Axis Bank Q1 Preview: NII, profit to grow in low single-digits as loan growth slows, margins shrink

India’s third-largest private lender, Axis Bank, is expected to deliver a muted performance for the January to March quarter (Q4FY25), weighed down by slow loan growth and weak margins. The bank is set to announce its quarterly results on July 17, 2025.

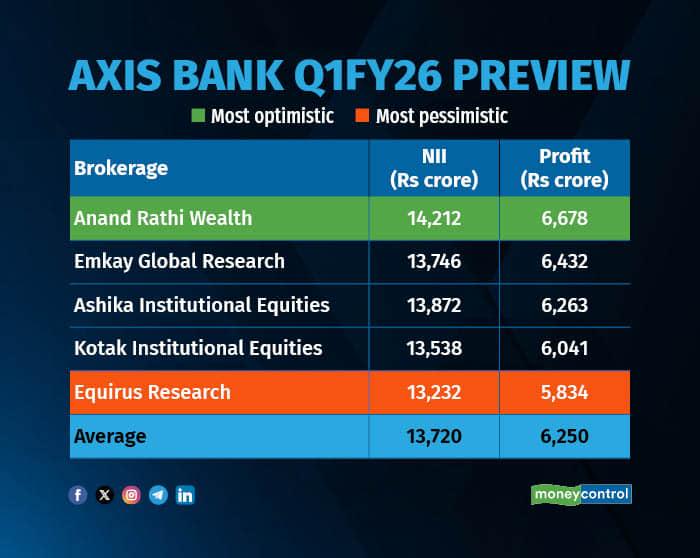

According to Moneycontrol's poll, Axis Bank’s net interest income (NII) is estimated to rise just 2 percent year-on-year, reaching Rs 13,720 crore in Q1FY26, compared to Rs 13,448 crore in the same period last year. The bank’s profit after tax (PAT) is also projected to see a modest 3.5 percent growth, to about Rs 6,250 crore, up from Rs 6,034 crore a year ago.

Estimates of analysts polled by Moneycontrol are shown to be in a narrow range, meaning any positive or negative surprises may elicit a sharp reaction in the stock price. Among the brokerages polled, Anand Rathi rolled out the most bullish projections while Equirus Research forecasted the slowest growth for Axis Bank.

What factors are driving the earnings?

Sluggish loan growth: According to Kotak analysts, Axis Bank’s loan growth is expected to come in at 7 percent year-on-year for the June quarter and remain flat compared to the previous quarter. Fee income is also likely to stay weak because of the slow pace of loan growth.

Margin pressure: Brokerages expect Axis Bank’s net interest margin (NIM) to contract by as much as 32 basis points year-on-year, dropping to about 3.5 percent in Q1FY26 from 3.8 percent a year ago. This is largely because around 72 percent of the bank’s loans are on floating rates, meaning their interest rates adjust quickly to RBI’s rate cuts — which can hurt earnings if deposit costs don’t fall as fast.

Rising slippages: Analysts at Kotak estimate slippages of around Rs 6,000 crore (about 2.3 percent of loans) this quarter, led largely by the retail segment and loan loss provisions (LLP) of about 90 basis points. Investors are expected to focus on updates regarding slippages — especially from the unsecured segment — along with deposit mobilisation and margin progression.

What should investors keep an eye on this quarter?

Investors are expected to focus on deposit growth, loan growth, and margin trends to gauge the bank’s health going forward.

During the April–June period, Axis Bank’s stock gained about 9 percent, roughly in line with the Nifty 50 index, which rose 8.5 percent over the same time.Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.