Coles at record highs, Woolworths near 6-year lows: Why "expensive" might still be right

- Coles has outperformed Woolworths for the first time in nearly a decade, with shares hitting all-time highs while Woolworths trades near 2019 lows, signaling what Morgan Stanley believes is a structural rather than cyclical shift.

- Woolworths faces an expensive turnaround requiring potentially $200 million in price investment for FY26 just to achieve 3% same-store sales growth, double what Coles spent in FY25, creating significant earnings downgrade risk.

- Coles benefits from multiple structural advantages including supply chain automation, better promotional alignment with consumer preferences, and superior margin expansion prospects of 50 basis points versus Woolworths' 10 basis points.

For the first time in nearly a decade, Coles COL has sustained sales momentum over Woolworths, signalling what Morgan Stanley analysts believe represents a fundamental change in Australia's supermarket landscape rather than a temporary blip.

The FY25 results of the two supermarket giants delivered dramatically different outcomes, with Coles smashing analyst expectations while Woolworths broadly missed across key metrics. The share price reaction also tell a similar story. Last month, Coles shares rallied 15.1% to all-time highs while Woolworths tanked 8.6% to trade near the lowest levels since June 2019.

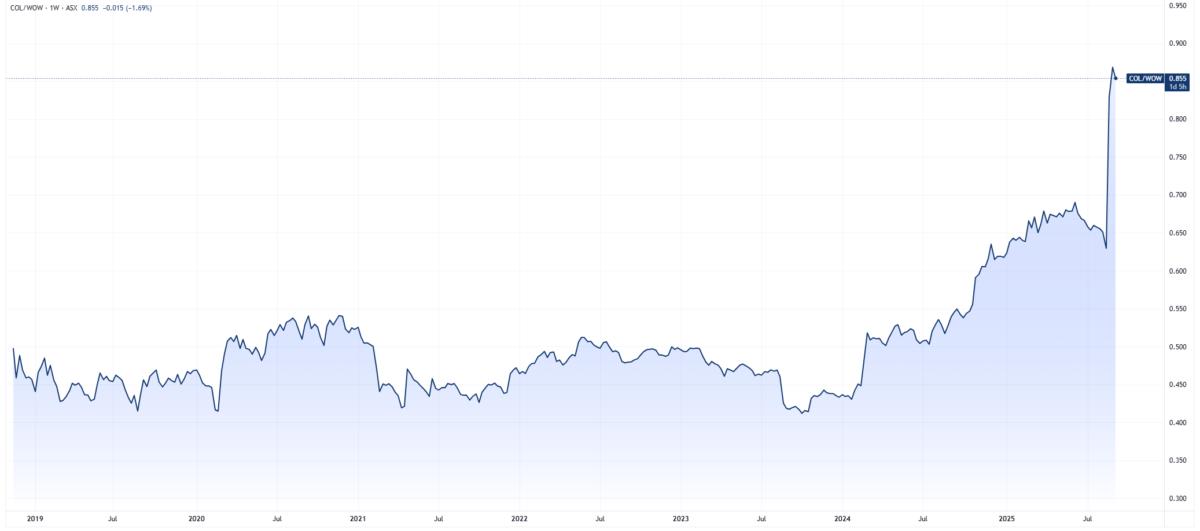

This performance gap represents uncharted territory. Since Coles' ASX debut in November 2019 following its demerger from Wesfarmers, its share price has never traded at such a premium relative to Woolworths. The chart below shows both stocks moved largely in tandem from 2019 to 2024, but Coles began pulling ahead in mid-2024 and that divergence has only accelerated in 2025.

Coles vs. Woolworths share price chart (Source; TradingView)

Morgan Stanley's assessment was rather straightforward: "the prospect of turning around sluggish sales is a costly and likely medium-to-long-dated process for Woolworths," with potential for more downgrades before any meaningful improvements emerge. Even after Coles' substantial rally, the analysts maintain their preference for the stock, pointing to its lower-risk earnings growth outlook and superior margin profile.

