to the wind stuff.

There has so far been zero demonstration of excess supply in the system at 21458. If anything, only total demand-side control in Friday’s white-bodied candle.

Volume throughout has been neither here nor there – roughly average on the sell down, and below average on the rally. Basically, neither side appears overly committed (it is summer holidays in the USA).

But in the vacuum of that commitment, prices are more often than not to favour the “default setting”. And that default setting was never really in question…

Conclusion: With Friday’s move, the Comp has all but nullified the 31-Jul/1-Aug supply-side threat. I’m still going to watchful for any supply-side candles that may pop up around here (21458), but I’m happy in the meantime to return to full risk position (“FRP”) settings here.

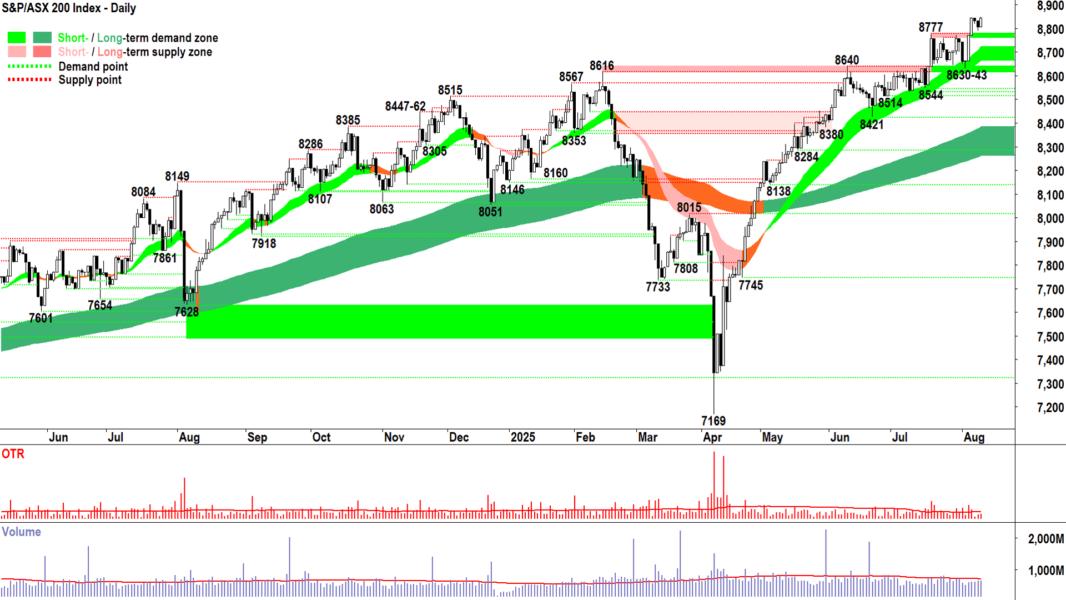

S&P/ASX 200 (XJO)

An interesting chart (click here for full size image)

Where there might have been a sliver of a doubt on the Comp since 31-Jul, there has been nothing but faith in the short and long term uptrends here.

And today’s modest-but-clear-demand-side showing, and record close, is reward for the faithful.

The XJO chart, ahem, the Golden Le Creuset chart, is a picture of demand-side control. Even how today’s candle with its higher high and higher low sets Friday’s low as a trough above the 8760-8777 demand zone (the shallower the pullback, the greater the excess demand in the system!).

But that’s just one of many, many things I like about this chart. And until there’s quite a few more things I don’t like about it, it’s very much stay the course for me here. FRP.

Economy

Today

There weren't any major economic data releases in our time zone today

Later this week

Tuesday

14:30 AUS RBA Cash Rate and Monetary Policy Statement

Cash Rate: -0.25% to 3.60% forecast

15:30 AUS RBA Governor Michelle Bullock press conference

22:30 USA Core Consumer Price Index (CPI) July (+0.3% m/m and +3.0% p.a. forecast vs +0.2% m/m and +2.9% p.a. in June)

Wednesday

11:30 AUS Wage Price Index June Quarter (+0.8% q/q forecast vs +0.9% q/q in March)

Thursday

11:30 AUS Employment Data July

Employment change: +25,300 forecast vs +2,000 in June

Unemployment rate: 4.2% forecast vs 4.3% in June

22:30 USA Core Producer Price Index (PPI) July (+0.2% m/m forecast vs +0.0% m/m in June)

