OPEN-SOURCE SCRIPT

Telah dikemas kini Volume Profile [LuxAlgo]

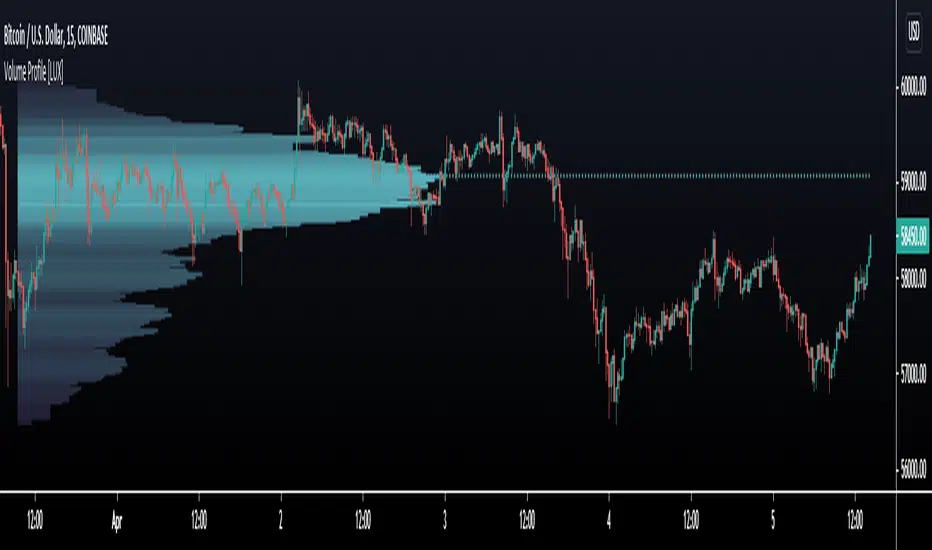

Displays the estimate of a volume profile, with the option to show a rolling POC (point of control). Users can change the lookback, row size, and various visual aspects of the volume profile.

Settings

Basic:

Style:

Usage

It is very common to display volume over time in order to visualize the trading activity made over a specific candle, however this is not the only way to display volume and it can be interesting to put it in relation with the price, which is what volume profiles do.

Volume profiles are displayed as price relative histograms showing the accumulated volume within certain price areas, the number of areas are determined by the row size of the volume profile. Knowing which price's area accumulated the most volume allow highlighting areas of interest to market participants.

Most accumulated volume will be encountered in zones of equilibrium between buyers and sellers; that is zones of local price stationarity. These zones are highlighted by high volume nodes in the volume profile. Imbalance between buyers and sellers are highlighted by thinner zones of the volume profile.

The price level with the most accumulated volume is highlighted by the "point of control" (POC), displayed by the dotted line in the indicator.

The POC is often considered an important level, commonly used as support/resistance by traders. One can verify the accuracy of this use case by using the rolling POC (assuming one would use the POC over time as SR).

Indicator Limitations

Volume profiles are calculated using tick data, which is not the case of this estimate, as such you won't have an accurate representation of an actual volume profile.

The rolling POC can introduce time outs in the script computation, use lower lookback and row size value to display it.

Settings

Basic:

- Lookback: Number of most recent bars to use for the calculation of the volume profile

- Row Size: Determines the number of rows used for the calculation of the volume profile

- Show Rolling POC: Determines whether to display the rolling POC of the volume profile

Style:

- Width (% of the box): Determines the length of the bars relative to the Lookback value

- Bar Width: Width of each bar

- Flip Histogram: Flips the histogram, when enabled, the histogram base will be located at the most recent candle

- Gradient: Allows to color the volume profile bars with a gradient, with a color intensity determined by the length of each bar

- Rows Solid Color: Color of each bar when 'Gradient' is disabled

- POC Solid Color: Color of the POC when 'Gradient' is disabled

Usage

It is very common to display volume over time in order to visualize the trading activity made over a specific candle, however this is not the only way to display volume and it can be interesting to put it in relation with the price, which is what volume profiles do.

Volume profiles are displayed as price relative histograms showing the accumulated volume within certain price areas, the number of areas are determined by the row size of the volume profile. Knowing which price's area accumulated the most volume allow highlighting areas of interest to market participants.

Most accumulated volume will be encountered in zones of equilibrium between buyers and sellers; that is zones of local price stationarity. These zones are highlighted by high volume nodes in the volume profile. Imbalance between buyers and sellers are highlighted by thinner zones of the volume profile.

The price level with the most accumulated volume is highlighted by the "point of control" (POC), displayed by the dotted line in the indicator.

The POC is often considered an important level, commonly used as support/resistance by traders. One can verify the accuracy of this use case by using the rolling POC (assuming one would use the POC over time as SR).

Indicator Limitations

Volume profiles are calculated using tick data, which is not the case of this estimate, as such you won't have an accurate representation of an actual volume profile.

The rolling POC can introduce time outs in the script computation, use lower lookback and row size value to display it.

Nota Keluaran

Minor changesNota Keluaran

Update to script title & minor changes.Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Build your own edge with AI: luxalgo.com

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Build your own edge with AI: luxalgo.com

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.