COMMENT-Norway's crown improving but facing headwinds

Norway's crown is set to record its first positive month since November 2022, but it still faces an up-hill battle versus the euro.

The Norges Bank has announced a reduction in NOK sales through July from NOK 1.3 billion to NOK 1.0 billion. The NOK sales on behalf of the government will continue to lean on the crown while petroleum tax revenue continues to exceed budgetary requirements.

Inflation remains a problem for global central banks and rate cuts are a way off yet, indeed further rate hikes are likely. The Norges Bank also maintains a hawkish bias, but the crown will continue to lose out to currencies that are more liquid.

Analysts are suggesting that the reduction in NOK sales announced by the Norges Bank could be linked to liquidity fears heading into the summer holiday season.

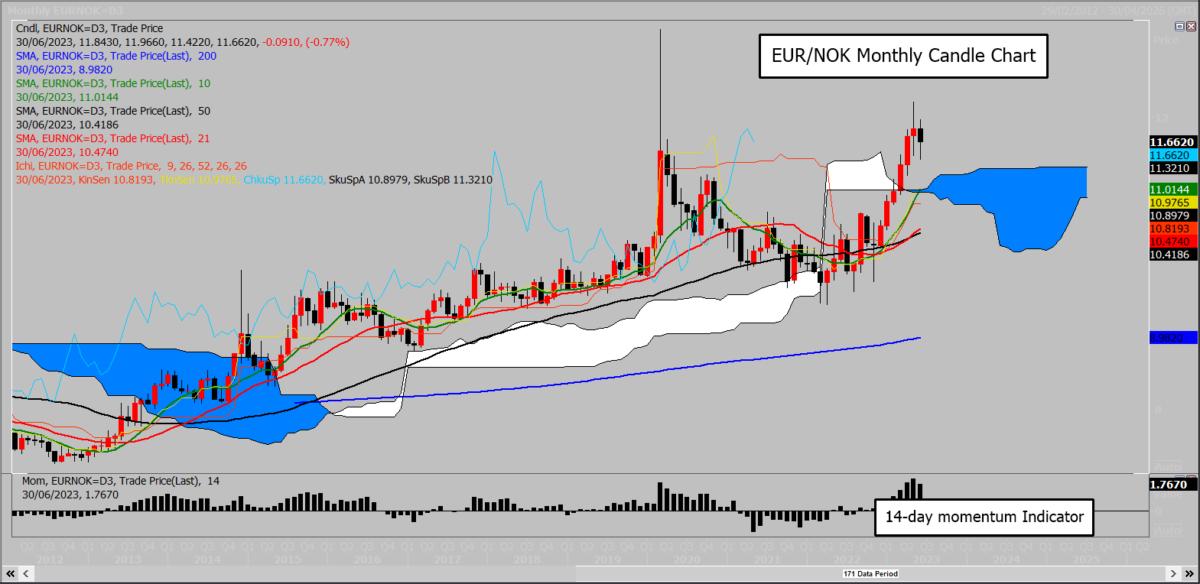

EUR/NOK peaked at 12.2030 in May, reversed course in June but found good bidding interest at 11.4220. A bearish bias so far Friday should ensure the NOK holds onto the bulk of its June gains into the close. Key support for the underlying EUR/NOK bull trend is at 11.4623, the 10-day moving average line.

For more click on