S&P assigns Strategy a junk-bond B-minus rating as analysts see MSTR shares doubling

S&P Global Ratings has assigned Strategy Inc. — the bitcoin-treasury company formerly known as MicroStrategy — a B-minus issuer credit rating with a stable outlook, placing it squarely in junk-bond territory.

The agency said Strategy’s balance sheet is overwhelmingly tied to bitcoin and that its low dollar liquidity and negative risk-adjusted capital outweigh strong access to capital markets and prudent debt management.

"The company is able to service debt for now, but vulnerable to shocks," Matthew Sigel, head of digital assets research at VanEck, posted on X, reacting to the rating.

S&P said the company's structure creates an inherent currency mismatch, with most assets held in bitcoin while debt and dividend obligations are denominated in U.S. dollars.

The rating matches that of stablecoin issuer Sky Protocol (formerly MakerDAO), which S&P also rated B-minus in August, grouping both entities among high-risk crypto-linked issuers exposed to liquidity and market-volatility shocks.

Despite the speculative tag, TD Cowen reaffirmed its "Buy" rating and $620 price target for MSTR, implying about 114% upside from Friday's close. Analysts Lance Vitanza and Jonnathan Navarrete said Strategy continues to "convert market appetite for volatility and return into bitcoin," noting that bitcoin per diluted share keeps climbing as issuance slows.

TD Cowen expects the firm to hold nearly 900,000 BTC by 2027, more than 4% of the total supply, and said bitcoin’s mainstream integration, from major banks’ collateral programs to a friendlier tone from the Federal Reserve, remains a powerful tailwind.

Earlier Monday, Strategy disclosed the purchase of 390 BTC for $43.4 million, funded through ongoing at-the-market sales of its perpetual preferred stock, bringing total holdings to 640,808 BTC worth roughly $74 billion. The company remains the largest public holder of bitcoin, ahead of Marathon, Twenty One Capital, and Metaplanet.

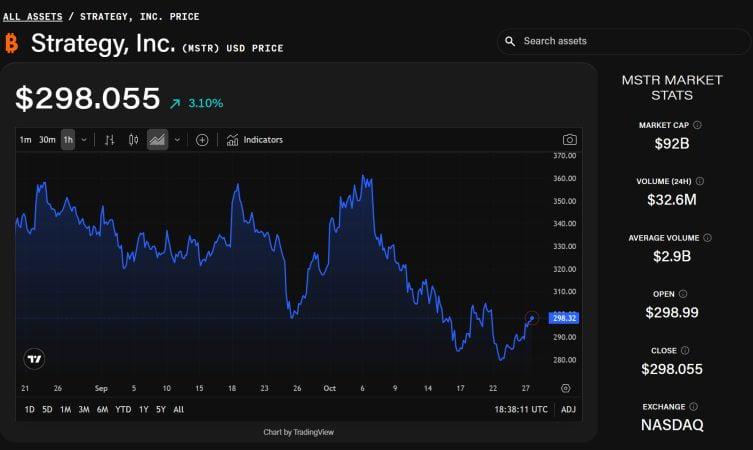

Shares of Strategy were trading near $298, up 3% on the day, according to The Block's price page.

Strategy MSTR Stock Price Chart. Source: The Block Price Page

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.