Maruti Suzuki Q1 Preview: Net profit to decline on high ad spends, negative operating leverage

New Delhi-headquartered Maruti Suzuki India Limited is set to release its earnings report for the first fiscal quarter of FY26 on July 31. Analysts expect a marginal uptick in revenue, aided by a slight rise in volumes and a higher average selling price. However, margins are likely to come under tremendous pressure during the quarter.

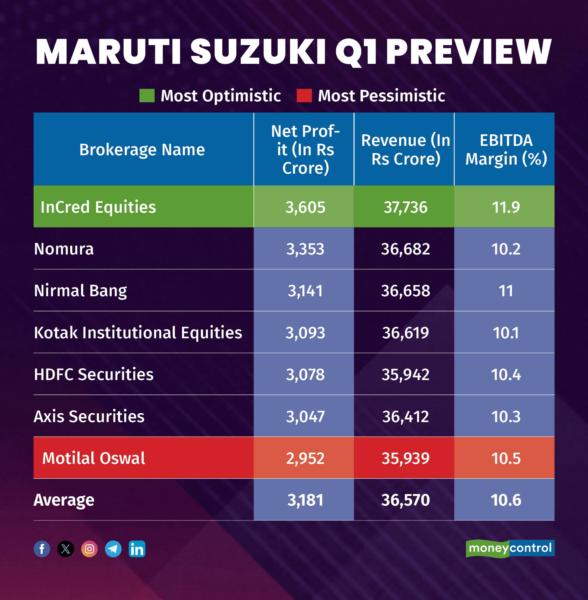

According to a Moneycontrol poll of seven brokerage firms, the Wagon-R maker is anticipated to record a 2.9 percent year-on-year increase in revenue, reaching Rs 36,570 crore. Net profit is projected to witness a steep 13 percent dip to Rs 3,181 crore from Rs 3,650 crore in the same quarter of the previous fiscal year.

Earnings estimates from analysts polled by Moneycontrol are in a diverse range, indicating that any positive or negative surprises could trigger a sharp reaction in the stock price. Most optimistic brokerage -- InCred Equities -- has forecasted a 1.2 percent decline in net profit. On the flipside, Motilal Oswal -- the most pessimistic brokerage -- projects a 19 percent drop in net profit.

What factors could affect Maruti Suzuki's earnings?

EBITDA Contraction: The country's largest four-wheeler OEM is expected to witness a 210 basis points decline in margins due to negative operating leverage, higher personnel cost due to wage increases revision, higher marketing and advertisement spends/ forex costs being partly offset by increased sales of CNG vehicles, exports and realignment of one-time costs in the previous quarter.

Tepid Volumes: The company will witness a 1 percent rise in volumes during the first quarter. This comes after heavy rains, price hikes, and liquidity stress hurt showroom footfalls, while a high base and lack of fresh launches weighed on conversions. Maruti sold 5.27 lakh vehicles in Q1, up from 5.21 sold in the same period last year.

UV Sales Drop: While the company's exports rose in Q1, this benefit was partially offset by a slight dip in the share of utility vehicles (UVs), which accounted for 30.7 percent of volumes in Q1FY26 compared to 31.3 percent in Q1FY25.

"Additionally, increased discounting in the entry-level vehicle segment is putting some pressure on overall margins and profitability," Axis Securities said in its automobile preview note.

On a slightly positive note, Motilal Oswal says Maruti Suzuki is its top OEM pick. "While its 1Q earnings are expected to be weak, we expect the same to revive in the balance 9M on the back of its new launches and ramp-up in exports," the brokerage added.

What to look out for in the quarterly show?

In the upcoming quarterly results, investors should track the company's margin trajectory and its strategy to navigate the rare-earth magnet supply crisis, which could impact both costs and production. Updates on EV production plans amid this constraint, as well as progress on new model launches—especially in the EV and premium segments—will also be key to watch.

Maruti Suzuki shares were trading at Rs 12,358, higher by 0.2 percent from the last close on the NSE. Maruti Suzuki shares have risen 14 percent year-to-date.Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.