OPEN-SOURCE SCRIPT

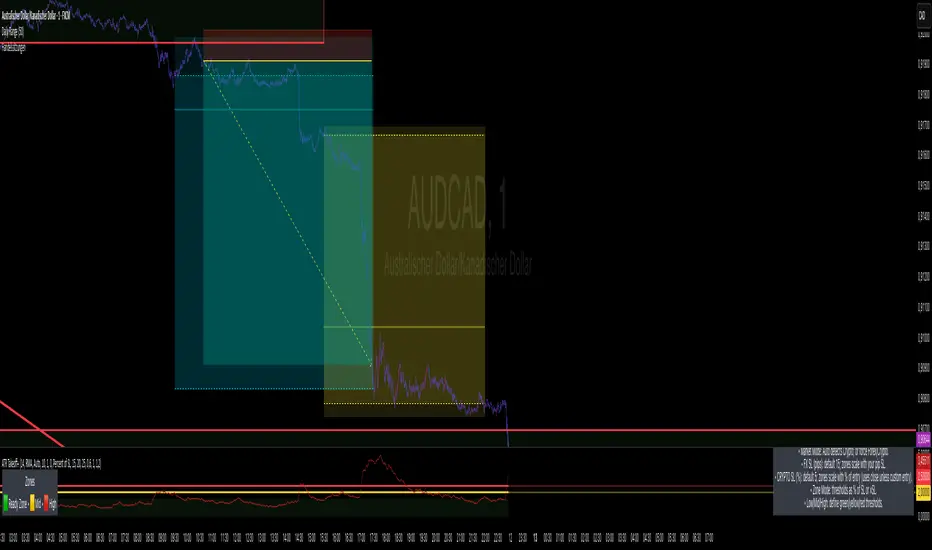

Telah dikemas kini 1m Scalping ATR (with SL & Zones)

A universal ATR indicator that anchors volatility to your stop-loss.

Read any market (FX, JPY pairs, Gold/Silver, indices, crypto) consistently—regardless of pip/point conventions and timeframe.

Why this indicator?

Classic ATR is absolute (pips/points) and feels different across markets/TFs. ATR Takeoff normalizes ATR to your stop-loss in pips and highlights clear zones for “quiet / ideal / too volatile,” so you instantly know if a 10-pip SL fits current conditions.

Key features

Auto pip detection (FX, JPY, XAU/XAG, indices, BTC/ETH).

Selectable ATR source: chart timeframe or fixed ATR TF (e.g., “15”, “30”, “60”).

Display modes:

Percent of SL – ATR relative to SL in %, great for M1 (typical 10–30%).

Multiple of SL – ATR as a multiple of SL (e.g., 0.6× / 1.0× / 1.2×).

Panel zones:

Green = “Ready for takeoff” (≤ Low), Yellow = reference (Mid), Red = too volatile (≥ High).

Status badge (top-right): Quiet / ATR ok / Wild, current ATR/SL value, ATR TF used.

Direction-agnostic: Works the same for longs and shorts.

Inputs (at a glance)

Length / Smoothing (RMA/SMA/EMA/WMA): ATR base settings.

Your Stop-Loss (Pips): Reference SL (e.g., 10).

ATR Timeframe (empty = chart): Use chart TF or a fixed TF.

Display Mode: “Percent of SL” or “Multiple of SL.”

Low/Mid/High (Percent Mode): Zone thresholds in % of SL.

Low/Mid/High (Multiple Mode): Zone thresholds in ×SL.

Recommended defaults

Length 14, Smoothing RMA, SL 10 pips

Display Mode: Percent of SL

Low/Mid/High (%): 15 / 20 / 25

ATR Timeframe: empty (= chart) for reactive, or “30” for smoother M30 context with M1 entries.

How to use

Set SL (pips). 2) Choose display mode. 3) Optionally pick ATR TF.

Interpretation:

≤ Low (green): setups allowed.

≈ Mid (yellow): neutral reference.

≥ High (red): too volatile → adjust SL/size or wait.

Note: Auto-pip relies on common ticker naming; verify on exotic symbols.

Disclaimer: For research/education. Not financial advice.

Read any market (FX, JPY pairs, Gold/Silver, indices, crypto) consistently—regardless of pip/point conventions and timeframe.

Why this indicator?

Classic ATR is absolute (pips/points) and feels different across markets/TFs. ATR Takeoff normalizes ATR to your stop-loss in pips and highlights clear zones for “quiet / ideal / too volatile,” so you instantly know if a 10-pip SL fits current conditions.

Key features

Auto pip detection (FX, JPY, XAU/XAG, indices, BTC/ETH).

Selectable ATR source: chart timeframe or fixed ATR TF (e.g., “15”, “30”, “60”).

Display modes:

Percent of SL – ATR relative to SL in %, great for M1 (typical 10–30%).