Friday

12:00 CHN China Data Dump July

New Home Prices m/m

Industrial Production y/y: +6.0% p.a. forecast vs +6.8% p.a. in June

Retail Sales y/y: +4.6% p.a. forecast vs +4.8% p.a. in June

Fixed Asset Investment ytd/y: +2.7% ytd/y forecast vs +2.8% ytd/y in June

Unemployment Rate: +5.1% forecast vs +5.0% previous

22:30 USA Core Retail Sales July (+0.3% m/m forecast vs +0.5% m/m in June)

Saturday

00:00 USA Prelim UoM Consumer Sentiment August (61.9 forecast vs 61.7 in July)

Latest News

Reporting Season jbh

JB Hi-Fi earnings are up. So why is the stock getting smashed?

Mon 11 Aug 25, 2:52pm (AEST)

Data Insights apx bap

The 10 most shorted ASX stocks plus the biggest risers and fallers – Week 33

Mon 11 Aug 25, 1:35pm (AEST)

Data Insights alq amp

ASX 200 stocks hitting fresh 52-week highs and lows – Week 33

Mon 11 Aug 25, 11:53am (AEST)

Market Wraps

ASX 200 Live Today - Monday, 11th August

Mon 11 Aug 25, 11:01am (AEST)

Technical Analysis

ChartWatch ASX Scans: Trying to pick the low of beaten down ASX mining stocks!

Mon 11 Aug 25, 9:00am (AEST)

Market Wraps

Morning Wrap: ASX 200 futures flat, Nasdaq hits record high as Apple shares surge + JB Hi-Fi, Car Group earnings

Mon 11 Aug 25, 8:22am (AEST)

More News

Interesting Movers

Trading higher

+67.3% Energy Transition Minerals (ETM) - Retraction of In-Ground Value and Board Changes.

+36.4% Eclipse Metals (EPM) - No news 🤔, rise is consistent with prevailing short and long term uptrends 🔎📈

+22.2% Many Peaks Minerals (MPK) - High-Grade Gold in Deeper Delineation Drilling at Ferke, rise is consistent with prevailing short and long term uptrends 🔎📈

+21.7% Ioneer (INR) - No news, general strength across the broader Lithium sector today, Benchmark lithium futures were limit up (+8%) in China today on news over the weekend that major lithium producer and consumer CATL will be suspending operations at its Jianxiawo mines.

+19.7% Pilbara Minerals (PLS) - No news, general strength across the broader Lithium sector today, rise is consistent with prevailing short term uptrend and rising peaks and rising troughs 🔎📈

+18.3% Liontown Resources (LTR) - No news, general strength across the broader Lithium sector today, rise is consistent with prevailing short term uptrend and long term trend is transitioning from down to up 🔎📈

+15.0% Core Lithium (CXO) - No news, general strength across the broader Lithium sector today.

+14.6% Novonix (NVX) - No news, general strength across the broader Lithium sector today.

+13.3% Coronado Global Resources (CRN) - No news, China anti-involution theme rampant!

+12.9% 4DMEDICAL (4DX) - Continued positive response to 31-Jul 4DMedical secures $10m strategic investment from Pro Medicus, rise is consistent with prevailing short term uptrend and long term trend is transitioning from down to up 🔎📈

+12.8% Victory Metals (VTM) - Updated MRE Identifies HREO/TREO Ratios Up To 83%, general strength across the broader Rare Earths & Critical Minerals sector today, rise is consistent with prevailing short and long term uptrends, a regular in ChartWatch ASX Scans Uptrends list 🔎📈

+12.2% Mineral Resources (MIN) - Becoming a substantial holder, general strength across the broader Lithium sector today, rise is consistent with prevailing short term uptrend and long term trend is transitioning from down to up, a recent regular in ChartWatch ASX Scans Uptrends list 🔎📈

+12.0% Dateline Resources (DTR) - REE Target Found Beneath Fenite Outcrops, general strength across the broader Rare Earths & Critical Minerals sector today.

+10.7% Galan Lithium (GLN) - No news, general strength across the broader Lithium sector today, rise is consistent with prevailing short term uptrend and long term trend is transitioning from down to up 🔎📈

+9.4% St Barbara (SBM) - No news 🤔.

