# Bear Market Probability Model: A Multi-Factor Risk Assessment Framework

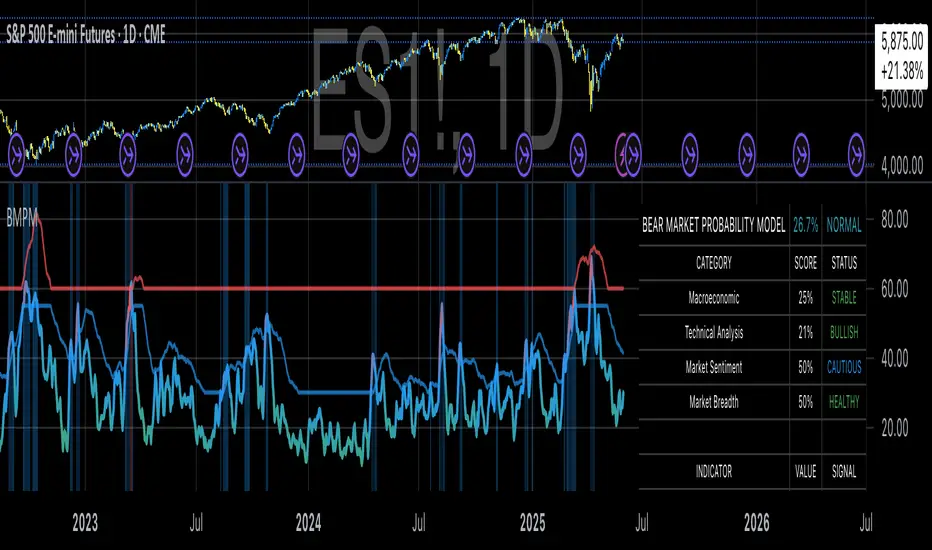

The Bear Market Probability Model represents a comprehensive quantitative framework for assessing systemic market risk through the integration of 13 distinct risk factors across four analytical categories: macroeconomic indicators, technical analysis factors, market sentiment measures, and market breadth metrics. This indicator synthesizes established financial research methodologies to provide real-time probabilistic assessments of impending bear market conditions, offering institutional-grade risk management capabilities to retail and professional traders alike.

## Theoretical Foundation

### Historical Context of Bear Market Prediction

Bear market prediction has been a central focus of financial research since the seminal work of Dow (1901) and the subsequent development of technical analysis theory. The challenge of predicting market downturns gained renewed academic attention following the market crashes of 1929, 1987, 2000, and 2008, leading to the development of sophisticated multi-factor models.

Fama and French (1989) demonstrated that certain financial variables possess predictive power for stock returns, particularly during market stress periods. Their three-factor model laid the groundwork for multi-dimensional risk assessment, which this indicator extends through the incorporation of real-time market microstructure data.

### Methodological Framework

The model employs a weighted composite scoring methodology based on the theoretical framework established by Campbell and Shiller (1998) for market valuation assessment, extended through the incorporation of high-frequency sentiment and technical indicators as proposed by Baker and Wurgler (2006) in their seminal work on investor sentiment.

The mathematical foundation follows the general form:

Bear Market Probability = Σ(Wi × Ci) / ΣWi × 100

Where:

- Wi = Category weight (i = 1,2,3,4)

- Ci = Normalized category score

- Categories: Macroeconomic, Technical, Sentiment, Breadth

## Component Analysis

### 1. Macroeconomic Risk Factors

#### Yield Curve Analysis

The inclusion of yield curve inversion as a primary predictor follows extensive research by Estrella and Mishkin (1998), who demonstrated that the term spread between 3-month and 10-year Treasury securities has historically preceded all major recessions since 1969. The model incorporates both the 2Y-10Y and 3M-10Y spreads to capture different aspects of monetary policy expectations.

Implementation:

- 2Y-10Y Spread: Captures market expectations of monetary policy trajectory

- 3M-10Y Spread: Traditional recession predictor with 12-18 month lead time

Scientific Basis: Harvey (1988) and subsequent research by Ang, Piazzesi, and Wei (2006) established the theoretical foundation linking yield curve inversions to economic contractions through the expectations hypothesis of the term structure.