eCommerce gap offers major growth runway

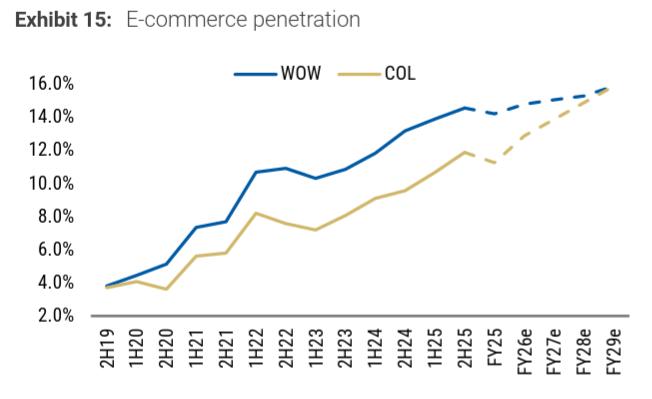

E-commerce presents the clearest growth opportunity, with Coles lagging Woolworths by roughly 20% in penetration rates. Morgan Stanley estimates that closing this gap over four to five years could deliver an additional 80 basis points of annual sales growth, which appears achievable given recent customer acquisition trends and new distribution centre capacity.

Source: Morgan Stanley Research

Promotional strategy paying dividends

Morgan Stanley's proprietary consumer survey shows Coles has aligned its promotional approach with what shoppers actually want. About 35% of consumers prefer percentage discounts on individual items over other promotional formats, matching the strategy Coles adopted in FY25 when it narrowed its promotional range but offered deeper discounts.

This strategic shift comes at an opportune time, coinciding with growing demand for private label products. Half of survey respondents reported increased private label purchases over the past 6-12 months, and Coles has capitalised by building private label penetration to approximately 35% versus Woolworths' 30%. This helps defend against discount competitors like Aldi by narrowing the basket cost gap.

Woolworths faces costly turnaround

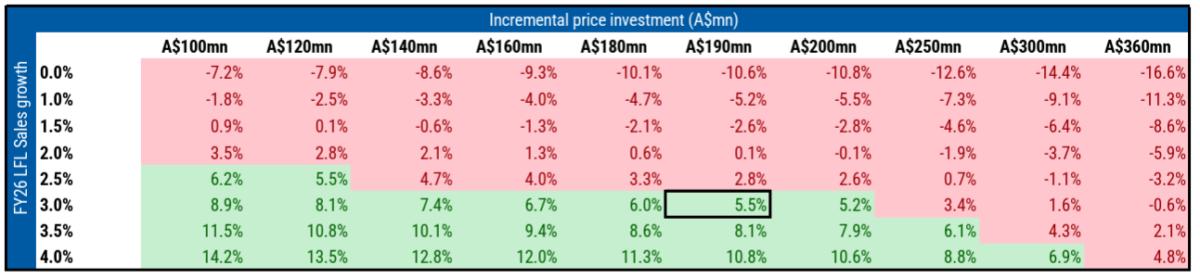

The analysts suggest Woolworths needs to spend significantly more than its current guidance of "above $100 million" in price investment to regain sales momentum. The estimates show that Coles spent around $100 million on incremental price investment in FY25, implying Woolworths may need to invest $200 million in FY26 just to achieve 3% same-store sales growth.

Woolworths Australian Food EBIT growth sensitivity to incremental price investment and LFL sales growth (Source: Morgan Stanley Research)

Even with such investment, consensus forecasts may prove optimistic. Current estimates assume Woolworths can achieve modest sales growth with only $100-150 million in price investment, which could set up potential earnings downgrades if the competitive reality proves more expensive.

Margin expansion divergence ahead

The competitive dynamics are reshaping profit trajectories. Morgan Stanley forecasts Coles will expand EBIT margins by 50 basis points in FY26 compared to just 10 basis points for Woolworths. This reflects Coles' supply chain efficiency gains, stronger sales leverage, and the removal of implementation costs as major capital programs complete.

By contrast, Woolworths faces multiple headwinds from higher price investment requirements, smaller-scale productivity programs, and ongoing system replacement costs.

Coles is also positioned to accelerate store expansion as its major capital works programs near completion. The company targets net space growth above 1.5% annually versus Woolworths' more modest 1% expansion rate, creating an additional 0.5% annual sales growth tailwind for Coles.

The bottom line

The research report positions this as a structural rather than cyclical shift, with Coles benefiting from supply chain automation, sharper pricing strategies, and operational simplification while Woolworths confronts a costly and potentially lengthy turnaround process.

For Woolworths, the path back to competitive parity appears both expensive and uncertain. The company faces significant downgrade risk if the investment required exceeds current estimates, and while its valuation has already de-rated, further consensus downgrades remain possible if sales momentum fails to improve despite increased spending.

While Woolworths may appear oversold and Coles expensive on the surface, Morgan Stanley's analysis suggests backing the structural winner remains the smarter play.