+9.1% DigiCo REIT (DGT) - SYD1 Data Centre Receives HCF Strategic Certification.

+8.6% IGO (IGO) - No news, general strength across the broader Lithium sector today, rise is consistent with prevailing short term uptrend and long term trend is transitioning from down to up, a recent regular in ChartWatch ASX Scans Uptrends list 🔎📈

+8.2% Digitalx (DCC) - Strategic Intention to Expand Bitcoin Holdings, Major cryptos up over the weekend….

+8.1% American Rare Earths (ARR) - No news, general strength across the broader Rare Earths & Critical Minerals sector today.

+8.1% Vulcan Energy Resources (VUL) - No news, general strength across the broader Lithium sector today.

+7.7% Sayona Mining (SYA) - No news, general strength across the broader Lithium sector today.

Trading lower

-9.0% Block (XYZ) - Quarterly Report for the Quarter Ended June 30, stock was up here on Friday after results, but got pasted on Friday night in New York….

-8.4% JB HI-FI (JBH) - Results Presentation - 2025 Full Year Results and Group CEO Transition.

-7.5% Cygnus Metals (CY5) - No news, fall is consistent with prevailing short and long term downtrends 🔎📉

-7.2% Iress (IRE) - FY25 Half Year Results Presentation and FY25 Half Year Report.

-7.2% AMP (AMP) - No news since 07-Aug ASX AMP Appendix 4D and 2025 Half Year Report, pulled back in the wake of recent sharp rally.

-6.5% MTM Critical Metals (MTM) - No news 🤔.

-6.4% Avita Medical (AVH) - Continued negative response to 08-Nov AVITA second quarter 2025 financial and business update, fall is consistent with prevailing short and long term downtrends, a regular in ChartWatch ASX Scans Downtrends list 🔎📉

-4.9% PYC Therapeutics (PYC) - No news 🤔.

-4.3% WEB Travel Group (WEB) - No news, fall is consistent with prevailing short and long term downtrends, a regular in ChartWatch ASX Scans Downtrends list 🔎📉

-4.3% Telix Pharmaceuticals (TLX) - Continued negative response to 05-Aug Historical Financials in USD and H12025 OPEX, fall is consistent with prevailing short term downtrend and long term trend is transitioning from up to down, a regular in ChartWatch ASX Scans Downtrends list 🔎📉

-4.2% Insurance Australia Group (IAG) - No news, general weakness across the broader Insurance sector today, Insurance stocks have had a tough couple of sessions since QBE's earnings miss….

-3.8% Suncorp Group (SUN) - No news, general weakness across the broader Insurance sector today.

Broker Moves

Life360 Inc (360)

Retained at Buy at Citi; Price Target: $46.20

Adrad Holdings (AHL)

Retained at Buy at Bell Potter; Price Target: $1.05

Amcor Plc (AMC)

Retained at Buy at UBS; Price Target: $18.25

ANZ Group Holdings (ANZ)

Retained at Sell at UBS; Price Target: $26.50

ARB Corporation (ARB)

Upgraded to Neutral from Sell at UBS; Price Target: $35.00 from $31.00

AUB Group (AUB)

Retained at Neutral at UBS; Price Target: $36.00

Bendigo and Adelaide Bank (BEN)

Retained at Neutral at UBS; Price Target: $11.00

Bega Cheese (BGA)

Retained at Outperform at Macquarie; Price Target: $6.40

BHP Group (BHP)

Retained at Overweight at Morgan Stanley; Price Target: $48.35 from $43.50

Retained at Neutral at UBS; Price Target: $40.00

Bank of Queensland (BOQ)

Retained at Sell at UBS; Price Target: $6.50

Breville Group (BRG)

Retained at Outperform at Macquarie; Price Target: $40.20

CAR Group (CAR)

Retained at Buy at Citi; Price Target: $42.85 from $42.60

Charter Hall Group (CHC)

Retained at Buy at Citi; Price Target: $22.50

Collins Foods (CKF)

Retained at Neutral at Macquarie; Price Target: $8.50

Coles Group (COL)

Retained at Outperform at Macquarie; Price Target: $24.10

COSOL (COS)