#### Credit Risk Premium Assessment

High-yield credit spreads serve as a real-time gauge of systemic risk, following the methodology established by Gilchrist and Zakrajšek (2012) in their excess bond premium research. The model incorporates the ICE BofA High Yield Master II Option-Adjusted Spread as a proxy for credit market stress.

Threshold Calibration:

- Normal conditions: < 350 basis points

- Elevated risk: 350-500 basis points

- Severe stress: > 500 basis points

#### Currency and Commodity Stress Indicators

The US Dollar Index (DXY) momentum serves as a risk-off indicator, while the Gold-to-Oil ratio captures commodity market stress dynamics. This approach follows the methodology of Akram (2009) and Beckmann, Berger, and Czudaj (2015) in analyzing commodity-currency relationships during market stress.

### 2. Technical Analysis Factors

#### Multi-Timeframe Moving Average Analysis

The technical component incorporates the well-established moving average convergence methodology, drawing from the work of Brock, Lakonishok, and LeBaron (1992), who provided empirical evidence for the profitability of technical trading rules.

Implementation:

- Price relative to 50-day and 200-day simple moving averages

- Moving average convergence/divergence analysis

- Multi-timeframe MACD assessment (daily and weekly)

#### Momentum and Volatility Analysis

The model integrates Relative Strength Index (RSI) analysis following Wilder's (1978) original methodology, combined with maximum drawdown analysis based on the work of Magdon-Ismail and Atiya (2004) on optimal drawdown measurement.

### 3. Market Sentiment Factors

#### Volatility Index Analysis

The VIX component follows the established research of Whaley (2009) and subsequent work by Bekaert and Hoerova (2014) on VIX as a predictor of market stress. The model incorporates both absolute VIX levels and relative VIX spikes compared to the 20-day moving average.

Calibration:

- Low volatility: VIX < 20

- Elevated concern: VIX 20-25

- High fear: VIX > 25

- Panic conditions: VIX > 30

#### Put-Call Ratio Analysis

Options flow analysis through put-call ratios provides insight into sophisticated investor positioning, following the methodology established by Pan and Poteshman (2006) in their analysis of informed trading in options markets.

### 4. Market Breadth Factors

#### Advance-Decline Analysis

Market breadth assessment follows the classic work of Fosback (1976) and subsequent research by Brown and Cliff (2004) on market breadth as a predictor of future returns.

Components:

- Daily advance-decline ratio

- Advance-decline line momentum

- McClellan Oscillator (Ema19 - Ema39 of A-D difference)

#### New Highs-New Lows Analysis

The new highs-new lows ratio serves as a market leadership indicator, based on the research of Zweig (1986) and validated in academic literature by Zarowin (1990).

## Dynamic Threshold Methodology

The model incorporates adaptive thresholds based on rolling volatility and trend analysis, following the methodology established by Pagan and Sossounov (2003) for business cycle dating. This approach allows the model to adjust sensitivity based on prevailing market conditions.

Dynamic Threshold Calculation:

- Warning Level: Base threshold ± (Volatility × 1.0)

- Danger Level: Base threshold ± (Volatility × 1.5)

- Bounds: ±10-20 points from base threshold

## Professional Implementation

### Institutional Usage Patterns

Professional risk managers typically employ multi-factor bear market models in several contexts:

#### 1. Portfolio Risk Management

- Tactical Asset Allocation: Reducing equity exposure when probability exceeds 60-70%

- Hedging Strategies: Implementing protective puts or VIX calls when warning thresholds are breached

- Sector Rotation: Shifting from growth to defensive sectors during elevated risk periods

#### 2. Risk Budgeting

- Value-at-Risk Adjustment: Incorporating bear market probability into VaR calculations

- Stress Testing: Using probability levels to calibrate stress test scenarios

- Capital Requirements: Adjusting regulatory capital based on systemic risk assessment

#### 3. Client Communication

- Risk Reporting: Quantifying market risk for client presentations

- Investment Committee Decisions: Providing objective risk metrics for strategic decisions

- Performance Attribution: Explaining defensive positioning during market stress

### Implementation Framework

Professional traders typically implement such models through:

