Nasdaq-listed Sonnet BioTherapeutics agrees to $888 million merger to become Hyperliquid Strategies, launch HYPE treasury

Nasdaq-listed Sonnet BioTherapeutics, Inc. has agreed to merge with Rorschach I LLC to become Hyperliquid Strategies, Inc. and launch a HYPE treasury strategy.

Rorschach I LLC is a newly formed company by an entity affiliated with Atlas Merchant Capital LLC, an affiliate of Paradigm Operations LP, and additional sponsors, according to a Monday press release.

At closing, the new entity will be renamed Hyperliquid Strategies, Inc., and is expected to hold 12.6 million HYPE tokens and $305 million in cash, for a total estimated value of $888 million.

The transaction includes participation from strategic investors like Paradigm, Galaxy Digital, Pantera Capital, D1 Capital, Republic Digital, and 683 Capital, with Hyperliquid Strategies to continue trading on the Nasdaq under a new ticker as a public crypto treasury company upon closing.

"Hyperliquid has broken out as a crypto project with real fundamentals: strong core contributors, exacting product quality, and meteoric growth," Paradigm co-founder Matt Huang said. "We hear lots of institutional demand for exposure to Hyperliquid, yet the native token HYPE is difficult to access in the United States. We are excited about this treasury strategy, which we believe will contribute to the Hyperliquid ecosystem in many ways over time."

Cash proceeds to acquire more HYPE

The cash proceeds will enable Hyperliquid Strategies to acquire more HYPE, creating one of the top strategic reserves of HYPE — the native token of the decentralized exchange Hyperliquid — the parties said. Hyperliquid has generated more than $1.5 trillion in perps volume over the past year and recently set a new all-time high of $11.3 billion in open interest.

At closing, Atlas co-founder and CEO Bob Diamond will become Hyperliquid Strategies' chairman, and fellow Atlas co-founder and CIO David Schamis will be named its CEO. The board will also add former Boston Fed president Eric Rosengren, along with two of Sonnet's current independent directors, they added.

"We are delighted by this opportunity to partner with Sonnet in establishing a leading crypto treasury management strategy to ultimately deliver strong value to shareholders," Diamond said. "We believe HYPE and the Hyperliquid protocol represent a truly differentiated offering within the digital asset space. We believe Hyperliquid Strategies will be well placed to maximize these opportunities because of our unique team of investors and operators with deep, relevant crypto and financial services experience."

Sonnet BioTherapeutics is an oncology-focused biotechnology company with a proprietary platform for innovating biologic drugs of single or bifunctional action. After the deal closes, Sonnet will become a subsidiary of Hyperliquid Strategies, continue focusing on existing assets and business lines, and give shareholders a contingent value right (CVR) — a right to future payments if its biotech assets, which it's still seeking partners for, generate value.

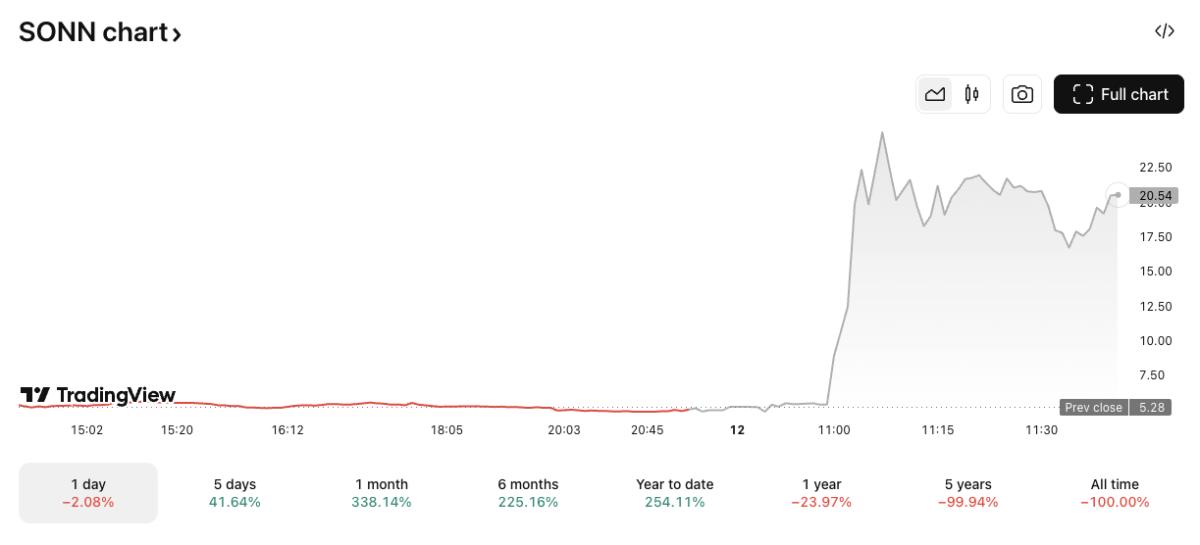

Sonnet BioTherapeutics shares are up around 300% in pre-market trading on Monday following the news, according to TradingView, bringing the company's market cap to just over $16 million.

SONN/USD market cap. Image: TradingView.

In June, Nasdaq-listed Lion Group's shares also jumped after announcing a $600 million facility to fund a HYPE treasury initiative.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.