Retained at Buy at Bell Potter; Price Target: $0.80 from $0.90

Retained at Buy at Ord Minnett; Price Target: $1.05 from $1.12

Charter Hall Retail REIT (CQR)

Retained at Buy at Citi; Price Target: $4.20

Domino's Pizza Enterprises (DMP)

Retained at Neutral at Macquarie; Price Target: $18.40

Endeavour Group (EDV)

Retained at Underperform at Macquarie; Price Target: $3.80

Elders (ELD)

Retained at Buy at Bell Potter; Price Target: $9.45 from $9.10

Fortescue (FMG)

Retained at Overweight at Morgan Stanley; Price Target: $20.65 from $19.40

GQG Partners Inc. (GQG)

Retained at Outperform at Macquarie; Price Target: $2.64 from $2.90

Retained at Buy at UBS; Price Target: $2.35 from $2.65

Harvey Norman Holdings (HVN)

Retained at Outperform at Macquarie; Price Target: $5.90

Insurance Australia Group (IAG)

Retained at Neutral at Macquarie; Price Target: $9.20

Retained at Buy at UBS; Price Target: $9.50 from $9.30

IGO (IGO)

Retained at Neutral at Citi; Price Target: $4.10

Iluka Resources (ILU)

Retained at Overweight at Morgan Stanley; Price Target: $6.00 from $6.05

Imdex (IMD)

Retained at Neutral at Citi; Price Target: $3.15 from $2.80

Inghams Group (ING)

Retained at Neutral at Macquarie; Price Target: $3.70

JB Hi-Fi (JBH)

Retained at Buy at Citi; Price Target: $120.00

Retained at Neutral at Macquarie; Price Target: $112.00

Judo Capital Holdings (JDO)

Retained at Buy at UBS; Price Target: $2.20

James Hardie Industries Plc (JHX)

Retained at Buy at Jefferies; Price Target: $34.00 from $63.00

Mader Group (MAD)

Retained at Buy at Bell Potter; Price Target: $9.00 from $6.70

Mineral Resources (MIN)

Retained at Neutral at Citi; Price Target: $31.00 from $20.00

Retained at Overweight at Morgan Stanley; Price Target: $49.15 from $37.50

Medallion Metals (MM8)

Retained at Speculative buy at Canaccord Genuity; Price Target: $0.80 from $0.65

Medibank Private (MPL)

Retained at Neutral at UBS; Price Target: $5.45

Macquarie Group (MQG)

Retained at Neutral at UBS; Price Target: $225.00

Metcash (MTS)

Retained at Neutral at Macquarie; Price Target: $4.00

National Australia Bank (NAB)

Retained at Neutral at UBS; Price Target: $37.50

Nick Scali (NCK)

Retained at Buy at Citi; Price Target: $24.40 from $20.64

Upgraded to Outperform from Hold at CLSA; Price Target: $22.30 from $16.40

Upgraded to Overweight from Neutral at Jarden; Price Target: $20.68 from $17.71

Retained at Buy at Jefferies; Price Target: $23.50 from $22.00

Retained at Overweight at JPMorgan; Price Target: $21.50 from $19.50

Retained at Outperform at Macquarie; Price Target: $21.90 from $19.90

Retained at Outperform at Macquarie; Price Target: $19.90

Upgraded to Lighten from Sell at Ord Minnett; Price Target: $18.00 from $16.00

Retained at Market-weight at Wilsons; Price Target: $20.40 from $19.20

Newmont Corporation (NEM)

Retained at Buy at UBS; Price Target: $110.00

NIB Holdings (NHF)

Retained at Buy at UBS; Price Target: $7.85

NRW Holdings (NWH)

Retained at Buy at Citi; Price Target: $3.65

Orora (ORA)

Retained at Neutral at UBS; Price Target: $2.10

Pointsbet Holdings (PBH)

Retained at Hold at Bell Potter; Price Target: $1.25 from $1.20

Pilbara Minerals (PLS)

Retained at Neutral at Citi; Price Target: $1.80

Premier Investments (PMV)

Retained at Neutral at Macquarie; Price Target: $21.80

QBE Insurance Group (QBE)

