Adani's reprieve in India is largely symbolic

By Shritama Bose

Gautam Adani is catching a moment of relief. India's securities regulator cleared the tycoon and units of his $152 billion infrastructure conglomerate of stock manipulation charges raised by a short seller in 2023. However, its fortunes won't improve much so long as U.S. charges hang over the group.

The Securities and Exchange Board of India on Thursday said the transactions involving Adani Enterprises ADANIENT, Adani Ports

ADANIPORTS and Adani Power

ADANIPOWER between 2018 and 2023 flagged by Nathan Anderson's now-disbanded firm Hindenburg Research did not violate the rules at the time on related party transactions.

The order closes the loop on a more than two-year-old saga marked by a $150 billion reduction in Adani group companies' market value and muddled by allegations of conflict of interest against former SEBI Chair Madhabi Puri Buch, who left her role in February.

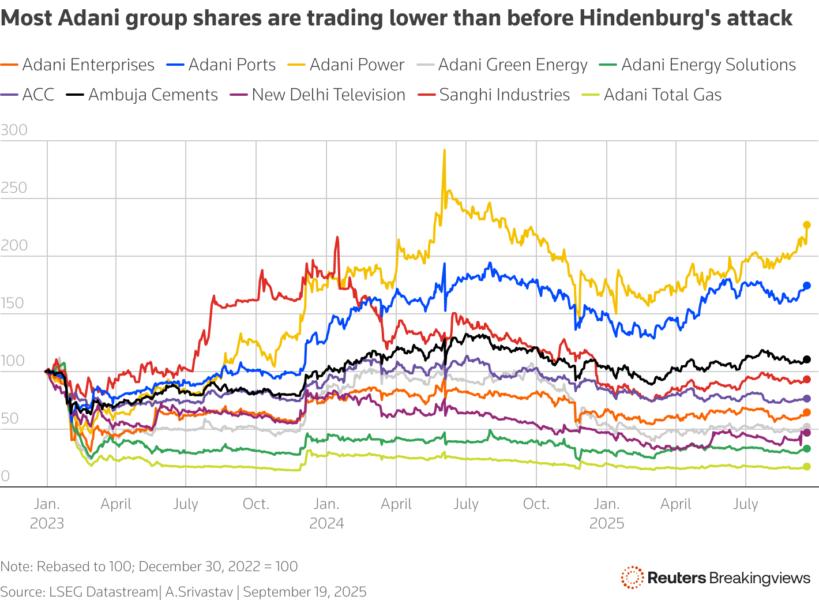

The clean bill of health from the watchdog now led by Tuhin Kanta Pandey hardly changes the group's local standing. Indian mutual funds managing some $850 billion in assets were wary of what they see as the group's opacity and its rapid growth before Hindenburg struck, and remain so: Adani Enterprises stock is about 30% lower than at the start of 2023.

A more potent overhang is the U.S. Justice Department's indictment of the tycoon in a $265 million Indian bribery scheme. The Adani group denies any wrongdoing but the charges have complicated the conglomerate's fundraising prospects. Though BlackRock BLK subscribed to bonds an Adani unit issued in April to finance an acquisition, that borrowing came at an increased cost than its past deals.

Non-U.S. banks including Barclays BARC and DBS

D05 lent $250 million to Adani's airport and ports units last month, Bloomberg reported citing unnamed people familiar with the transactions. But the U.S. issue stalled Adani's efforts to cut its dependence on Indian banks, which hold 47% of its 2.9 trillion rupees ($32.8 billion) debt. The group has returned to equity markets but only for carefully controlled issuances to institutional investors, not the public.

If anything, its stateside problems are widening. A subsidiary of Adani Enterprises has been named among 43 Indian exporters in a U.S. complaint over dumping of solar exports, a person familiar with the situation told Reuters Breakingviews. Similar investigations into Southeast Asian companies have attracted prohibitively high tariffs.

The resumption of trade talks this week between India and the U.S. may smooth the path for Adani to eventually draw a line under the Justice Department's probe, perhaps through a settlement. Until then, its other victories are superficial.

Follow Shritama Bose on LinkedIn and X.

CONTEXT NEWS

The Securities and Exchange Board of India on September 18 dismissed allegations of stock manipulation against billionaire Gautam Adani and his group of companies made by U.S. short-seller Hindenburg Research.

The capital markets regulator began investigating the group's flagship Adani Enterprises and its ports and energy units in 2023 after Hindenburg accused them of using tax havens and failing to disclose transactions between related parties. SEBI officials said in the order that the transactions under review, which were carried out between 2018 and 2023, did not qualify as related party transactions under the rules at the time.