Multiple of SL – ATR as a multiple of SL (e.g., 0.6× / 1.0× / 1.2×).

Panel zones:

Green = “Ready for takeoff” (≤ Low), Yellow = reference (Mid), Red = too volatile (≥ High).

Status badge (top-right): Quiet / ATR ok / Wild, current ATR/SL value, ATR TF used.

Direction-agnostic: Works the same for longs and shorts.

Inputs (at a glance)

Length / Smoothing (RMA/SMA/EMA/WMA): ATR base settings.

Your Stop-Loss (Pips): Reference SL (e.g., 10).

ATR Timeframe (empty = chart): Use chart TF or a fixed TF.

Display Mode: “Percent of SL” or “Multiple of SL.”

Low/Mid/High (Percent Mode): Zone thresholds in % of SL.

Low/Mid/High (Multiple Mode): Zone thresholds in ×SL.

Recommended defaults

Length 14, Smoothing RMA, SL 10 pips

Display Mode: Percent of SL

Low/Mid/High (%): 15 / 20 / 25

ATR Timeframe: empty (= chart) for reactive, or “30” for smoother M30 context with M1 entries.

How to use

Set SL (pips). 2) Choose display mode. 3) Optionally pick ATR TF.

Interpretation:

≤ Low (green): setups allowed.

≈ Mid (yellow): neutral reference.

≥ High (red): too volatile → adjust SL/size or wait.

Note: Auto-pip relies on common ticker naming; verify on exotic symbols.

Disclaimer: For research/education. Not financial advice.

Nota Keluaran

ATR Takeoff+ (v2.0) — SL-Anchored ATR for FX & CryptoWhat it is

ATR Takeoff+ turns the classic ATR into an actionable, *stop-loss–anchored* volatility gauge that stays consistent across markets and timeframes.

* **Forex mode:** You define your stop distance in **pips** (default **15 pips**).

* **Crypto mode:** You define your stop distance as **% of entry** (default **5%**).

* The indicator converts ATR to the same unit and compares it to your SL, giving you **uniform zones**:

* 🟩 **Ready Zone** (≤ Low) – conditions are suitable for your default SL

* 🟨 **Mid** – neutral reference

* 🟥 **High** (≥ High) – too volatile for your default SL

Whenever you change your SL (pips or %), the **green band and the yellow/red lines update instantly**.

---

Why it helps

* **Consistency:** Judge volatility relative to *your* risk, not absolute values.

* **Cross-market:** FX and Crypto “feel” the same despite different price scales.

* **Fast decisions:** A compact badge shows state (**ATR ok / Neutral / Too volatile**), market type (FOREX/CRYPTO), and current ATR (in pips for FX, price units for Crypto).

---

How it works (under the hood)

* **ATR core:** Standard TR smoothed by your chosen MA (RMA/SMA/EMA/WMA; default RMA, length 14).

* **FX:** ATR is converted to **pips** using symbol conventions (incl. JPY, metals/indices heuristics).

* **Crypto:** Your SL% × entry (close or optional custom entry) → **absolute price distance**. ATR is compared to that distance.

* **Zones:** You can define thresholds as **% of SL** (intuitive) or **×SL** (multiples).

---

Inputs (key settings)

* **ATR Lookback (bars)** – ATR period (default 14).

* **ATR MA Type** – RMA/SMA/EMA/WMA (default RMA).

* **Market Mode** – *Auto* (detects common crypto tickers) or force **Forex/Crypto**.

* **FX: Stop-Loss (Pips)** – Your standard SL in pips (default **15**).

* **CRYPTO: Stop-Loss % of Entry** – Your SL as % (default **5**).

* **CRYPTO: Use custom entry price? / Custom entry** – Fix the entry price for exact SL distance; otherwise close is used.

* **Zone Mode** – **Percent of SL** or **Multiple of SL**.

* **Low / Mid / High** – Thresholds for the green band top, yellow reference, and red limit.

* **Show legend / Show Help Panel** – Small on-chart guides.

**Tip:** Start with **Percent of SL** and thresholds **15 / 20 / 25%**. For multiples, try **0.60× / 1.00× / 1.20×**.

---

Recommended workflow

1. Set your baseline SL (FX pips or Crypto %).

2. Choose **Zone Mode** and threshold style that matches your management.

3. Trade your setup **only when ATR ≤ Low** (green band), be cautious around **Mid**, stand down or adapt risk when **ATR ≥ High**.

---

Notes & limitations

*Symbol heuristics for pips are sensible defaults; exotic symbols may need manual judgment.

*Indicator is **direction-agnostic**; combine with your entry model (breakout/structure/FVG/OB, sessions, etc.).

**Disclaimer:** For research/education only. Not financial advice. Always manage risk.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.