Retained at Hold at Bell Potter; Price Target: $21.20 from $21.40

Retained at Neutral at Macquarie; Price Target: $23.30 from $23.00

Retained at Overweight at Morgan Stanley; Price Target: $25.00 from $24.80

Retained at Hold at Ord Minnett; Price Target: $25.50

Retained at Buy at UBS; Price Target: $25.00 from $26.00

Rio Tinto (RIO)

Retained at Equal-weight at Morgan Stanley; Price Target: $123.50 from $118.00

Retained at Neutral at UBS; Price Target: $115.00

Steadfast Group (SDF)

Retained at Buy at UBS; Price Target: $6.85

Sandfire Resources (SFR)

Retained at Buy at UBS; Price Target: $13.35

Sigma Healthcare (SIG)

Retained at Underperform at Macquarie; Price Target: $2.60

Super Retail Group (SUL)

Retained at Neutral at Macquarie; Price Target: $14.10 from $11.00

Suncorp Group (SUN)

Retained at Neutral at Macquarie; Price Target: $19.60

Retained at Neutral at UBS; Price Target: $22.50

Temple & Webster Group (TPW)

Retained at Outperform at Macquarie; Price Target: $17.60

Tesoro Gold (TSO)

Retained at Speculative Buy at Morgans; Price Target: $0.15 from $0.11

Tuas (TUA)

Retained at Buy at Citi; Price Target: $7.10

Universal Store Holdings (UNI)

Retained at Outperform at Macquarie; Price Target: $9.80

West African Resources (WAF)

Retained at Outperform at Macquarie; Price Target: $3.40 from $3.30

Scans

Top Gainers

| Code | Company | Last | % Chg |

|---|---|---|---|

| ETM | Energy Transition... | $0.092 | +67.27% |

| DAL | Dalaroo Metals Ltd | $0.036 | +44.00% |

| EPM | Eclipse Metals Ltd | $0.03 | +36.36% |

| BEL | Bentley Capital Ltd | $0.016 | +33.33% |

| AGY | Argosy Minerals Ltd | $0.037 | +27.59% |

View all top gainers

Top Fallers

| Code | Company | Last | % Chg |

|---|---|---|---|

| SNT | Syntara Ltd | $0.027 | -52.63% |

| BUX | Buxton Resources Ltd | $0.029 | -30.95% |

| WEC | White Energy Comp... | $0.028 | -30.00% |

| OLH | Oldfields Holding... | $0.02 | -23.08% |

| HTG | Harvest Technolog... | $0.015 | -16.67% |

View all top fallers

52 Week Highs

| Code | Company | Last | % Chg |

|---|---|---|---|

| ETM | Energy Transition... | $0.092 | +67.27% |

| EPM | Eclipse Metals Ltd | $0.03 | +36.36% |

| LKY | Locksley Resource... | $0.23 | +24.32% |

| BCN | Beacon Minerals Ltd | $1.60 | +23.55% |

| MPK | Many Peaks Minera... | $0.88 | +22.22% |

View all 52 week highs

52 Week Lows

| Code | Company | Last | % Chg |

|---|---|---|---|

| SNT | Syntara Ltd | $0.027 | -52.63% |

| WEC | White Energy Comp... | $0.028 | -30.00% |

| MGT | Magnetite Mines Ltd | $0.07 | -9.09% |

| RIM | Rimfire Pacific M... | $0.012 | -7.69% |

| TAS | Tasman Resources Ltd | $0.013 | -7.14% |

View all 52 week lows

Near Highs

| Code | Company | Last | % Chg |

|---|---|---|---|

| FASI | Fidelity Asia Act... | $11.17 | -0.62% |

| APE | Eagers Automotive... | $20.46 | -0.92% |

| SMLL | Betashares Austra... | $3.89 | 0.00% |

| ECF | Elanor Commercial... | $0.68 | 0.00% |

| LKY | Locksley Resource... | $0.23 | +24.32% |

View all near highs

Relative Strength Index (RSI) Oversold

| Code | Company | Last | % Chg |

|---|---|---|---|

| ASX | ASX Ltd | $64.63 | +0.12% |

| MHK | Metal Hawk Ltd | $0.175 | 0.00% |

| BOE | Boss Energy Ltd | $1.835 | +1.10% |

| BUGG | Global X Cybersec... | $12.07 | -1.23% |

| GTK | Gentrack Group Ltd | $9.02 | -0.99% |

View all RSI oversold