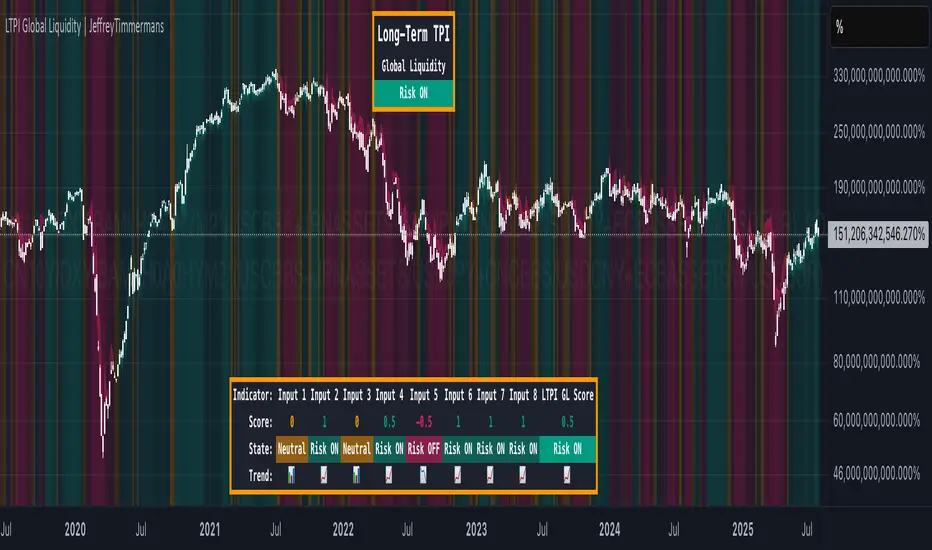

LTPI Global Liquidity | JeffreyTimmermans

The "Long-Term Probability Indicator (LTPI)" on a generic liquidity ticker is a custom-built analytical tool designed to evaluate market conditions over a long-term horizon, with a strong focus on global liquidity trends. By combining six carefully selected input signals into a single probability score, this indicator helps traders and analysts identify prevailing long-term market states: Bullish, Bearish, or Neutral.

Where short-term systems/timeframes react quickly to price fluctuations, LTPI smooths out noise and focuses on the bigger picture, allowing for informed strategic decision-making rather than short-term speculation.

Key Features

Multi-Input Aggregation:

- Uses six independent inputs, each based on long-term liquidity and macro-related data, to generate a composite market probability score.

Long-Term Focus:

- Prioritizes medium-to-long-term trends, ignoring smaller fluctuations that often mislead traders in volatile markets.

Simplified Market States:

Classifies the global market into three primary states:

- Bullish: Favorable liquidity and conditions for long-term risk-taking.

- Bearish: Tightening liquidity and conditions that require caution.

- Neutral: Transitional phases or uncertain conditions.

Background Coloring:

- Visual cues on the chart help identify which regime is active at a glance.

Global Liquidity Perspective:

- Designed for use on a generic liquidity ticker, based on M2 money supply, to track macroeconomic liquidity flows and risk appetite.

Dashboard Display:

- A compact on-screen table summarizes all six inputs, their states, and the resulting LTPI score.

Dynamic Alerts:

- Real-time alerts signal when the LTPI shifts from one regime to another.

Inputs & Settings

LTPI Inputs:

- Input Sources (6): Each input is a carefully chosen trend following indicator.

- Weighting: Each input contributes equally to the final score.

Score Calculation:

- Bullish = +1

- Bearish = -1

- Neutral = 0

Color Settings:

- Strong Bullish: Bright Green

- Weak Bullish: Light Green

- Neutral: Gray/Orange

- Weak Bearish: Light Red

- Strong Bearish: Bright Red

(Colors can be customized.)

Calculation Process

Collect Data:

- Six long-term inputs are evaluated at each bar.

Scoring:

- Each input’s state contributes +1 (bullish), -1 (bearish), or around 0 (neutral).

Aggregate Probability:

- The LTPI Score is calculated as the sum of all six scores divided by 6, resulting in a value between -1 and +1.

Market Classification:

- Score > 0.1: Bullish regime

- Score < -0.1: Bearish regime

- -0.1 ≤ Score ≤ 0.1: Neutral

Background Coloring:

- Background colors are applied to highlight the current regime.

How to Use LTPI

Strategic Positioning:

- Bullish: Favor holding or adding to long-term positions.

- Bearish: Reduce risk, protect capital.

- Neutral: Wait for confirmation before making significant moves.

Confirmation Tool:

- LTPI works best when combined with shorter-term indicators like MTPI or trend-following tools to confirm alignment across multiple timeframes.

Dynamic Alerts:

- Bullish Regime Entry: When the LTPI Score crosses above 0.1.

- Bearish Regime Entry: When the LTPI Score crosses below -0.1.

- Neutral Zone: When the score moves back between -0.1 and 0.1.

These alerts help identify significant macro-driven shifts in market conditions.

Conclusion

The Long-Term Probability Indicator (LTPI) is an advanced, liquidity-focused tool for identifying macro-driven market phases. By consolidating six inputs into a single probability score and presenting the results visually, LTPI helps long-term investors and analysts stay aligned with global liquidity trends and avoid being distracted by short-term volatility.

Skrip jemputan sahaja

Hanya pengguna disahkan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Keizinan selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi JeffreyTimmermans secara terus.

TradingView TIDAK menyarankan pembayaran atau penggunaan skrip kecuali anda mempercayai sepenuhnya penulis dan memahami bagaimana ia berfungsi. Anda juga boleh menjumpai alternatif sumber terbuka dan percuma yang lain di dalam skrip komuniti kami.

Arahan penulis

Penafian

Skrip jemputan sahaja

Hanya pengguna disahkan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Keizinan selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi JeffreyTimmermans secara terus.

TradingView TIDAK menyarankan pembayaran atau penggunaan skrip kecuali anda mempercayai sepenuhnya penulis dan memahami bagaimana ia berfungsi. Anda juga boleh menjumpai alternatif sumber terbuka dan percuma yang lain di dalam skrip komuniti kami.