#### Signal Hierarchy:

1. Probability < 30%: Normal risk positioning

2. Probability 30-50%: Increased hedging, reduced leverage

3. Probability 50-70%: Defensive positioning, cash building

4. Probability > 70%: Maximum defensive posture, short exposure consideration

#### Risk Management Integration:

- Position Sizing: Inverse relationship between probability and position size

- Stop-Loss Adjustment: Tighter stops during elevated risk periods

- Correlation Monitoring: Increased attention to cross-asset correlations

## Strengths and Advantages

### 1. Comprehensive Coverage

The model's primary strength lies in its multi-dimensional approach, avoiding the single-factor bias that has historically plagued market timing models. By incorporating macroeconomic, technical, sentiment, and breadth factors, the model provides robust risk assessment across different market regimes.

### 2. Dynamic Adaptability

The adaptive threshold mechanism allows the model to adjust sensitivity based on prevailing volatility conditions, reducing false signals during low-volatility periods and maintaining sensitivity during high-volatility regimes.

### 3. Real-Time Processing

Unlike traditional academic models that rely on monthly or quarterly data, this indicator processes daily market data, providing timely risk assessment for active portfolio management.

### 4. Transparency and Interpretability

The component-based structure allows users to understand which factors are driving risk assessment, enabling informed decision-making about model signals.

### 5. Historical Validation

Each component has been validated in academic literature, providing theoretical foundation for the model's predictive power.

## Limitations and Weaknesses

### 1. Data Dependencies

The model's effectiveness depends heavily on the availability and quality of real-time economic data. Federal Reserve Economic Data (FRED) updates may have lags that could impact model responsiveness during rapidly evolving market conditions.

### 2. Regime Change Sensitivity

Like most quantitative models, the indicator may struggle during unprecedented market conditions or structural regime changes where historical relationships break down (Taleb, 2007).

### 3. False Signal Risk

Multi-factor models inherently face the challenge of balancing sensitivity with specificity. The model may generate false positive signals during normal market volatility periods.

### 4. Currency and Geographic Bias

The model focuses primarily on US market indicators, potentially limiting its effectiveness for global portfolio management or non-USD denominated assets.

### 5. Correlation Breakdown

During extreme market stress, correlations between risk factors may increase dramatically, reducing the model's diversification benefits (Forbes and Rigobon, 2002).

## References

Akram, Q. F. (2009). Commodity prices, interest rates and the dollar. Energy Economics, 31(6), 838-851.

Ang, A., Piazzesi, M., & Wei, M. (2006). What does the yield curve tell us about GDP growth? Journal of Econometrics, 131(1-2), 359-403.

Baker, M., & Wurgler, J. (2006). Investor sentiment and the cross‐section of stock returns. The Journal of Finance, 61(4), 1645-1680.

Baker, S. R., Bloom, N., & Davis, S. J. (2016). Measuring economic policy uncertainty. The Quarterly Journal of Economics, 131(4), 1593-1636.

Barber, B. M., & Odean, T. (2001). Boys will be boys: Gender, overconfidence, and common stock investment. The Quarterly Journal of Economics, 116(1), 261-292.

Beckmann, J., Berger, T., & Czudaj, R. (2015). Does gold act as a hedge or a safe haven for stocks? A smooth transition approach. Economic Modelling, 48, 16-24.

Bekaert, G., & Hoerova, M. (2014). The VIX, the variance premium and stock market volatility. Journal of Econometrics, 183(2), 181-192.

Brock, W., Lakonishok, J., & LeBaron, B. (1992). Simple technical trading rules and the stochastic properties of stock returns. The Journal of Finance, 47(5), 1731-1764.

Brown, G. W., & Cliff, M. T. (2004). Investor sentiment and the near-term stock market. Journal of Empirical Finance, 11(1), 1-27.

Campbell, J. Y., & Shiller, R. J. (1998). Valuation ratios and the long-run stock market outlook. The Journal of Portfolio Management, 24(2), 11-26.

Dow, C. H. (1901). Scientific stock speculation. The Magazine of Wall Street.

Estrella, A., & Mishkin, F. S. (1998). Predicting US recessions: Financial variables as leading indicators. Review of Economics and Statistics, 80(1), 45-61.

