OPEN-SOURCE SCRIPT

Instant Breakout Strategy with RSI & VWAP

Instant Breakout Strategy with RSI & VWAP

This TradingView strategy (Pine Script v6) trades breakouts using pivot points, with optional filters for volume, momentum, RSI, and VWAP. It’s optimized for the 1-second timeframe.

Overview

The strategy identifies breakouts when price crosses above resistance (pivot highs) or below support (pivot lows). It can use basic pivot breakouts or add filters for stronger signals. Take-profit and stop-loss levels are set using ATR, and signals are shown on the chart.

Inputs

Left/Right Pivot Bars: Bars to detect pivots (default: 3). Lower values increase sensitivity.

Volume Surge Multiplier: Volume threshold vs. 20-period average (default: 1.5).

Momentum Threshold: Minimum % price change from bar open (default: 1%).

Take-Profit ATR Multiplier: ATR multiplier for take-profit (default: 9.0).

Stop-Loss ATR Multiplier: ATR multiplier for stop-loss (default: 1.0).

Use Filters: Enable/disable volume, momentum, RSI, and VWAP filters (default: off).

How It Works

1. Pivot Detection

Finds pivot highs (resistance) and lows (support) using ta.pivothigh and ta.pivotlow.

Tracks the latest pivot levels.

2. Volume Surge

Compares current volume to a 20-period volume average.

A surge occurs if volume exceeds the average times the multiplier.

3. Momentum

Measures price change from the bar’s open.

Bullish: Price rises >1% from open.

Bearish: Price falls >1% from open.

4. RSI and VWAP

RSI: 3-period RSI. Above 50 is bullish; below 50 is bearish.

VWAP: Price above VWAP is bullish; below is bearish.

5. ATR

14-period ATR sets take-profit (close ± atr * 9.0) and stop-loss (close ± atr * 1.0).

Trading Rules

Breakout Conditions

Bullish Breakout:

Price crosses above the latest pivot high.

With filters: Volume surge, bullish momentum, RSI > 50, price > VWAP.

Without filters: Only the crossover is needed.

Bearish Breakout:

Price crosses below the latest pivot low.

With filters: Volume surge, bearish momentum, RSI < 50, price < VWAP.

Without filters: Only the crossunder is needed.

Entries and Exits

Long: Enter on bullish breakout. Set take-profit and stop-loss. Close any short position.

Short: Enter on bearish breakout. Set take-profit and stop-loss. Close any long position.

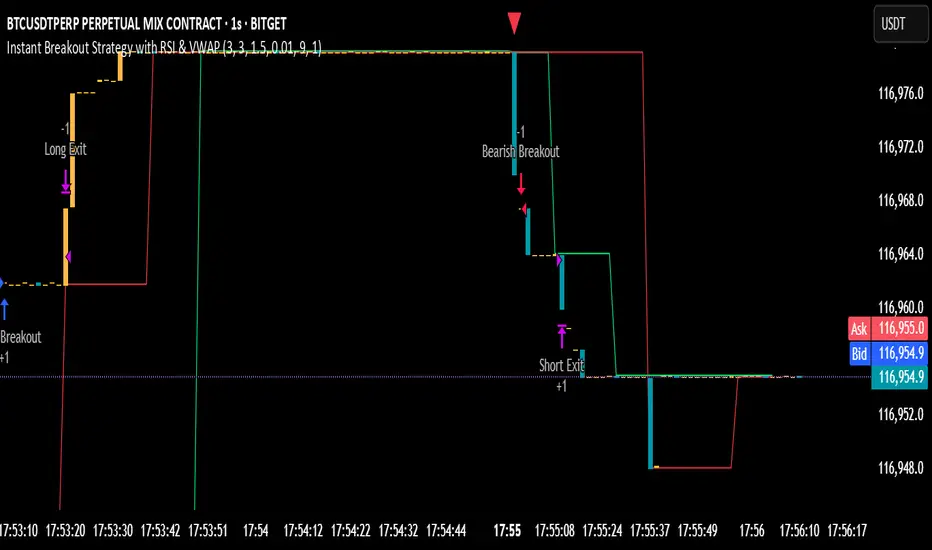

Visuals

Signals: Green triangles (bullish) below bars, red triangles (bearish) above bars.