Fama, E. F., & French, K. R. (1989). Business conditions and expected returns on stocks and bonds. Journal of Financial Economics, 25(1), 23-49.

Forbes, K. J., & Rigobon, R. (2002). No contagion, only interdependence: measuring stock market comovements. The Journal of Finance, 57(5), 2223-2261.

Fosback, N. G. (1976). Stock market logic: A sophisticated approach to profits on Wall Street. The Institute for Econometric Research.

Gilchrist, S., & Zakrajšek, E. (2012). Credit spreads and business cycle fluctuations. American Economic Review, 102(4), 1692-1720.

Harvey, C. R. (1988). The real term structure and consumption growth. Journal of Financial Economics, 22(2), 305-333.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 263-291.

Magdon-Ismail, M., & Atiya, A. F. (2004). Maximum drawdown. Risk, 17(10), 99-102.

Nickerson, R. S. (1998). Confirmation bias: A ubiquitous phenomenon in many guises. Review of General Psychology, 2(2), 175-220.

Pagan, A. R., & Sossounov, K. A. (2003). A simple framework for analysing bull and bear markets. Journal of Applied Econometrics, 18(1), 23-46.

Pan, J., & Poteshman, A. M. (2006). The information in option volume for future stock prices. The Review of Financial Studies, 19(3), 871-908.

Taleb, N. N. (2007). The black swan: The impact of the highly improbable. Random House.

Whaley, R. E. (2009). Understanding the VIX. The Journal of Portfolio Management, 35(3), 98-105.

Wilder, J. W. (1978). New concepts in technical trading systems. Trend Research.

Zarowin, P. (1990). Size, seasonality, and stock market overreaction. Journal of Financial and Quantitative Analysis, 25(1), 113-125.

Zweig, M. E. (1986). Winning on Wall Street. Warner Books.

The Bear Market Probability Model represents a comprehensive quantitative framework for assessing systemic market risk through the integration of 13 distinct risk factors across four analytical categories: macroeconomic indicators, technical analysis factors, market sentiment measures, and market breadth metrics. This indicator synthesizes established financial research methodologies to provide real-time probabilistic assessments of impending bear market conditions, offering institutional-grade risk management capabilities to retail and professional traders alike.

## Theoretical Foundation

### Historical Context of Bear Market Prediction

Bear market prediction has been a central focus of financial research since the seminal work of Dow (1901) and the subsequent development of technical analysis theory. The challenge of predicting market downturns gained renewed academic attention following the market crashes of 1929, 1987, 2000, and 2008, leading to the development of sophisticated multi-factor models.

Fama and French (1989) demonstrated that certain financial variables possess predictive power for stock returns, particularly during market stress periods. Their three-factor model laid the groundwork for multi-dimensional risk assessment, which this indicator extends through the incorporation of real-time market microstructure data.

### Methodological Framework

The model employs a weighted composite scoring methodology based on the theoretical framework established by Campbell and Shiller (1998) for market valuation assessment, extended through the incorporation of high-frequency sentiment and technical indicators as proposed by Baker and Wurgler (2006) in their seminal work on investor sentiment.

The mathematical foundation follows the general form:

Bear Market Probability = Σ(Wi × Ci) / ΣWi × 100

Where:

- Wi = Category weight (i = 1,2,3,4)

- Ci = Normalized category score

- Categories: Macroeconomic, Technical, Sentiment, Breadth

## Component Analysis

### 1. Macroeconomic Risk Factors

#### Yield Curve Analysis

The inclusion of yield curve inversion as a primary predictor follows extensive research by Estrella and Mishkin (1998), who demonstrated that the term spread between 3-month and 10-year Treasury securities has historically preceded all major recessions since 1969. The model incorporates both the 2Y-10Y and 3M-10Y spreads to capture different aspects of monetary policy expectations.

Implementation:

- 2Y-10Y Spread: Captures market expectations of monetary policy trajectory

- 3M-10Y Spread: Traditional recession predictor with 12-18 month lead time

Scientific Basis: Harvey (1988) and subsequent research by Ang, Piazzesi, and Wei (2006) established the theoretical foundation linking yield curve inversions to economic contractions through the expectations hypothesis of the term structure.