Pivot Levels: Green line (resistance), red line (support).

Indicators: RSI (blue, separate pane), VWAP (purple, on chart).

How to Use

Apply to a 1-second chart in TradingView for best results.

Adjust inputs (e.g., pivot bars, multipliers). Enable filters for stricter signals.

Watch for buy/sell triangles and monitor RSI/VWAP.

Use ATR-based take-profit/stop-loss for risk management.

Notes

Best on 1-second timeframe due to fast RSI and responsiveness.

Disable filters for more signals (less confirmation).

Backtest before live trading to check performance.

This strategy uses pivots, volume, momentum, RSI, and VWAP for clear breakout trades on the 1-second timeframe.

This TradingView strategy (Pine Script v6) trades breakouts using pivot points, with optional filters for volume, momentum, RSI, and VWAP. It’s optimized for the 1-second timeframe.

Overview

The strategy identifies breakouts when price crosses above resistance (pivot highs) or below support (pivot lows). It can use basic pivot breakouts or add filters for stronger signals. Take-profit and stop-loss levels are set using ATR, and signals are shown on the chart.

Inputs

Left/Right Pivot Bars: Bars to detect pivots (default: 3). Lower values increase sensitivity.

Volume Surge Multiplier: Volume threshold vs. 20-period average (default: 1.5).

Momentum Threshold: Minimum % price change from bar open (default: 1%).

Take-Profit ATR Multiplier: ATR multiplier for take-profit (default: 9.0).

Stop-Loss ATR Multiplier: ATR multiplier for stop-loss (default: 1.0).

Use Filters: Enable/disable volume, momentum, RSI, and VWAP filters (default: off).

How It Works

1. Pivot Detection

Finds pivot highs (resistance) and lows (support) using ta.pivothigh and ta.pivotlow.

Tracks the latest pivot levels.

2. Volume Surge

Compares current volume to a 20-period volume average.

A surge occurs if volume exceeds the average times the multiplier.

3. Momentum

Measures price change from the bar’s open.

Bullish: Price rises >1% from open.

Bearish: Price falls >1% from open.

4. RSI and VWAP

RSI: 3-period RSI. Above 50 is bullish; below 50 is bearish.

VWAP: Price above VWAP is bullish; below is bearish.

5. ATR

14-period ATR sets take-profit (close ± atr * 9.0) and stop-loss (close ± atr * 1.0).

Trading Rules

Breakout Conditions

Bullish Breakout:

Price crosses above the latest pivot high.

With filters: Volume surge, bullish momentum, RSI > 50, price > VWAP.

Without filters: Only the crossover is needed.

Bearish Breakout:

Price crosses below the latest pivot low.

With filters: Volume surge, bearish momentum, RSI < 50, price < VWAP.

Without filters: Only the crossunder is needed.

Entries and Exits

Long: Enter on bullish breakout. Set take-profit and stop-loss. Close any short position.

Short: Enter on bearish breakout. Set take-profit and stop-loss. Close any long position.

Visuals

Signals: Green triangles (bullish) below bars, red triangles (bearish) above bars.

Pivot Levels: Green line (resistance), red line (support).

Indicators: RSI (blue, separate pane), VWAP (purple, on chart).

How to Use

Apply to a 1-second chart in TradingView for best results.

Adjust inputs (e.g., pivot bars, multipliers). Enable filters for stricter signals.

Watch for buy/sell triangles and monitor RSI/VWAP.

Use ATR-based take-profit/stop-loss for risk management.

Notes

Best on 1-second timeframe due to fast RSI and responsiveness.

Disable filters for more signals (less confirmation).

Backtest before live trading to check performance.

This strategy uses pivots, volume, momentum, RSI, and VWAP for clear breakout trades on the 1-second timeframe.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.