#### Credit Risk Premium Assessment

High-yield credit spreads serve as a real-time gauge of systemic risk, following the methodology established by Gilchrist and Zakrajšek (2012) in their excess bond premium research. The model incorporates the ICE BofA High Yield Master II Option-Adjusted Spread as a proxy for credit market stress.

Threshold Calibration:

- Normal conditions: < 350 basis points

- Elevated risk: 350-500 basis points

- Severe stress: > 500 basis points

#### Currency and Commodity Stress Indicators

The US Dollar Index (DXY) momentum serves as a risk-off indicator, while the Gold-to-Oil ratio captures commodity market stress dynamics. This approach follows the methodology of Akram (2009) and Beckmann, Berger, and Czudaj (2015) in analyzing commodity-currency relationships during market stress.

### 2. Technical Analysis Factors

#### Multi-Timeframe Moving Average Analysis

The technical component incorporates the well-established moving average convergence methodology, drawing from the work of Brock, Lakonishok, and LeBaron (1992), who provided empirical evidence for the profitability of technical trading rules.

Implementation:

- Price relative to 50-day and 200-day simple moving averages

- Moving average convergence/divergence analysis

- Multi-timeframe MACD assessment (daily and weekly)

#### Momentum and Volatility Analysis

The model integrates Relative Strength Index (RSI) analysis following Wilder's (1978) original methodology, combined with maximum drawdown analysis based on the work of Magdon-Ismail and Atiya (2004) on optimal drawdown measurement.

### 3. Market Sentiment Factors

#### Volatility Index Analysis

The VIX component follows the established research of Whaley (2009) and subsequent work by Bekaert and Hoerova (2014) on VIX as a predictor of market stress. The model incorporates both absolute VIX levels and relative VIX spikes compared to the 20-day moving average.

Calibration:

- Low volatility: VIX < 20

- Elevated concern: VIX 20-25

- High fear: VIX > 25

- Panic conditions: VIX > 30

#### Put-Call Ratio Analysis

Options flow analysis through put-call ratios provides insight into sophisticated investor positioning, following the methodology established by Pan and Poteshman (2006) in their analysis of informed trading in options markets.

### 4. Market Breadth Factors

#### Advance-Decline Analysis

Market breadth assessment follows the classic work of Fosback (1976) and subsequent research by Brown and Cliff (2004) on market breadth as a predictor of future returns.

Components:

- Daily advance-decline ratio

- Advance-decline line momentum

- McClellan Oscillator (Ema19 - Ema39 of A-D difference)

#### New Highs-New Lows Analysis

The new highs-new lows ratio serves as a market leadership indicator, based on the research of Zweig (1986) and validated in academic literature by Zarowin (1990).

## Dynamic Threshold Methodology

The model incorporates adaptive thresholds based on rolling volatility and trend analysis, following the methodology established by Pagan and Sossounov (2003) for business cycle dating. This approach allows the model to adjust sensitivity based on prevailing market conditions.

Dynamic Threshold Calculation:

- Warning Level: Base threshold ± (Volatility × 1.0)

- Danger Level: Base threshold ± (Volatility × 1.5)

- Bounds: ±10-20 points from base threshold

## Professional Implementation

### Institutional Usage Patterns

Professional risk managers typically employ multi-factor bear market models in several contexts:

#### 1. Portfolio Risk Management

- Tactical Asset Allocation: Reducing equity exposure when probability exceeds 60-70%

- Hedging Strategies: Implementing protective puts or VIX calls when warning thresholds are breached

- Sector Rotation: Shifting from growth to defensive sectors during elevated risk periods

#### 2. Risk Budgeting

- Value-at-Risk Adjustment: Incorporating bear market probability into VaR calculations

- Stress Testing: Using probability levels to calibrate stress test scenarios

- Capital Requirements: Adjusting regulatory capital based on systemic risk assessment

#### 3. Client Communication

- Risk Reporting: Quantifying market risk for client presentations

- Investment Committee Decisions: Providing objective risk metrics for strategic decisions

- Performance Attribution: Explaining defensive positioning during market stress

### Implementation Framework

Professional traders typically implement such models through:

#### Signal Hierarchy:

1. Probability < 30%: Normal risk positioning

2. Probability 30-50%: Increased hedging, reduced leverage

3. Probability 50-70%: Defensive positioning, cash building

4. Probability > 70%: Maximum defensive posture, short exposure consideration

#### Risk Management Integration:

- Position Sizing: Inverse relationship between probability and position size

- Stop-Loss Adjustment: Tighter stops during elevated risk periods

- Correlation Monitoring: Increased attention to cross-asset correlations

## Strengths and Advantages

### 1. Comprehensive Coverage

The model's primary strength lies in its multi-dimensional approach, avoiding the single-factor bias that has historically plagued market timing models. By incorporating macroeconomic, technical, sentiment, and breadth factors, the model provides robust risk assessment across different market regimes.

### 2. Dynamic Adaptability

The adaptive threshold mechanism allows the model to adjust sensitivity based on prevailing volatility conditions, reducing false signals during low-volatility periods and maintaining sensitivity during high-volatility regimes.

### 3. Real-Time Processing

Unlike traditional academic models that rely on monthly or quarterly data, this indicator processes daily market data, providing timely risk assessment for active portfolio management.

### 4. Transparency and Interpretability

The component-based structure allows users to understand which factors are driving risk assessment, enabling informed decision-making about model signals.

### 5. Historical Validation

Each component has been validated in academic literature, providing theoretical foundation for the model's predictive power.

## Limitations and Weaknesses

### 1. Data Dependencies

The model's effectiveness depends heavily on the availability and quality of real-time economic data. Federal Reserve Economic Data (FRED) updates may have lags that could impact model responsiveness during rapidly evolving market conditions.

### 2. Regime Change Sensitivity

Like most quantitative models, the indicator may struggle during unprecedented market conditions or structural regime changes where historical relationships break down (Taleb, 2007).

### 3. False Signal Risk

Multi-factor models inherently face the challenge of balancing sensitivity with specificity. The model may generate false positive signals during normal market volatility periods.

### 4. Currency and Geographic Bias

The model focuses primarily on US market indicators, potentially limiting its effectiveness for global portfolio management or non-USD denominated assets.

### 5. Correlation Breakdown

During extreme market stress, correlations between risk factors may increase dramatically, reducing the model's diversification benefits (Forbes and Rigobon, 2002).

## References

Akram, Q. F. (2009). Commodity prices, interest rates and the dollar. Energy Economics, 31(6), 838-851.

Ang, A., Piazzesi, M., & Wei, M. (2006). What does the yield curve tell us about GDP growth? Journal of Econometrics, 131(1-2), 359-403.

Baker, M., & Wurgler, J. (2006). Investor sentiment and the cross‐section of stock returns. The Journal of Finance, 61(4), 1645-1680.

Baker, S. R., Bloom, N., & Davis, S. J. (2016). Measuring economic policy uncertainty. The Quarterly Journal of Economics, 131(4), 1593-1636.

Barber, B. M., & Odean, T. (2001). Boys will be boys: Gender, overconfidence, and common stock investment. The Quarterly Journal of Economics, 116(1), 261-292.

Beckmann, J., Berger, T., & Czudaj, R. (2015). Does gold act as a hedge or a safe haven for stocks? A smooth transition approach. Economic Modelling, 48, 16-24.

Bekaert, G., & Hoerova, M. (2014). The VIX, the variance premium and stock market volatility. Journal of Econometrics, 183(2), 181-192.

Brock, W., Lakonishok, J., & LeBaron, B. (1992). Simple technical trading rules and the stochastic properties of stock returns. The Journal of Finance, 47(5), 1731-1764.

Brown, G. W., & Cliff, M. T. (2004). Investor sentiment and the near-term stock market. Journal of Empirical Finance, 11(1), 1-27.

Campbell, J. Y., & Shiller, R. J. (1998). Valuation ratios and the long-run stock market outlook. The Journal of Portfolio Management, 24(2), 11-26.

Dow, C. H. (1901). Scientific stock speculation. The Magazine of Wall Street.

Estrella, A., & Mishkin, F. S. (1998). Predicting US recessions: Financial variables as leading indicators. Review of Economics and Statistics, 80(1), 45-61.

Fama, E. F., & French, K. R. (1989). Business conditions and expected returns on stocks and bonds. Journal of Financial Economics, 25(1), 23-49.

Forbes, K. J., & Rigobon, R. (2002). No contagion, only interdependence: measuring stock market comovements. The Journal of Finance, 57(5), 2223-2261.

Fosback, N. G. (1976). Stock market logic: A sophisticated approach to profits on Wall Street. The Institute for Econometric Research.

Gilchrist, S., & Zakrajšek, E. (2012). Credit spreads and business cycle fluctuations. American Economic Review, 102(4), 1692-1720.

Harvey, C. R. (1988). The real term structure and consumption growth. Journal of Financial Economics, 22(2), 305-333.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 263-291.

Magdon-Ismail, M., & Atiya, A. F. (2004). Maximum drawdown. Risk, 17(10), 99-102.

Nickerson, R. S. (1998). Confirmation bias: A ubiquitous phenomenon in many guises. Review of General Psychology, 2(2), 175-220.

Pagan, A. R., & Sossounov, K. A. (2003). A simple framework for analysing bull and bear markets. Journal of Applied Econometrics, 18(1), 23-46.

Pan, J., & Poteshman, A. M. (2006). The information in option volume for future stock prices. The Review of Financial Studies, 19(3), 871-908.

Taleb, N. N. (2007). The black swan: The impact of the highly improbable. Random House.

Whaley, R. E. (2009). Understanding the VIX. The Journal of Portfolio Management, 35(3), 98-105.

Wilder, J. W. (1978). New concepts in technical trading systems. Trend Research.

Zarowin, P. (1990). Size, seasonality, and stock market overreaction. Journal of Financial and Quantitative Analysis, 25(1), 113-125.

Zweig, M. E. (1986). Winning on Wall Street. Warner Books.

Nota Keluaran

Bear Market Probability Model - Major Improvements and Technical LimitationsImprovements Made to the Indicator

1. Robust Data Validation and Error Handling

- Added comprehensive null checks (na()) for all external data sources

- Implemented division-by-zero protection for all ratio calculations

- Added fallback values for missing or invalid data points

- Enhanced error handling for FRED economic data and market indices

2. Mathematical Accuracy and Normalization

- Fixed inconsistent factor weighting that caused calculation errors

- Implemented proper normalization ensuring all components stay within [0,1] range

- Added validation to keep final probability within [0,100] bounds

- Corrected aggregation logic with explicit factor counting per category

3. Enhanced Calculation Logic

- Advance/Decline Analysis: Fixed ratio calculations with proper total validation

- McClellan Oscillator: Separated EMA calculations for better accuracy

- New Highs/Lows Ratio: Added safe division handling for zero totals

- Dynamic Thresholds: Implemented logical ordering (Warning < Danger) with range validation

4. Improved Reliability

- Added safety checks for volatile market conditions

- Enhanced threshold calculations with fallback values

- Implemented consistent scoring methodology across all factors

- Fixed PineScript-specific variable initialization issues

Technical Limitation: The request.security() Problem

What is the Issue?

Some users noticed that market breadth indicators (VIX, Advance/Decline Ratio, New Highs/New Lows Ratio) show slight variations when switching between different chart symbols (e.g., from NVIDIA to Palantir).

Root Cause - PineScript Architecture Limitation:

This is a fundamental design limitation in PineScript's request.security() function. Here's what happens:

Context Problem: When you use request.security("INDEX:ADVN", "D", close), the close parameter should reference the closing value of INDEX:ADVN (advancing issues)

Symbol Leakage: However, due to PineScript's execution context, close sometimes references the current chart symbol's close price instead of the requested security's actual value

Inconsistent Behavior: This causes the function to occasionally pull data from the chart symbol rather than the intended external index

Why A/D Ratio Changes with Chart Symbols:

When viewing NVDA: The function might pull NVDA's close price instead of actual advancing issues count

When viewing PLTR: The function might pull PLTR's close price instead of actual advancing issues count

Since NVDA ≠ PLTR, the A/D Ratio calculation changes even though it should be market-wide data

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Where others speculate, we systematize.

edgetools.org

edgetools.org

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Where others speculate, we systematize.

edgetools.org

edgetools.org

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.